This article does not endorse investing in cryptocurrency. Several cryptocurrencies have come and gone, but some names remain to this day. Our goal is to provide a general guideline for anyone looking to go in that direction. If you think crypto is here to stay, this information can help you see you through your investing journey.

Five steps to invest in crypto

In this section, you will learn the steps to take so you can make your initial investment. We hope the information here can help you make wise investment decisions.

№ 1. Only invest a risk capital

In every type of investment, a common suggestion is to invest your risk capital. Do not put the money you need for another essential purpose at risk. If you lose your investment, it should not affect your living condition. If you have limited savings, do not empty your bank account to have something to invest in crypto.

Do not try to get a loan to be used for your investment. Many people are not aware or have violated this injunction, and they face the consequence of their actions. Any investment has a 50 percent chance of playing out and a 50 percent chance of failing. Keep this idea in mind.

While you can see big moves in crypto, there are times when the crypto market is silent. As in any type of market, you have to be patient when investing in crypto. You cannot predict when the market starts a trending phase, enters a ranging phase, or goes into a correction phase.

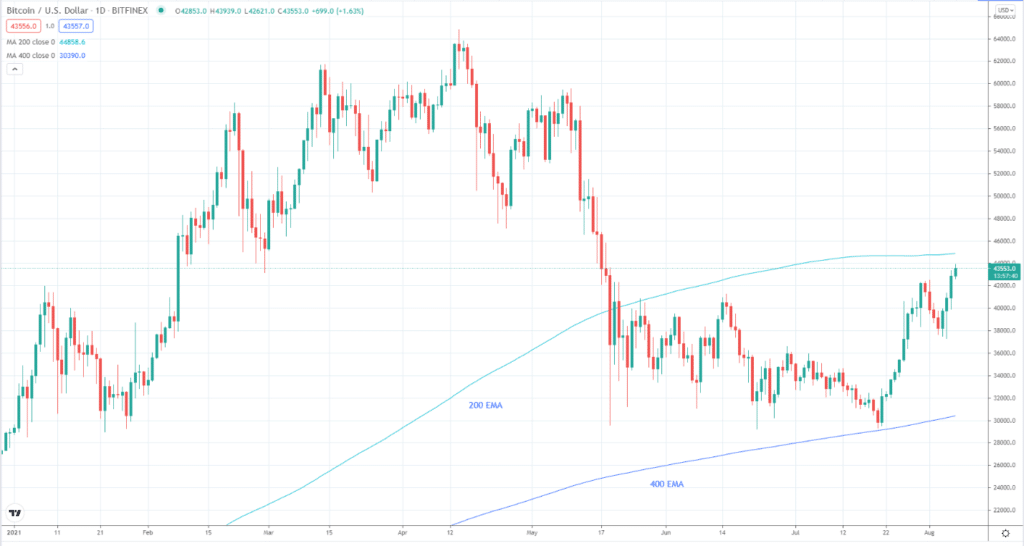

Consider the above daily chart of Bitcoin. The price is within the 200 EMA and 400 EMA range, meaning the price is consolidating. This will continue until the price breaks above the 200 EMA or close below the 400 EMA. When price breaks to the upside, it would mean the market is simply making a pullback and is ready to start another leg of the trend up. For more than two months, the price is stalling in a range after coming down from a strong bull run that made Bitcoin reach the highest high so far of almost $65,000 on 14 April 2021.

If the price is not moving up (i.e., either consolidating or pulling back), your expected profits might take longer than you initially thought. At this time, your money might not grow, or you might encounter some losses. If you need the money you deposited in your investment account, you might feel sorry for yourself because you could miss potential opportunities when the market does pick up speed later.

Always consider the possibility of losing all your investment. When that happens, will you keep your sanity? That is an important question you should answer. Once you put money in a trading account, you can withdraw some profits, but not your capital. Therefore, invest just the money you are willing to risk. The next thing to do is leave your account alone and not be too emotional when your account takes a rollercoaster ride.

№ 2. Understand what you are investing in

Before you put money in a crypto investment account, learn as much as you can about crypto. Even if crypto has become the talk of the town and many people you know have joined the fray, you must first do your due diligence before engaging. It is just too easy for people to say they know something and appear knowledgeable about it when they just heard it from someone else.

Here are some scenarios where you need to perform due diligence before making a decision:

- If you plan to get a house or an apartment, will you buy it without visiting and seeing the property?

- If you want to get a used car, will you pay for it without possessing the papers?

- If you want to be a gym member, will you apply for an annual membership without seeing the gym first and knowing the offered services?

If your answer to all the above questions is a resounding “no,” then you would do the same for crypto investing. Get yourself educated about the workings of this business venture before you dive headfirst.

Of course, there is no need to know the ins and outs of crypto investing before you start. It is not practical at all time-wise. Just get a bird’s eye view of the business. While you can ask your friends or family about it, research is the best way to do it. Browse online, read articles, or watch videos on streaming platforms.

№ 3. Diversify your investment

In every form of investment, whatever asset class you invest in, diversification is crucial. You can say the same thing about cryptocurrencies. You must have heard people saying not to place all your eggs in one basket. This is because if you accidentally drop that basket, you risk breaking all your eggs. If you have 50 eggs and divide them into five small baskets, you will lose ten eggs only when you drop one basket.

You can use the same logic when investing. Consider dividing your capital into the following assets:

- Real estate

- Jewelry

- Stocks

- Cryptocurrencies

Putting all your crypto allocation in one asset, such as Bitcoin, is not a good idea for cryptocurrency. It is best to buy multiple coins to spread the risk across different asset types. Here you can purchase assets from mining-based coins, stablecoins, and security tokens.

№ 4. Secure your crypto

You must have heard the news about crypto hacking. Regrettably, such information is valid. When you hear such reports of stolen crypto, please note that they always happen in crypto exchanges. While it does not mean you should not use an exchange, you should not put all your digital money in exchanges.

Instead, you can put most of your digital assets in crypto wallets, such as:

- Hot wallet

- Cold wallet

- Physical wallet

Storing and retrieving your private keys is another concern. Make sure that you store them in secure locations. If you forget your private key, you can say goodbye to your crypto stored in a wallet.

№ 5. Track your results

After you have bought some crypto assets, the next thing to do after ensuring their protection is track your results. Three things can happen after you invest:

- Make money

- Lose money

- No change in value

Monitoring the performance of your crypto assets can be challenging because you will check how each asset changes from the previous value. Good thing, you can use apps to track your portfolio quickly and automatically. Examples include Delta and FTX (formerly Blockfolio). You can download these apps in PlayStore.

Final thoughts

With the step-by-step guide given above, now you know how to start investing in crypto. The information you learned here is not everything there is about crypto investing. We hope we provided you a hand in your search for knowledge about investing in the exciting world of crypto.