If you want to see yourself leading a path to a high-income career, perhaps you’ll consider the financial service industry, where you may get diversity while finding the suitable one for you, fitting your qualifications and objective for the future.

However, working in the financial service sector is quite rewarding. There are two paths available in this sector that you may consider first as a financial advisor and another as a wealth manager.

Although they both have some primary resemblance, there is still a certain unlikeness. In the coming section, you will get more information about the two careers mentioned above; perhaps one of them can become the best fit for you.

Who is the financial advisor?

This specialist offers various services, mainly regarding the client’s requirements. Also, they have an extensive collection of clients in contrast to a wealth manager. Such advisors serve a wide variety of clients; on the other hand, wealth managers serve particular clients with deep-pocketed.

In most cases, wealth managers require having a set minimum amount of net worth to start engaging with the clients. But usually, financial advisors do not have any pre-set blockade for the entry. However, solitary firms have standards for assessing the eligibility of the relationship with clients based on complications, competency, and assets.

However, financial advisors can be of various types and distinct competency and interest spheres. Below are some of the all-inclusive services provided by a financial advisor.

- Creating financial plan

- Savings allocations

- Developing retirement plan

- Planning for taxation

- Developing inheritance and trust

- Funding for college

- Developing the plan for exit or chain or progression for a business

Who is the wealth manager?

Generally, this specialist operates for high-net-worth or deep-pocketed clients and provides a personal and intense level of financial management. An individual whose net worth is over $1 million of liquid available to be invested assets will come into the range of being a High Net Worth Individual (HNWI). The wealth manager’s client asset approach is the major contrast that makes financial advisors distinct.

In most cases, wealth managers operate for the HNWI making them more active with a family’s or individual’s wealth. Here are some services offered by this specialist:

- Developing an investment management plan

- Estate planning

- Creating a risk management strategy

- Plan for capital gains

- Philanthropic gifting or charity

- Inheritance planning

- Planning for taxation

- Planning for real estate transaction

Financial advisor vs. wealth manager

A financial advisor’s definition can be very extended. What type of advice has been given, what kind of services are provided, and which type of clients has taken the service; all these will decide whether you are taking these specialist into consideration since both of them portray the financial advising subdivision.

However, financial advisors generally serve to plan lifestyle, including budgeting, planning for cash flow, funding for college, and retirement. Although the range of the clients of financial planners may spread in the width of their income still, the clients are mostly middle-class people with a robust need to make their money to go as far as possible.

On the other hand, wealth managers give services needed mainly by HNWIs and Ultra High Net Worth Individual (UHNWIs), such as planning for capital gains, estate planning, and developing risk management policy. A wealth manager provides services for managing clients.

Wealth managers manage literal assets, whereas financial advisors handle the routine client’s finances, hoping to go further, which is the major distinction between financial advisors and wealth managers. However, both careers grab the attention of bright young finance professionals at top colleges and universities.

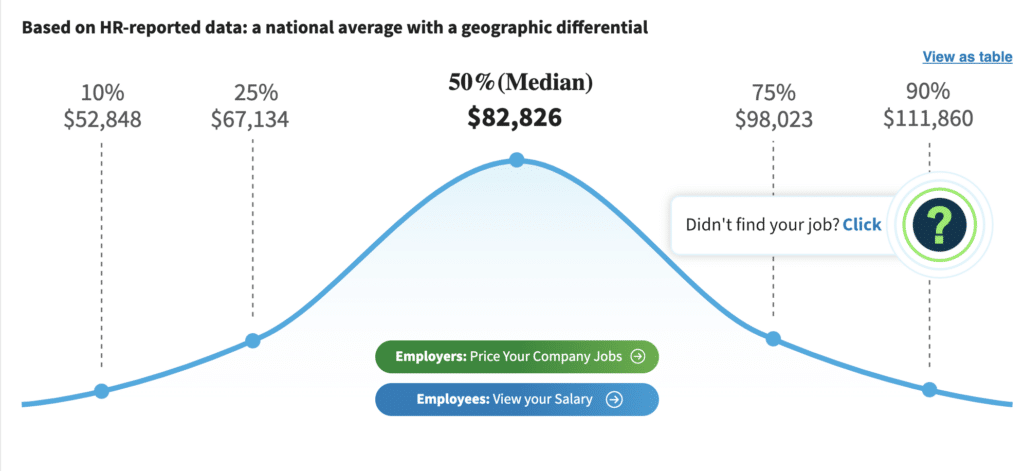

According to the world-famous job providing service, the average salary for a wealth manager is $77,278. Other major companies pay the annual salary at the following rate.

Education

Most successful financial advisors and wealth managers hold a minimum bachelor’s degree certification, but that has to be achieved from a top-tier school, like the University of Chicago or from one of the Ivy Leagues universities, which will give an advantage in the competition.

Apart from that, individual firms within each industry pre-set educational qualifications for potential recruitments. They do not go according to the state or federal licensing boards. However, many wealth managers possess licensed attorneys or CPA certification; none of these are required for the vocation. Fewer financial planners have these designations. Still, they managed to have a great professional state.

Job overview

In 2020, there were 275,200 jobs in the financial advising sector, as reported by the BLS. Still, that number is predicted to expand by 5% in the coming 10-year period between 2020 and 2030, which is a scrolling mode in contrast to the average progression estimated for other career paths.

Also, the subdivision of financial planning tends to trace the trend for financial advising entirely closely. Besides, wealth management has the advantage of intense growth due to the economic blast. However, it engages beyond just financial advising entirely during economic slumps.

Starting salary

Mentioning the payments as salary is a misnaming to some extent. The income from both careers comes as a commission. However, usually, firms offer small-scale salaries to get you through the early months of developing your experience, and you are expected to strike the targeted sales in return. If you fail to fulfill the sales target, the employer will not keep you in that job for long.

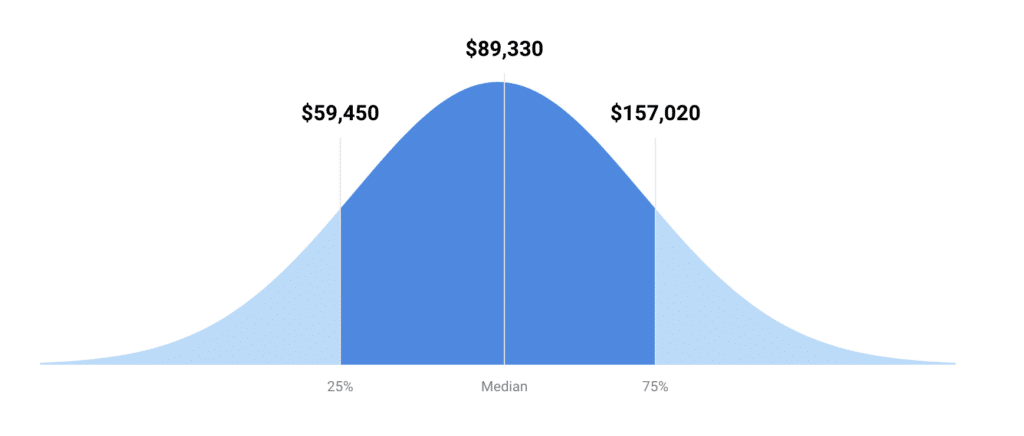

Moreover, as per Glassdoor, the average income of wealth managers was approximately $88,000 per annum, whereas, for financial planners, the average is $69,000 per annum. Although a massive range of data consists of these averages, it relies upon your performance, and the income may fluctuate much higher or lower. The Bureau of Labor Statistics reported that the average annual salary in the financial advising sector comprising financial planning and wealth management was $89,330 in 2020. Also, the top 10% of these sectors generated over $208,000. Besides, the income of the people in the bottom 10% was lower than $44,100.

Final thoughts

The financial advisor terminology sounds very typical, but they offer financial planning and investment management services. Besides, a wealth manager also provides financial advice but in a very intense and all-inclusive manner leading the client to deal with only one advisor for all of their financial requirements.