Gold used to be the underlying asset of US dollars. This is how the term “gold standard” came about. The United States relies on fiat money, dollar bills, and coins without gold backing. Unlike other currencies, Bitcoins are neither backed by actual materials nor by any government. Moreover, a bank account isn’t necessary, nor is a physical form required.

BTC is one of the first forms of crypto. It relies on cryptography and the network of individuals who have access to it. Instead of backing it with gold and blockchain provides approval for it. Because there is no bank for storing BTC, users must keep it themselves, which can be difficult.

This guide contains information about securely and safely storing BTC if you’re considering buying it or owning it.

Tips for safely storing BTC

Below you will find several tips to store your coins securely.

1. Protect your identity

Increasingly, people are armed with guns and attacking Bitcoin holders, so it is advisable to keep your investments and holdings low-profile. For example, a Dutchman who was 38-years-old got hurt with a drill in an attempt to steal his crypto holdings. So, privacy and anonymity are beneficial for your crypto holdings and your safety and well-being.

Please do not disclose any information that can allow others to access your personal information, such as PINs, phone numbers, email addresses, and passwords. Not even the name of your first pet or your mother’s maiden name, as both are common backup questions. Also, do not engage in transactions involving the exchange of personal information. If you don’t feel good about a deal, don’t be afraid to back out.

2. Make use of a hardware wallet

A hardware wallet can store cryptos, such as BTC, on physical pieces of hardware, much like an external hard drive or a USB stick. However, a hardware wallet is less common than an electronic wallet or an offline wallet for this coin and can be harder to locate.

Hardware wallets guarantee anonymous transactions and contain no personal data about the user. In addition, because malware cannot compromise hardware wallets, they are more secure than offline wallets.

One advantage of hardware wallets is that they do not face the same problems digital wallets encounter. However, a penalty is that they are not digital. In the event of losing the physical wallet, the money in the hardware wallet goes for good.

3. Store private keys offline

As a simple matter, your private key should not be familiar with anyone you deem untrustworthy; it is your absolute crypto lifeline. If you want to keep your assets secure, you can store them on a computer without an internet connection, such as a BTC cold storage.

As a result, you will remain safe from malware and hackers. Additionally, you can use private keys securely on paper or on special hardware, also called a cold wallet, similar to a USB drive.

An offline wallet stores a user’s address and private key on something that does not have access to the internet. These wallets typically come with software that simultaneously displays the user’s portfolio without putting their private key at risk.

Using a paper wallet is probably the most secure method of storing cryptocurrency offline. Using a paper wallet, you can generate a cold wallet off certain websites. The program will then produce both public and private keys, which you can print out. If you do not possess that piece of paper, you will not be able to access cryptocurrency from those addresses. Paper wallets can often be laminated and placed in bank safety deposit boxes or even in a home safe. A paper wallet lacks any user interface apart from a piece of paper and the blockchain itself.

4. Make use of digital wallets

Digital wallets can be hardware or web-based and run on computers, smartphones, or even paper. Most Bitcoin should remain in cold storage, which is much safer than keeping a small amount of Bitcoin in your digital wallet for spending. In addition, the digital wallet should have encryption to prevent unauthorized access to the private keys.

A digital wallet can be accessed remotely, making it a good option for use when walking around cash or traveling. Digital wallets are just as vulnerable to hacking as any other digital product or service.

How to find?

There are several ways to see past security breaches and features of digital wallet companies. However, using a tool on the Bitcoin organization’s website is simpler.

You’ll be able to find a digital wallet based on the operating system you use, whether you prefer hardware, and other criteria and features, such as those listed below.

Control

The question here is whether you would like total control over your Bitcoin, meaning that you are solely responsible for backing it up and securing it. In addition, you can use an outside provider, but you will lose total control over your wallet.

Validation

Third-party verification of a transaction is also called validation. There is no need for a third party in a node-based digital wallet.

Bech32

Bech32 addresses are unique address types that aren’t compatible with all wallets; they are also referred to as “bc1 addresses”.

Hardware wallet

On the Bitcoin organization’s digital wallet quiz, check this box if you want to use a physical wallet.

Legacy addresses

Legacy addresses begin with one or three instead of bc1, as most current Bitcoin addresses do. These addresses tend to appear on older wallets or exchanges.

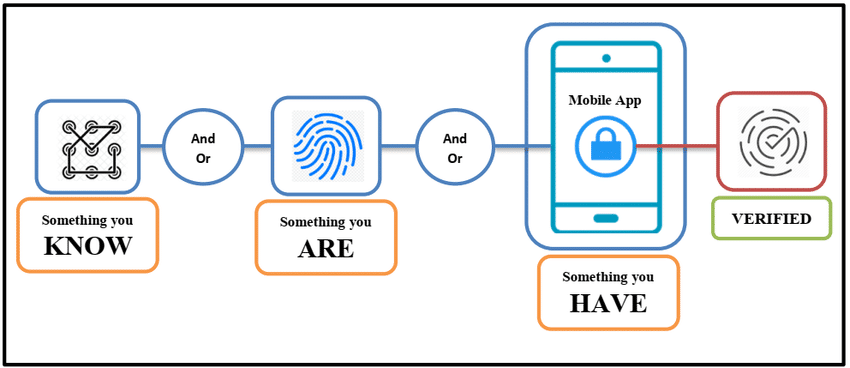

5. Use two-factor authentication (2FA)

To ensure cryptographic security, an additional layer of protection is required. Even though going through the authentication process time and again may be exhausting, it is much better than losing your coins.

The second layer of protection is 2FA, in which a code is sent to a trusted device after you enter a password or transaction details so that hackers are unable to intervene and steal your funds.

Final thoughts

Choosing the proper storage solution for your Bitcoin does not mean selecting the most appealing option for everyone. Instead, it means understanding the different options and knowing which suits you.

As you now understand how Bitcoin storage works, you will be able to compare more accurately the features offered by different wallets and choose the most suitable wallet for your needs.