Bond investment is one of the safest ways to protect your savings and make a profit by lending money to organizations worldwide. During the 2008 crisis, bondholders outperformed stockholders and saved their assets from the market crash.

While many investors lost their money when their companies’ stock prices went zero, corporations and countries had to fulfill their obligations to bondholders.

Bonds are instruments that generate profit for investors by making money out of the bond interest. So, if you are thinking about investing, let’s find out if bond investments are suitable for you.

How to invest in bonds?

A general rule when investing in funds is to put the money you don’t need right away. Bonds are long-term investments, so you need to understand that money won’t come back until the bond’s maturity. Although, you can always trade your bond.

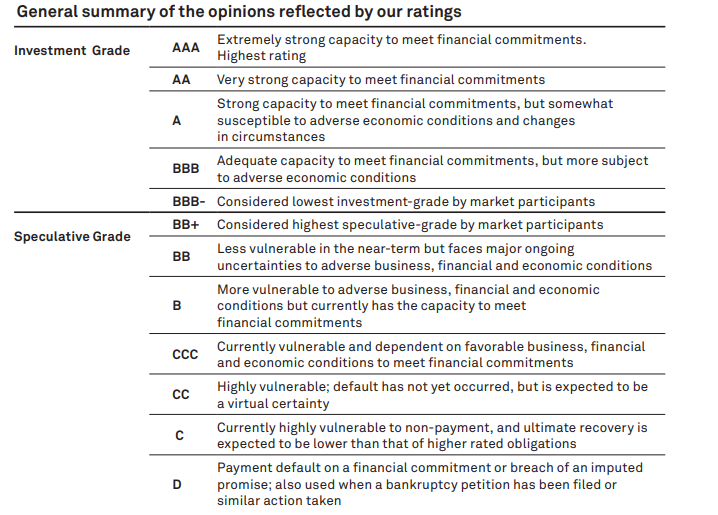

Once you establish how much you are willing to invest, the selection of the bond is key. Bonds are rated according to the estimation of agencies that the issuer will fulfill its obligation. The rating goes from AAA to D. Below, BBB bonds are considered junk bonds. Junk bonds offer high-interest rates but only because the risk of not getting your principal back is high. Avoid these bonds and try to invest in investment-grade bonds.

You can invest in bonds through online brokers.

When to invest?

There are two different perspectives.

- The first is market conditions. Investors are always trying to know if the interest rates will be low due to the best situation to invest in bonds. Now, this is a difficult task. Although, in the beginning, interest might be low, it could be a good investment with time. So, bonds investment should be more linked to your portfolio than the market conditions.

- The other way of looking at this is the time of each person. Many small investors want to make money for their retirement, so they often put part of their capital in bonds and the other part in other markets like stock. Since bonds are considered safer investments than others, you should lower your risk and invest more in bonds while you get older.

Which factors influence bond price?

The most relevant factor influencing bond prices is interest rates. When someone invests in bonds, that investor is looking to get better profits than he could get from regular interest rates. However, investors lose interest in bonds when interest rates rise because they could get similar returns without risking money. Therefore, bonds have an inverse correlation to interest rates.

Another factor is creditworthiness. During the lifetime of a bond, the qualification of the organization could change. For example, a country could go from a BBB to a BB rate or vice versa. This represents a higher risk for investors and would impact the bond price.

Rules for deciding: when to buy bonds

Bonds are a good investment when you are trying to preserve your capital. However, there is no exact amount of money to invest. It varies according to different factors. In general, you should always keep a percentage of your portfolio invested in bonds. Let’s review some rules used to determine when is a good time to invest in bonds.

Rule 1: focus on your age

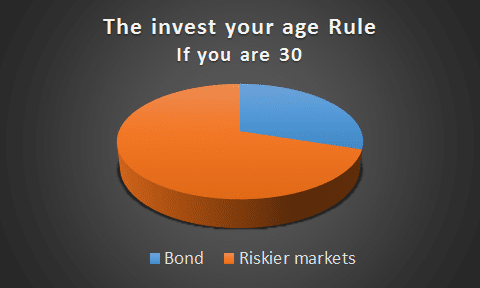

The goal of many investors is to have sufficient money when they retire. That’s why this rule focuses on your age. While you are young, you have more time to amend errors and recover from poor investments, so it makes sense to put more money on riskier markets like stocks.

While you get closer to your retirement, you need to preserve your capital, so bond investment makes more sense every time. According to these rules, you want to invest your age in bonds. For example, if you are 30 years old, you want to buy 30% of your capital in bonds, so you can put the other 70% of your portfolio in other more lucrative but riskier markets.

Rule 2: read the economic predictions

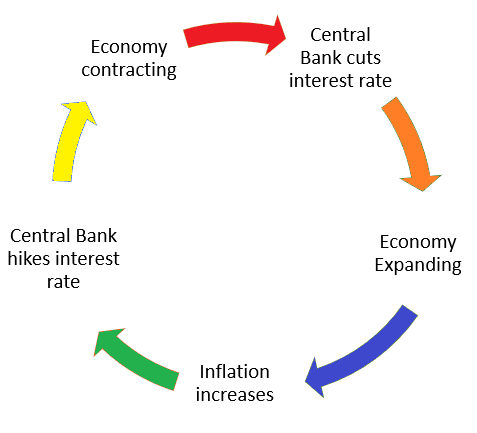

Predicting if the government will raise interest rates is not easy. This is a tough one. However, many factors influence government decisions. The main element is the general state of the economy. In a weak economy, national monetary institutions lower the interest rates to stimulate the economy.

When inflation becomes a problem, interest rates also fall. So, a good reading of the economy is necessary before investing in bonds. When interest rates are low, the bond investment makes a lot of sense.

Rule 3: be prepared

The first requisite to invest is to have savings. You should only invest in bonds and on any other market when you saved the equivalent to three to six months of your living expenses. If you don’t, you are vulnerable to emergencies, and you won’t be able to access the money you need immediately.

Alternatives to bonds

It is recommended to have a part of your portfolio invested in bonds. Bonds are some of the more secure investments. However, finding the balance between risk and reward is sometimes hard. For big players, it makes sense to put some AAA-rated bonds and a smaller amount on BB bonds risking their money to get a greater return, but small investors can’t do that.

One great alternative is to invest in bond funds. These are packages made of many individual bonds with low and moderate risks. It’s the equivalent of putting small amounts on many different bonds to seek better coupons on average.

Are bonds worth investing in?

Bonds are always a good investment. Today, most investors see bonds as a defensive investment to protect their capital from market changes. The real question should be how much you should invest in bonds?

Bonds should not have much weight in your portfolio if you are young because the stock market and other investment options have historically outperformed bonds. However, as you get close to retirement, your capacity to take risks is lower, so bonds should take more importance.

Safest bonds in 2021

US saving bonds are one of the most reliable bonds to invest in. With almost zero chance to default, the US saving bonds offer fixed rent for your retirement plan.

Bond funds are also good options. When buying a bond fund, the risk of default is almost impossible, and even when one or a few companies may default, the impact is negligible.

Final thoughts

The stock market is always more attractive to investors due to its higher returns. However, bonds have always worked as a protective investment through difficult economic times. Rules with fixed percentages to establish how much of your portfolio you should invest is outdated. Today’s investors should be smart and change their strategies according to the market situation.