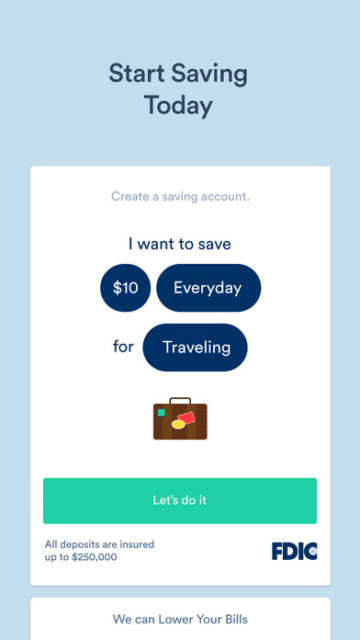

Software for budgeting and financial planning provides a dashboard of all your accounts, such as checking, savings, and credit cards, to give you a perspective on your financial position. A breakdown of where your money goes each month is also available on the dashboard. Using the app, you can, for example, set aside $10 from your checking account every Friday so you’ll have money for a big trip coming up.

For managing your funds, Clarity Money is the best All-In-One budgeting app. Artificial intelligence and machine learning help you construct a budget and find methods to save money. This article will find the top features that will help you in phenomenal budgeting for the future.

Top features

Financial items like loans and the Marcus high-yield savings account, which frequently appears on our list of the top online savings accounts, are recommended depending on your financial situation by the program. Even if you’ve connected savings accounts from other banks, Clarity Money may propose a Marcus account if there’s significant yield. If you’re wondering what Clarity Money offers, here is what you need to know.

1. Safety and security

When you create an account and connect your bank accounts, the app employs multi-factor authentication to verify the accuracy of the data you enter. Additionally, the site encrypts all of your data so that even the data scientists working on the algorithms cannot view any personally identifying information. An authentication method such as a passcode or fingerprint will be required when you access the app on your phone.

The app also bans you from capturing app screenshots for security reasons, which is a little inconvenient if you require a fast snapshot of your account. That being said, it is one less avenue via which your private financial information might be accessed by someone else.

2. Membership plans

Different membership plans offer a variety of tools and facilities. Freemium approach: LearnVest, offers a freemium model where you can manage your money for free, but you must upgrade to access extra tools and advice from a financial advisor. LearnVest isn’t a bargain. It has a $299 starting cost and a $19-a-month subscription price for the first year.

New additional personal finance applications charge for services provided by the firm or its partners, such as an investment account or savings account, rather than a monthly, annual, or transactional cost.

3. Budgeting and goals

As a financial portal rather than a budget app, Clarity Money is more appealing to us. Despite this, it still provides a few budget-friendly options.

These tools, despite their simplicity, can be used to set budget limits for a range of categories. To begin, you’ll be asked to confirm your monthly revenue and split it into weekly budgets. As a result, the app will also reveal how much money you generally spend each week, based on your last three months of transactions.

4. Special features

For those looking for an app with a wide range of features, Clarity Money is one of the best options on the market. Everyday individuals, from small business owners to CEOs, may benefit from a portable, all-in-one approach to money. Clarity Money makes it possible for individuals to achieve their financial objectives more quickly, efficiently, and effortlessly by placing all of their money in the palm of their hand.

5. Syncing of bank accounts

Have you wanted to keep yourself on track with your financial goals? If this is the situation, then creating a Clarity Money savings account and setting up automatic transfers into this account is a great option. Up to $250,000 of your money is protected by the FDIC. In addition, clarity Money customers who synchronize their bank accounts with Clarity Money are eligible for the free auto-savings service.

6. Transactions and reporting

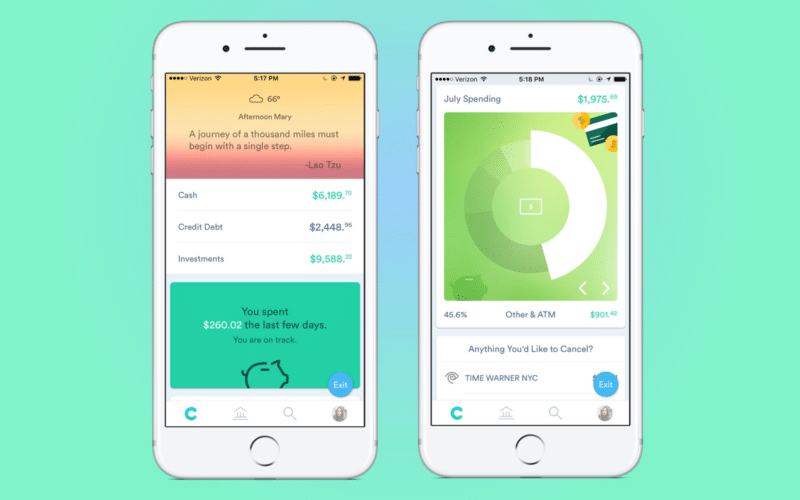

After a brief greeting and a random quotation, the first thing you’ll see in your feed is a breakdown of your current balances. Cash on hand, credit card debt, and investment balances are all included. A list of recent transactions follows this. It also entails a fast count of how much you’ve spent in the last few days. As a bonus, there are corporate logos shown next to each transaction.

Despite a few tabs (for better access to your accounts, transactions, and preferences), the majority of information you need is available in a single feed. This feed looks a lot like your iPhone’s “Today” screen, replete with a slew of useful widgets. Like other applications of this kind, these widgets are immensely more helpful if all of your bank and credit card accounts are linked to them.

7. Support

At any moment, users may contact the support staff using the built-in chat feature. For difficulties or to find out how to make Clarity Money work for your specific financial requirements, this tool is available in the app.

While Clarity Money has customer service representatives on hand, the personal touch is noticeably lacking. This may not be an issue for individuals accustomed to online banking, but it might be a roadblock for others searching for specialized financial guidance. If this is the case, you’ll need to seek either a human, financial planner or a robo-advisor.

Pros and cons

| Pros | Cons |

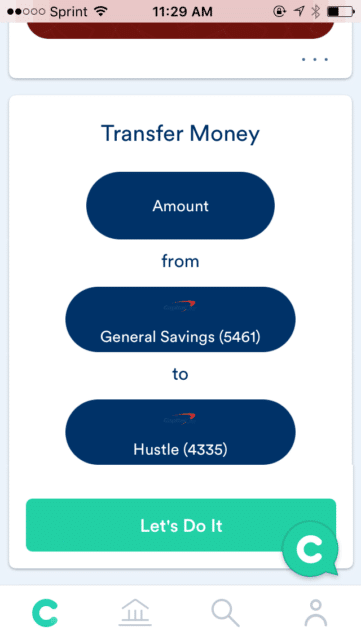

| Transfer funds from one account to another. | Inability to interact with every financial institution, such as a small bank or credit union. |

| Get a free credit report now. They work with Experian and use the VantageScore model. | Inability to cancel or negotiate all recurring payments and costs. |

| Automate the process of saving money for you by opening a new savings account. | It doesn’t function outside the US. |

| Find credit cards and personal loans with reduced interest rates. |

Final thoughts

It’s like having your banker at your fingertips when you use the Clarity Money app. To answer all of your financial queries, you may use this app accessible on iOS and Android smartphones. Clarity Money is here to help you get started, from savings accounts to annoying monthly payments. Although using Clarity Money is free, users should still be aware that they may be charged for overdrafts or transactions that exceed the limitations of third-party accounts linked to Clarity Money.