Cryptos are a high-risk investment, and trading them without a strategy may frequently result in a loss of invested funds. While most experts believe there is no flawless trading strategy, such methods can help you become a better-organized trader.

In this guide, we’ll talk about what strategies are and how you can choose the best.

What is a crypto trading strategy?

There are several methods to benefit from crypto trading. Trading strategies assist you in organizing such approaches into a logical framework that you can adhere to. You can constantly examine and optimize your crypto approach this way. There are two types: technical and fundamental.

- Technical analysis is a sort of analysis that seeks to forecast future market behavior based on past price and volume data. It entails using indicators, recognizing chart patterns, and observing the general trend direction. The strategy is widely used in traditional financial markets for stocks and other assets, but it is also an essential component of the cryptocurrency market.

- Fundamental analysis is predicated on the idea that an asset’s future potential should be centered on more than simply past performance. Therefore, it considers microeconomic and macroeconomic factors that may impact the cryptocurrency market.

Top five tips for trading with crypto strategies

Now that you know what crypto trading strategies are let’s move on to how you can choose the best one.

Tip 1. Choose your trading style

The trading style is divided into four categories: scalping, day trading, swing trading, and position trading. Each trading style differs in terms of duration. A trading style can alter depending on how the market acts, but this is dependent on whether you want to enter or exit your trade until things improve.

- Scalping trades, for example, are held for only a few seconds or minutes at most.

- Day trades can last anything from a few seconds to a few hours.

- Swing traders might be kept for a few days at a time.

- Position trades are kept for a period ranging from a few days to several years.

How to deal?

One of the most common errors that inexperienced traders make is switching trading styles at the first hint of problems. However, regularly changing your trading style or strategy is a solid method to catch any losing run. Once you’ve found a trading technique that works for you, stick with it.

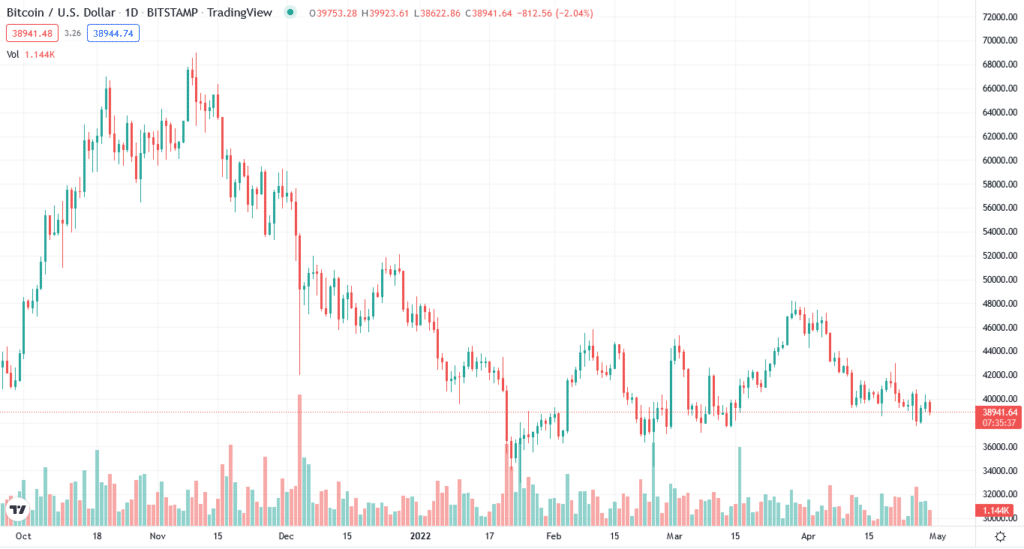

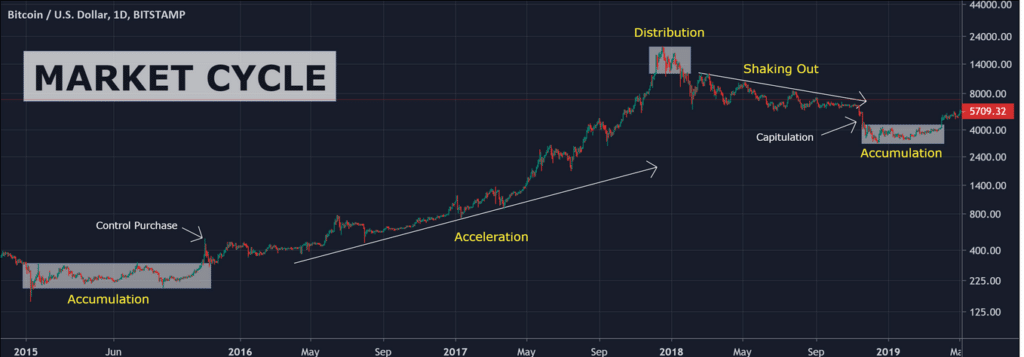

Tip 2. Keeping track of market cycles

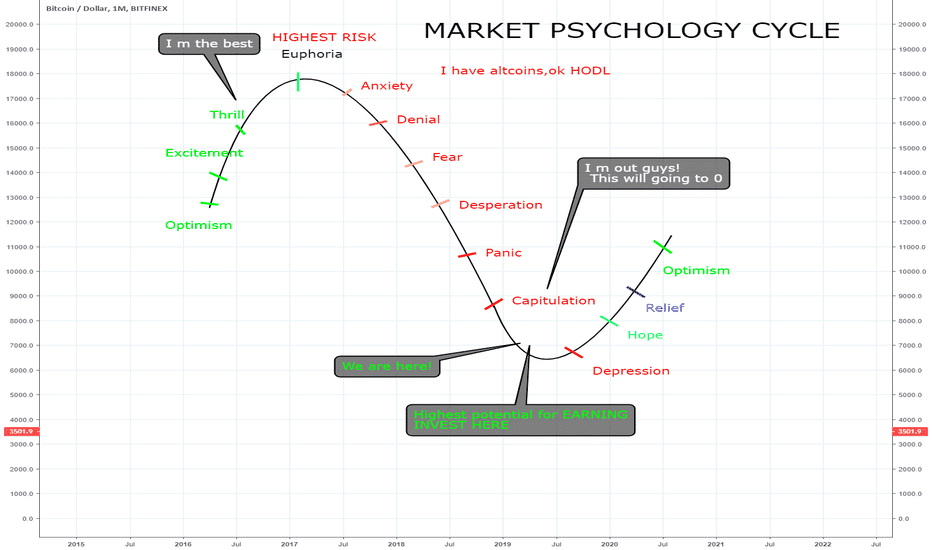

The market has a basic structure that renders it vulnerable to certain actions. It is a natural progression of cycles that will come and go as time passes.

The cycle is divided into four major stages:

- Accumulation

- Markup

- Distribution

- Decline

As the market transitions between these stages, traders will constantly adjust their positions by consolidating, retracing, or correcting.

How to deal?

The best strategy for capitalizing on your grasp of market cycle stages is straightforward: buy or accumulate at the bottom when the market is nervous, HODL on the way up, sell during distribution when everyone is pleased and greedy, and exit or short before the market plummets.

Tip 3. Understand market psychology

This phenomenon of prevalent feeling is referred to as market psychology. It’s easy to forget that, for the most part, these trades are being executed by actual individuals who, as a result, are susceptible to emotional reactions that may have a huge impact on the market. In addition, the extreme level of volatility connected with cryptocurrency trading creates a pressure cooker situation that may destabilize anyone.

How to deal?

Instead of getting carried away by excessive volatility, you may make a reasonable, wise decision if you can control your emotions. Unfortunately, at the same time, most market participants act on the turmoil’s emotion.

Tip 4. Noticing the whales

Whales with significant sums of money to trade are primarily responsible for price changes. A cryptocurrency trading strategy should be aware of the instruments of the trade that whales like, such as their favorite technical indicators. Simply put, whales have a good sense of what they’re doing. By predicting whales’ intents, a trader might collaborate with these professional movers to generate a profit with their method.

Some whales act as market makers, putting bids and asks on both sides of the market to generate liquidity for an item while profiting. Whales may be found in almost every market, from stocks and commodities to cryptocurrency.

How to deal?

Because blockchain-based transactions are public, monitoring whales can reveal hints about potential shifts, allowing market players to act proactively and position themselves to gain once the movement occurs.

Tip 5. Risk management

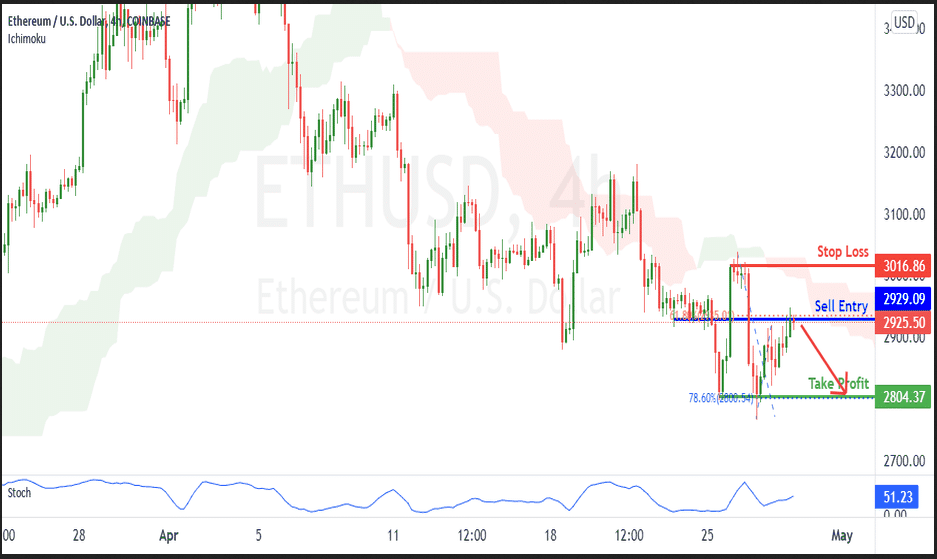

Risk in crypto trading refers to the possibility of losing invested cash. As a result, risk management is the capacity to forecast and mitigate potential losses from a failed trade. Risk management is an important part of every trading strategy. Before you enter a deal, you should know how much money you are willing to lose on that crypto trade if it goes against you. This can be determined by various things, including your trading capital. For example, a person may desire to risk just 1% of their whole trading capital, either in total or per trade.

How to deal?

You will surely lose money if you do not have a risk management approach and trade intuitively. Therefore, you need to use stop-loss appropriately with every position. It will limit your losses.

Final thoughts

Trading strategies can vary greatly, depending on their interests, personalities, trading money, risk tolerance, etc. Trading entails a great deal of responsibility. Before engaging in trading, everyone considering it must first assess their position.