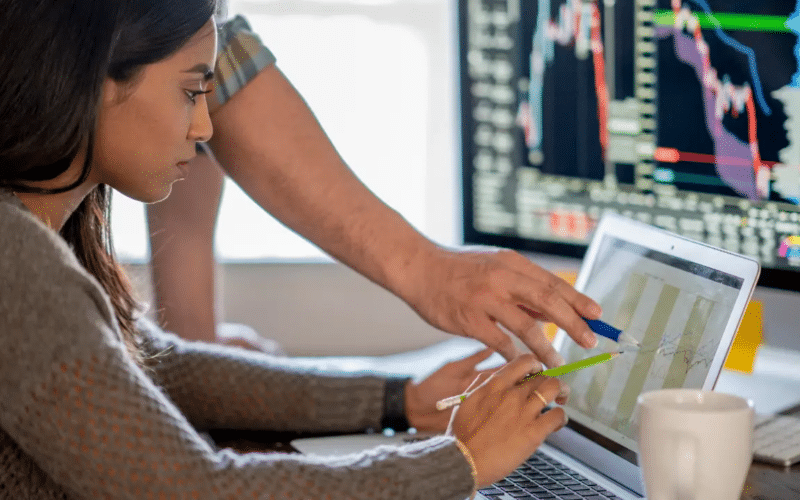

When talking about money, you want only the most reliable companies coming near your hard-earned bucks. Regardless of the reason you decided to invest, it is still an admirable move. Now when the “if” is out of the way, it is time to focus on the “how?”

Choosing a broker can be a daunting task, and we are here to try and make the process a tad easier. We will answer what a broker does and some intelligent ways to determine if a broker is a respectable one.

Let’s see what Bankrate’s got to say on the matter.

What is a broker?

To buy securities from an exchange, be it a stock, an ETF, or something else, you need to have an intermediary. This is because exchanges don’t allow individual investors to participate in the execution process directly.

A broker is a person or an entity that executes orders on your behalf. In simple terms, a broker is there to buy stocks you want and sell them when you tell them so.

Bankrate’s top five choices

There are many factors to be considered when choosing a broker, but trading fees, account minimums, research that comes for free, and other similar traits should come at the top of the list of the criteria used. Bankrate did all that, and these are the website’s top picks.

1. Charles Schwab

There is a reason why Bankrate gave Charles Schwab a five-star rating. You already know that, when it comes to trading, information is vital, and there is no way to beat Charles Schwab when it comes to resources available for both learning and staying up to date with the latest news.

Some may argue that there is a cheaper way to go in terms of commissions, but the sheer value and breadth of information you get are likely to persuade you to change your mind rather quickly. In addition, Schwab doesn’t charge stock and ETF trades, and there is no account minimum.

To make the deal even sweeter, with Schwab’s Stock Slices feature, you will be able to put all your assets in an investment, whether you can afford a full stock or not. It might not sound like too big of a deal, but it can come in handy when purchasing some of the pricier indices.

2. Interactive Brokers

While Schwab takes care of almost all of your needs if you are a beginner investor, there is maybe no better option for active traders than Interactive Brokers. If you are serious about investing and day trading, they are not joking around.

Interactive Brokers’ TraderWorkstation is their best-known trading platform, and it is a beauty. Charts, news, interactive analytics, real-time data, this platform has everything you want.

The brokerage also offers pretty decent commissions, especially in the case of high-volume traders. That aside, it is the low cost of margin loans that gave Interactive Brokers its name. It is maybe the company’s most famous trait, and it’s the main reason so many advanced traders trust the firm’s Pro Program.

As a side bonus, Interactive Brokers also boasts a state-of-the-art ESG rating system, allowing you to invest in companies that not only fall in line with your investment strategy but also meet your ethical standards.

3. Merrill Edge

Merrill Edge is a perfect example of how you can take a full-on real-life brokerage and put it online to lower the costs without losing any quality in the process.

It offers day-round, week-round customer service, and it also comes with unique benefits for those who are already members of its parent company, Bank of America.

The firm offers a valuable insight into the previous, current, and potential movement of stocks, ETFs, and mutual funds by combining data from Morningstar and Lipper. It also decided to go the extra mile, as its team now reports on individual stocks and the way they performed at a given time.

If you are looking for a nice mash-up of responsive customer service and a rich source of data and information allowing you to do the best preparation and research possible, you are in luck. Dare we say Merrill Edge is the place for you, and it doesn’t surprise it ranks so high on the Bankrate’s list.

4. Ally Invest

Ally Invest is the subsidiary of Ally Bank. It came to be as the lender was looking to consolidate its financial services and offer its client a single-stop-shop service.

It doesn’t have a special advantage in comparison to the previous brokers, but Bankrate still included it on its list as it might resonate with people trying to get all their financial tasks done in a single place.

If this sounds like you, Ally Invest has another trick up its sleeve for you. Its mobile application will allow you to do all of the things with a single app. On top of it all, it is pretty user-friendly and easy to grasp and get a hold of.

Like some of the industry’s biggest names, Ally Invest doesn’t charge stock and ETF trades fees. If you are more into debt, commissions on bond transactions are a dollar per bond, with the minimum amount set at $10.

5. Fidelity Investments

Fidelity Investments is another example of a rated five-star broker by Bankrate’s standards. Not only does this brokerage exclude almost all fees that go hand in hand with investing, but it also has no account minimum, making it incredibly investor-friendly.

As a client, you can trade ETFs, shares, funds, debt, and even options. Moreover, Fidelity will have you covered on almost any type of account you seek.

Like other industry giants, the broker also introduced the option to buy fractional shares, which you can do through its stocks by the slice feature. This means that you don’t have to sweat if you can afford a particular stock or fear that you will have unused funds that you can’t do anything with.

Final thoughts

As you can see, it all boils down to preference and determining what would work the best for you. To say that you’ll go wrong with any of the choices mentioned above would be a lie, but there is always the need to tailor the services you seek to your specific goals.

Take your time and examine the options you have. With enough preparation and research, this entire process will be more successful and enjoyable, and relaxing.