The present risk-off trading situation may be the polar opposite of the crypto market. Somewhat meaningless price movements are frequently used to characterize the crypto market due to social media activity, memes, and macroeconomic developments. Therefore, you can watch the top cryptos during this uncertainty with turmoil in the market.

This guide will talk about the top three cryptos to watch while the macroeconomic headwinds hit the blockchain.

Why is it worth investing?

The cryptocurrency area became rooted in the financial mainstream in 2021. After all, institutional investors and large banks have begun to use digital assets. According to Research and Markets, the worldwide cryptocurrency industry will be worth more than $32 trillion by 2027.

Over the last decade, the value of currencies like Bitcoin and Ethereum blockchain, among others, has skyrocketed. While the rates of return may not match the rate of increase seen in recent years, many investors remain optimistic about the expanding role of cryptocurrencies in our world.

In other words, if you believe in the crypto business, making smart investments is a way to put your money into the future you want to see.

How does it work?

If you’re investing for the long term, you likely have a good sense of why you think your assets will grow in value over time.

A news event that generates a brief drop in value may not reveal anything about what will happen in five or ten years. With this in mind, it’s critical to understand that you should closely monitor the crypto markets and then invest in the top ones.

Just as you shouldn’t let a price decrease affect your choice to acquire cryptocurrency, you shouldn’t let a quick price surge change your long-term investing plan. More importantly, do not begin buying additional cryptocurrency simply because the price is rising.

It is possible to gain a lot of money by investing in cryptocurrency, but it is also possible to lose your investment. If you have a high-risk tolerance, investing now might be wise. However, if you are unwilling to accept that risk or cannot afford to lose any money right now, you may be better off ignoring cryptocurrency.

How to start?

You don’t have to buy the cryptos amid macroeconomic headwinds. Instead, you can use the wait-and-watch policy and invest when the time is right.

The greatest approach to earning money with cryptocurrency is to invest for the long term, which means several years, if not decades. Prices may fluctuate significantly in the short term, but as long as average returns rise over time, you will profit in the long run.

Only watching what the market does is better than actually investing in cryptos. So you limit your risk exposure and don’t swirl yourself amid volatile market swings.

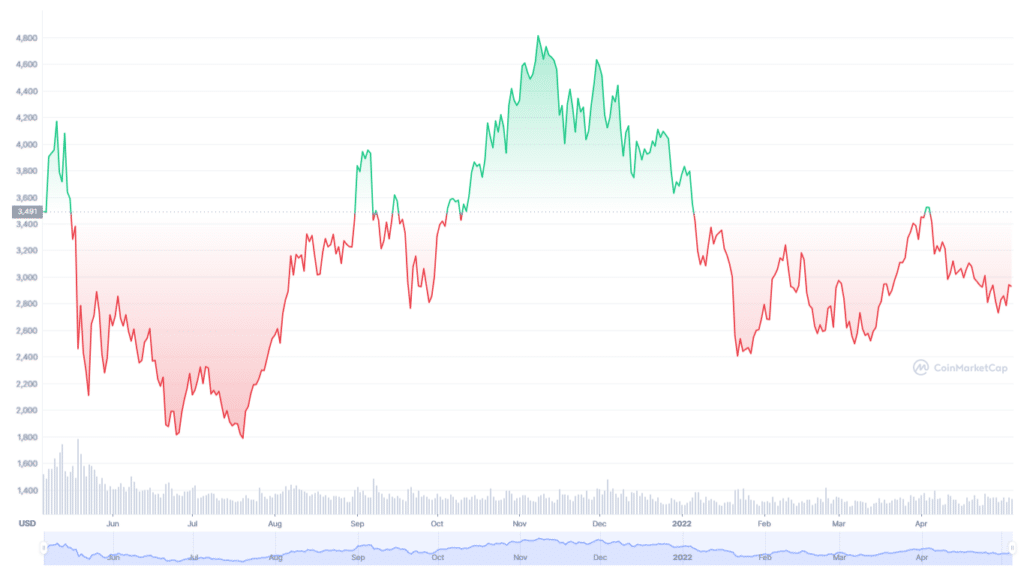

Ethereum (ETH)

52-week range: $1,707.60-$4,891.70

1-year price change: -17.18%

Forecast 2022: $3,673.32-$4,289.23

In terms of real-world utility, ETH is possibly the most popular cryptocurrency. However, it has gained significant traction in recent years and, according to analyst estimations, is still in the early stages of its growth. Its next upgrade will convert the network from proof-of-work to proof-of-stake.

There are several reasons why Ethereum is already so successful and continues to grow in popularity.

There are certain distinctions between Ethereum and Bitcoin. Ethereum is a programmable blockchain with a software network that allows developers to build and test new tools, applications, DeFi, smart contracts, and NFTs.

Many analysts believe that 2022 will be the year of Ethereum, with forecasts that its value will increase by up to 400%.

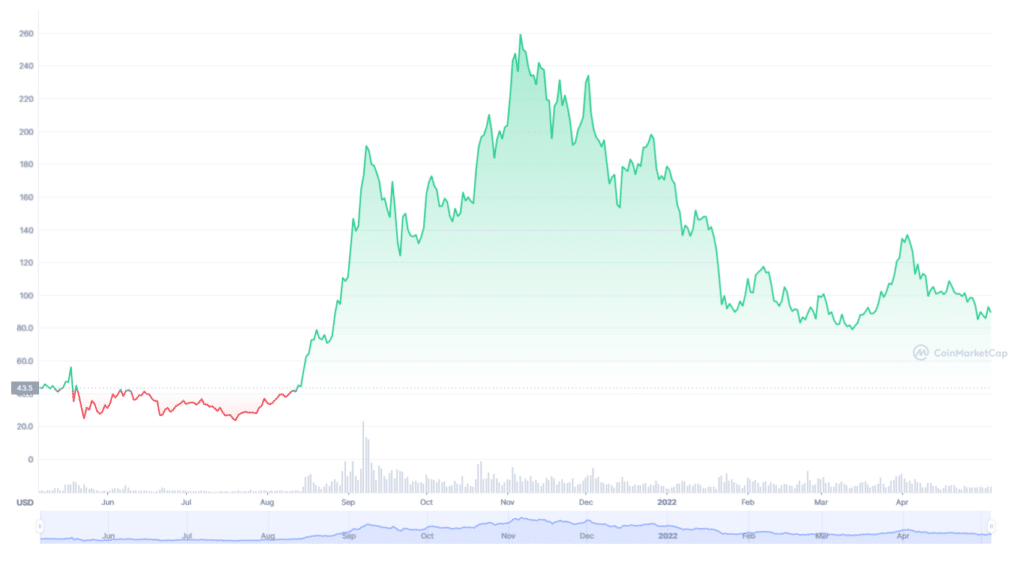

Solana (SOL)

52-week range: $19.14-$260.06

1-year price change: 103.67%

Forecast 2022: $100.73-$351.87

Last year, Solana was one of the most profitable cryptocurrency investments. From January 2021 to its November highs of $250, SOL/USD increased by more than 15,000%. However, it has now dropped off a cliff, losing more than 60% of its value. Nonetheless, it has one of the sector’s best bull-cases, making it an attractive long-term option.

Solana has been quite popular in developing dApps and non-fungible coins (NFTs). In just one year, the network’s initiatives increased from 70 to over 5,000. Furthermore, the blockchain has routinely placed second in NFT volumes for some months now, giving Ethereum some sweat.

Solana’s market value is only a fraction of Ethereum’s, implying that it has a significant growth runway ahead of it. Furthermore, Solana has increased by more than 200%, outpacing Bitcoin and Ether in the last year.

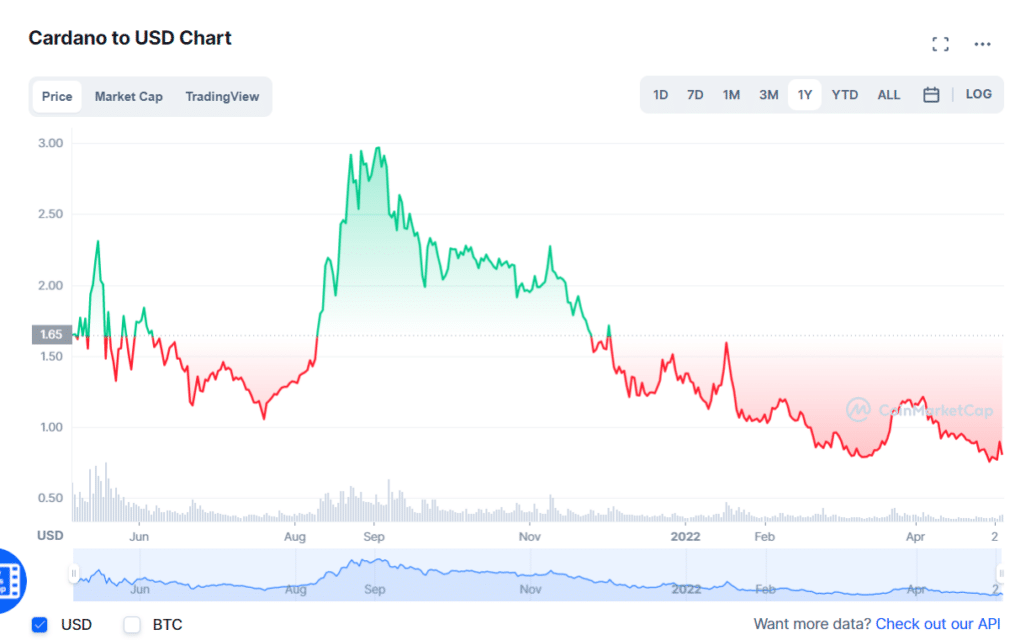

Cardano (ADA)

52-week range: $0.7424-$3.0992

1-year price change: -42.36%

Forecast 2022: $1.24-$1.44

Cardano was formerly one of the most popular cryptos. However, like its rivals, it has lost a significant amount of value and currently trades at a significant discount to its high. Cardano had a significant year with the release of smart contract functionality in 2021. On the platform, there are over 2,000 smart contract scripts.

Cardano can handle up to 250 transactions per second, but its creators want to reach 1,000 once its hydra scaling solution is complete. Its last two revisions are poised to outperform its competitors and climb the cryptocurrency rankings.

Cardano has made significant contributions to the advancement of DeFi applications, boosting access to financial services for underprivileged communities worldwide.

Cardano users can stake their coins using the platform’s native currency, ADA. Staking increases your crypto earnings by storing your crypto tokens in exchange for an annual percentage payout.

Upsides and downsides

| Upsides | Downsides |

| Prices are generally low amid macroeconomic headwinds | Not suitable for short-term investments. |

| Has a good long-term potential | Market fluctuations can affect investments. |

| Volatility can give a sudden boost to prices. | The macroeconomic uncertainty can continue for long. |

Final thoughts

The crypto market is going through macroeconomic headwinds, so it’s better to apply a wait-and-watch policy. Remember that if the prices are low, that doesn’t mean you have to buy the dip.