Several industries, including banking and healthcare, have been lauded as potential game-changers by the blockchain technology underlying Bitcoin and other cryptos.

Distributed ledgers enable new types of economic activity, previously impossible due to the removal of intermediaries from computer networks. Below you will find the most viewed cryptos of 2022.

Why is it worth investing in crypto?

People who believe that digital currencies have a promising future will find this investment attractive. Investing in crypto offers an opportunity to earn high returns while supporting the future of technology, a promise that many people believe in.

How does crypto work?

A blockchain is a distributed public ledger that records all transactions involving cryptos. It is an electronic ledger used by cryptos.

Computing devices operate to solve intricate mathematical problems that create coins to create crypto units. Brokers can also sell the currency to users, storing and spending it with a cryptographic wallet. This process is called mining.

You do not own anything tangible when you own crypto. Your key allows you to move records or units between people without requiring the assistance of a third party.

Even though Bitcoin has been around since 2009, cryptos and blockchain applications are still developing in financial applications, and more will follow. It may one day be possible to trade financial assets like bonds and stocks.

How to start?

Before you begin trading on the crypto market, knowing how it works and the jargon used to describe it is essential.

Decentralized digital currency networks, like crypto, work through peer-to-peer exchanges rather than central servers. Through ‘mining,’ transactions are added to crypto chains and shared digital ledgers that record information.

It is also a fact that cryptos are notoriously volatile, so it is essential to stay up to date, whether it is ICOs and blockchain forks, breaking news, or government regulation.

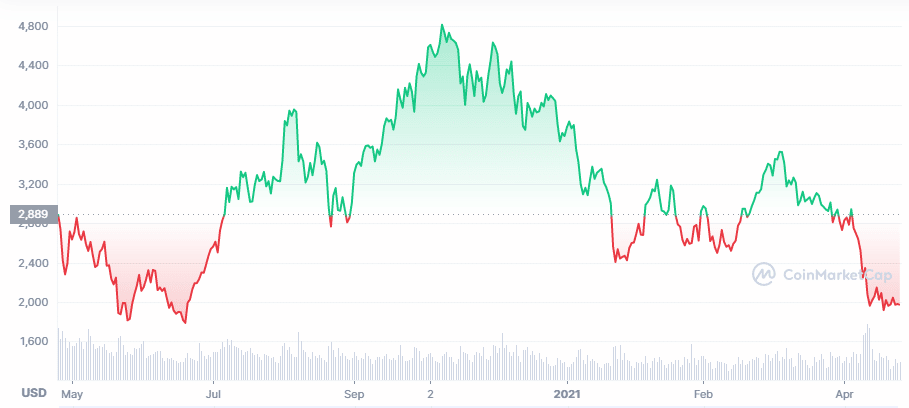

Ethereum (ETH) – blockchain network with smart contract functionality

52-week range: $1,707.60-$4,891.70

1-year price change: -6.86%

Forecast 2022: $4,000-$4,500

The Ethereum blockchain network is the choice of developers worldwide for creating decentralized applications. Due to Ethereum’s smart contract functionality, these apps rely on the Ethereum network. Using smart contracts, certain transactions are entirely decentralized, eliminating the middleman.

While Ethereum’s fees have been under fire for months, upgrading version 2.0 may provide relief. An upgrade to Ethereum’s ‘proof-of-stake’ protocol is likely to occur soon, a move that will significantly increase scalability and reduce fees. Upon implementing this upgrade, we may see more people than ever buying Ethereum.

Decentraland (MANA) – Metaverse virtual world

52-week range: $0.37-$5.90

1-year price change: +15%

Forecast 2022: $8

The virtual world aspect of Decentraland provides a similar investment opportunity to Sandbox. There is also the option of buying LAND tokens with MANA tokens that are ERC-20 compatible and run on Ethereum.

In this case, NFTs are used to assign ownership of the digital domain. The most valuable LAND lies near the busiest places in the world. A company focused on NFT purchased LAND for almost $2.5 million in the virtual world, indicating the growing interest shown by businesses in the Metaverse.

Lastly, the Metaverse received a mortgage in January. A client of TerraZero, a company with a vertically integrated Metaverse, acquired the property in Decentraland on January 29th.

Despite Mark Zuckerberg’s efforts to build a massive Metaverse, crypto developers have quietly been building an ‘open’ Metaverse for years at a fraction of the cost.

Lucky Block (LBLOCK) – overall best crypto to day trade

In terms of day trading, LBLOCK is the best crypto. Lottery tokens have a lot of potential, and despite being a new coin, they have attracted a lot of attention.

52-week range: $0.37-$5.90

1-year price change: +10%

Forecast 2022: $0.006-$0.007

Lucky Block has its own native token, LBLOCK. Using blockchain technology, the platform is transforming how gamblers play online games, thereby disrupting the online gaming industry.

Transparency and fairness are ensured by Lucky Block thanks to its use of the blockchain. To penetrate the $230 billion global gaming market, the company wants to enter the online gaming market.

LBLOCK users can play games on the Lucky Blocks platform. This January, PancakeSwap, a leading decentralized exchange — listed the token at an introductory price of $0.00020. LBLOCK reached its all-time high of $0.0096, more diminutive than a month later. Currently, the digital asset trades at $0.0039, still a significant increase from the listing price.

Upsides and downsides

| Upsides | Downsides |

| Anonymity Crypto transactions are anonymous and convenient for anyone who wants to remain anonymous. | Price volatility Cryptos are attractive for many investors due to their quick gains, but the risk of rapid and drastic losses also exists. Bitcoin, for example, lost 50% of its value in just two months between April and June 2021. From its high in January, Bitcoin has fallen by more than 30% in 2022 (CNBC). |

| Transparency Blockchain technology records data on an open ledger, even though anonymous transactions. The technology makes data transparent and publicly accessible at any time. | High cost to produce The mining of many types of crypto consumes enormous amounts of electricity and other resources. For example, the Harvard Business Review reports that the energy costs of mining Bitcoin make up most of the costs. |

| Decentralization Cryptos aren’t issued by central banks or backed by governments. They are free from government interference and will not influence monetary policy. | Regulatory restrictions Cryptos tend to be legal in many developed countries, but central governments do not formally regulate them. Federal governments will not be able to regulate crypto in the same way as fiat currencies, like the US dollar, until they adopt and approve it. |

Final thoughts

Currently, crypto market prices are rangebound, with altcoins following Bitcoin’s lead. It is becoming increasingly popular to predict whether BTC will break out to the upside in the first quarter of 2022, possibly aided by the geopolitical tensions affecting the global economy. Investing relatively small amounts could smooth out returns, thus eliminating the need to attempt to time the proper timing of a lump sum investment.