As a novice investor, you are probably wondering what growth stocks are. The assumption is that all stocks should grow. Since the premise behind these stocks is that the value of shares should go up.

There are different types of stocks, and growth stocks, in particular, are different from traditional assets.

We would like to believe that all companies grow, but some increase faster than others, as they offer a different type of product or service. These are the innovators of the world who amaze us with their advances in technology while making the end user’s life easier.

Therefore, if you want to know more about these types of stocks, you will need to read further to find out.

What are growth stocks?

Companies earmarked as growth stocks’ net profits and revenue grow more rapidly than the average business in the same industry. Growth stocks companies are usually leaders in technology and e-commerce.

Their unique product offering distinguishes growth stocks from traditional value stocks. In addition, the fast pace at which these companies grow is another crucial difference. Furthermore, growth stocks do not pay dividends to shareholders.

Revenue is reinvested to fast-track the growth. The company uses the income to acquire new assets and invest in researching and developing new or existing products and services.

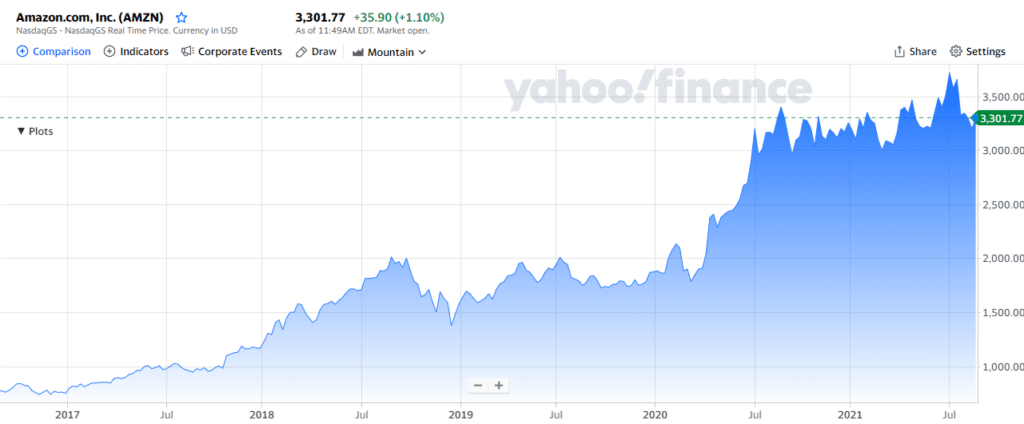

An example of a growth stock is the e-commerce giant Amazon.com Inc. The company’s earnings per share have a growth rate of 77.9%. And the projection is that the shares will grow in 2021 by another 37%, above the industry average of 27.2%.

How do growth stocks work?

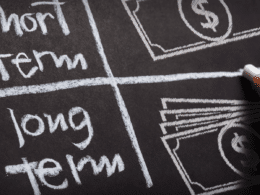

As we mentioned, investors do not receive dividends for the duration of their holdings. You earn capital gains on the basis that the shares will increase in value from where you purchased. Therefore, holding shares longer is the key to this type of investment.

Once the company’s stocks have gained significant value, you can sell off your shares and profit this way. The old rule of ‘buy low’ and ‘sell high’ applies here. However, investors should note that if the company fails to generate sufficient revenue, the growth will be much slower. And for a start-up company, this can be acceptable.

However, financials need to improve for investors to gain confidence in the stock.

These stocks have a high price-to-earnings ratio (P/E). Initially, they will not have earnings, but if the projections are favorable, they can increase in the future.

Growth stocks would have a loyal clientele, and their market share should be significant. This is also how they secure growth faster by leading the market with their unique product offering.

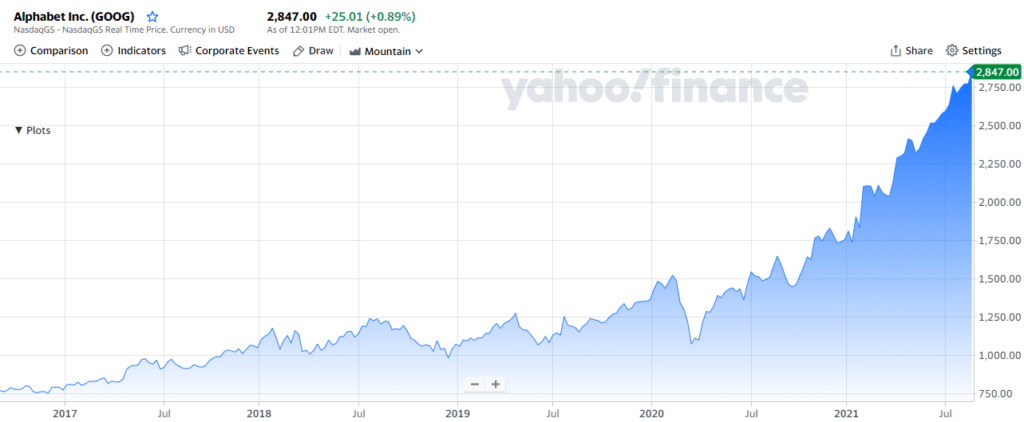

An example of a growth stock that offers a unique product is Alphabet Inc., and they lead the online digital advertising market share. Its closest rival being Facebook. Alphabet earns profits from online advertisements, which has expanded since markets are moving from TV and print advertising to online channels.

How to spot growth stocks

Growth stocks’ value rises rapidly in a short period, and you will see a sharp increase in price value. It is not unusual for growth stocks to gain more than 100% within a single year.

However, a stock can fall just as quickly as it rises. And many companies that start have gone through this. It might be that it was just a hyped-up stock initially, and the company couldn’t sustain the growth. There are a few things that you should consider when identifying the right growth stocks.

1. Profit margins

Growth stock companies have profit margins that rise consistently over time. It can be that the company starts in negative margins; however, as the growth rate improves, the margins become positive. This also means the share price of the stock has increased and moved out of the red. If you hold your shares during this time, you can potentially earn immense profits.

2. Sales revenue

Sales is a significant revenue driver for these companies since sales revenue helps accelerate growth. Investors would want to see an increase in sales every quarter; sales should also outperform previous years’ income.

3. Analysts’ projections

A company’s projected earnings by analysts boost investor’s confidence in the stock. Especially if the projections are towards positive growth, it gives investors a sense of whether the stock is good.

4. Return on equity (ROE)

ROE is a measure of how much profit a company makes concerning the investment. A high return on equity is favorable since it means the company is highly profitable. It’s also a sign to investors that the capital is generating significant profits.

5. Debt levels

Return on equity is a key indicator, but it’s important to note that besides the invested revenue, companies can use debt to increase equity as well. Therefore, using debt to generate high ROE is not a good practice. Liabilities should be minimal, and historical performance should show this trend. Another way is to compare the debt levels to those of its competitors in the same industry.

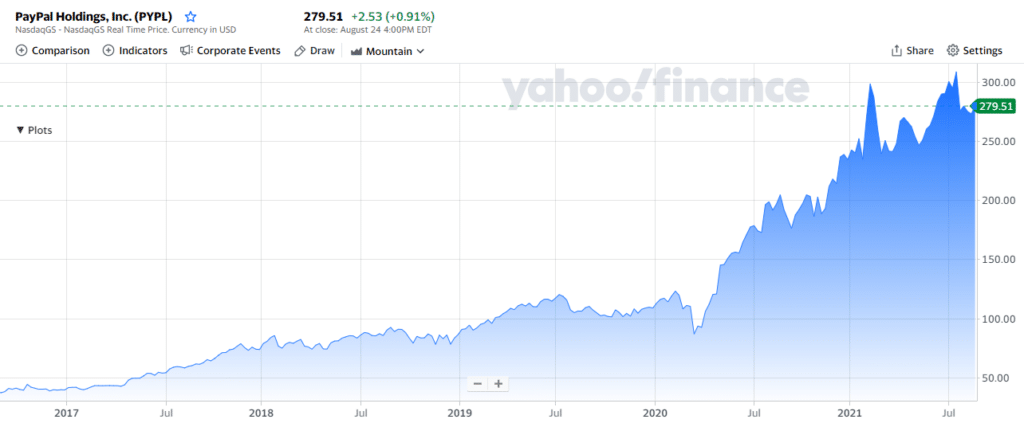

PayPal Inc. is a digital payments company; its revenue has increased by 17% and net income over 32% in the last three years.

Pros and cons of growth stocks

Growth stocks, although significantly profitable, can also pose risks for investors. As in the stock markets, nothing is ever certain; we have to consider the pros and cons of these investments.

| Pros | Cons |

| High returns fast You can benefit from the fast growth rate; therefore, you will make more money quicker than traditional dividend-paying stocks. Safeguard against inflation Historically growth stocks have outperformed inflation, and you can take advantage by holding your funds a little bit longer to maximize gains. Easy to buy Since growth stocks list on the major stock exchanges, it is easy to access. Buying through a verified broker or investment firm is straightforward, and some even offer low commission fees. | No dividends Unlike traditional stocks, growth stock companies do not pay dividends since most of the revenue goes back into the company to catapult the growth. You only profit once the stock has gained value. You will have to hold for a while before seeing profits. High risk There is always an inherent risk with stock investing. Even if the company has performed well, the unpredictable nature of the markets makes it a risky investment. In addition, if the growth rate is slow or the company performs poorly, you stand to lose everything. High volatility Growth stocks have higher volatility than common stocks since their prices rise and fall often. They go through high and low swings more regularly than other stocks. You, therefore, need the emotional maturity to withstand the high volatility of growth stocks. |

Final thoughts

Most growth stock companies are performing well, even during the current pandemic. They are showing high earnings per share; even though you will not earn dividends, you can rest assured that the profits are consistent and the value of the stocks are increasing.

Perhaps, these stocks are not for everyone since they come with high volatility. But the rewards are high if you can sustain the emotional drawdown. Again, it is ultimately your decision, and it comes down to your portfolio goals and risk appetite.