Buying a car requires planning and adjusting spending habits. So then, why is it necessary to save for one?

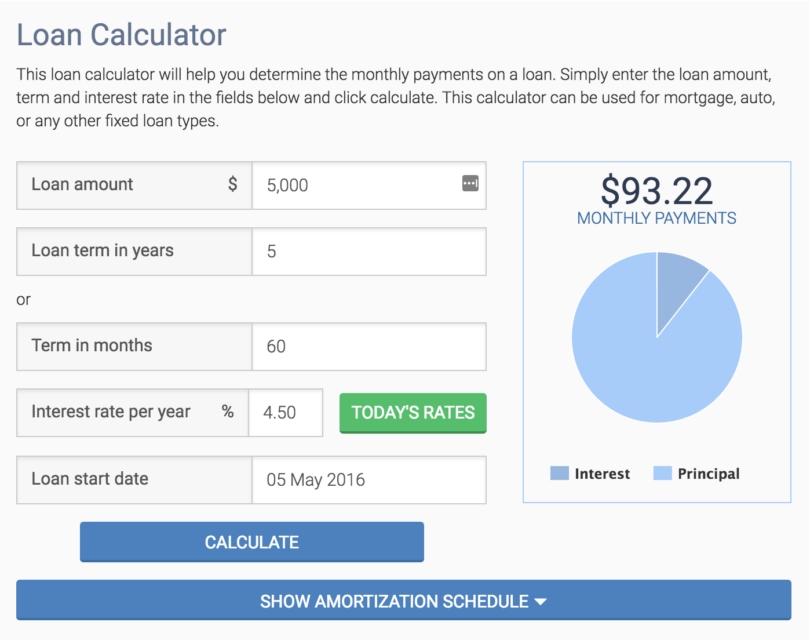

For example, borrowing $7,000 may mean repaying $265 a month to acquire the car, which costs $9,000 in total. However, if you save $2000, you can borrow less so that your monthly repayments are just $190, and your overall costs are just $8,800, a saving of $700.

If you plan to buy a new or used car, developing a savings strategy for the down payment will benefit you both. The following tips will help you get started on your car saving plan.

Tip 1. Figure out how many cars you can afford

An automobile isn’t an inexpensive purchase. Based on an online vehicle valuation service, Kelley Blue Book, the average cost of a new motor vehicle is over $40,000. Data from Experian further indicates that the average loan payment on a new passenger automobile in the fourth quarter of 2020 was $563.

Considering such an expensive purchase, you’ll want to calculate the amount you need to save for a down payment. Almost every lender requires an initial deposit, and the more you put down, the lower your monthly payments and the lower your interest costs. In addition, figure out what monthly payment can be worked into your budget, taking into account all of your other regular expenses, such as utility bills and housing.

Tip 2. Calculate your down payment

If you intend to buy a motor car, calculate your down payment before going to the lot. Depending on your financial situation and the type of motor you want, the amount will vary.

“The goal should be to save between 10 and 20 percent for the down payment on your new car”, says Nishank Khanna, Chief Marketing Officer at Clarify Capital in New York.

“Placing a large down payment will reduce the total interest you have to pay on your loan and thus lower the monthly payment.” In the case of a newer auto, you should put down around 20 percent.

In the case of a used car, a down payment of ten percent might be enough.

Tip 3. Establish a savings plan

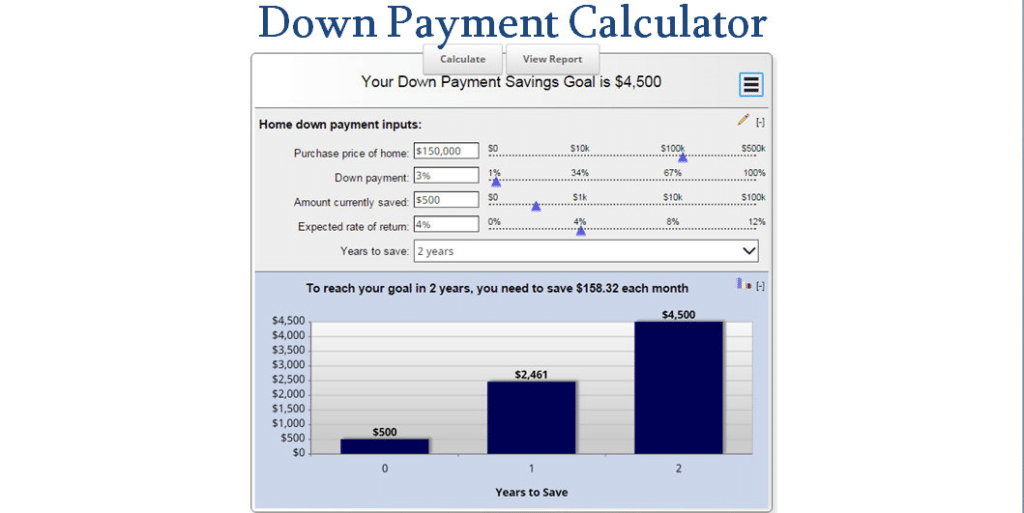

While you may know how much you want to conserve, you must put a specific number on it. Bankrate’s auto-down payment calculator helps you estimate how much you will need to save each month from affording a down payment.

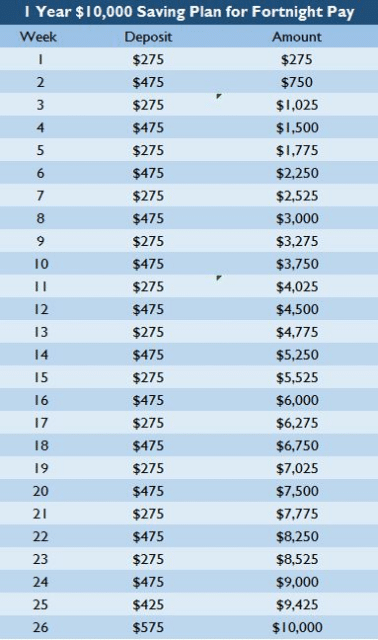

As soon as you decide on a budget, make sure that you’re spending less money every month to reach that goal. You might have to modify your lifestyle, such as canceling subscriptions that you don’t necessarily need. When storing your cash, find a place where it will be safe.

Open a savings account in a bank or credit union that is separate from your checking account. This will make it less tempting to dip into your savings. Regularly transferring money from your checking account to your savings account is another option.

Most banks offer this option, allowing you to put a portion of your paycheck into savings directly. In the present day, the best savings accounts offer an annual percentage yield of 0.4 percent and above. Savings accounts that pay a higher yield can boost your savings faster.

Tip 4. Deciding whether to lease or purchase?

In a lease agreement, you agree to pay for the use of the vehicle for a set period before returning it to the dealer. One advantage of leasing is that it requires less money upfront. The downside is that you may end up paying extra if you go over a certain mileage limit or if your motor car shows signs of wear and tear beyond average.

You can own a car outright after making enough payments to the lender to finance it. While leasing often carries lower monthly payments than financing, financing typically has no mileage restrictions. It would help if you considered your lifestyle and preferences when deciding whether to lease or buy. Renting can be a good choice for those who don’t want to put down a lot of money, enjoy driving a new car every few years, and don’t put too many miles on the vehicle.

Financing is often more expensive upfront, but it’s a better option if you want to keep the car once you make the final payment. Furthermore, you won’t need to worry about mileage limits.

Tip 5. Learn how to negotiate a deal

When visiting the dealership, know the number of funds you have available and get pre-approved for financing. This will set you up for successful negotiations.

You should insist on a lower price if your research suggests that the salesperson is asking for a higher price. The best price can be assured if you get offers from multiple dealerships. Online negotiations might reduce some of the tension you feel when negotiating.

Contacting a dealership via email or text message is possible for some companies. Some provide an online chat function through which you can speak to a representative about things like pricing. A dealership where you can electronically sign paperwork and even have the vehicle delivered to your home is a good option for buyers who prefer handling the whole process online.

Upsides and downsides

| Upsides | Downside |

| Plan and save You can smartly plan on saving money for buying a car. Once you are successful in saving money, you have the opportunity to buy a car and convert your idle funds into an asset. | Delays You may face delays as you may face a situation that sucks your savings. |

| Motivation Buying a car is excellent motivation to save the money you may spend on useless things and extravaganzas. | Demotivation Rising prices and hurdles in income may demotivate you. |

| Achievement You get a sense of achievement when you see your car. You get more power to set up life goals. |

As soon as you have collected the money to buy a new car, you can walk confidently into the dealership and ask for the keys. It is crucial to maintain the capacity of paying your car loans without interfering with the basic expenses that your family requires every month.

Buying a car can be a very lengthy process that can take up a lot of your time. When an urgent need arises, you will not have the time or ability to save up. It may not be feasible for you to save for a down payment if you need a car right now.

Final thoughts

Saving up for a car can prove to be a stressful task, but saving for it is the best option if you do not need it urgently. Using the following tips, you will make some extra money that does not affect your regular budget.