If you are a bond trader, you should grasp what the relationship is between bonds and yields. When acquiring a bond, there are two essential factors to consider: the price and the yield. Let’s walk you through them and find out their relationship.

Bond pricing explained

If you purchase an asset and hold it until it matures, price change and yields usually do not affect you until the asset is callable.

However, you are not required to purchase this asset directly from the issuer and retain them until maturity; instead, you can buy from and sell them to other individuals in the marketplace.

When you swap bonds with other investors, price is an essential factor. This is because this asset’s price is what you are paying to buy it.

Price & interest rates: hand in hand

The thing about bonds is that the price and their interest rates are like the deadly duo. Interest rates can considerably impact the price you pay for a bond. If interest rates are more significant than they were when the present bonds were issued, the prices of such assets will generally fall.

A key point to add here is that new bonds are more likely to be issued with higher coupon rates, and as interest rates increase, old or active bonds become less appealing unless you can purchase them at a lower price.

As a result, growing interest rates cause bond pricing to drop. Conversely, when interest rates drop, bond prices rise, which means you can sometimes sell an asset for more than the purchase price because other investors are ready to pay a premium for an asset with a higher interest rate. This is called a coupon.

Understanding bond yield

Assets yields are the predicted earnings created on a fixed-income deal, expressed as an interest rate or a percentage over a particular time.

When you buy an asset, you are lending money to its issuers. In return, issuers pay you interest on bonds depending on their expiration and reimburse the market value of assets at expiration.

The easiest way you can calculate the yield on a bond is to divide the coupon you pay by the bond’s market value. When you do the calculation, the resulting figure is the coupon rate.

For instance, if an asset has a market value of $100 and receives $10 in interest or coupon annually, the coupon rate is 10%. Yet, you can obtain a bond for more than its market value or less than its market value, which affects the yield received by the buyer.

What you need to know about bonds and yields

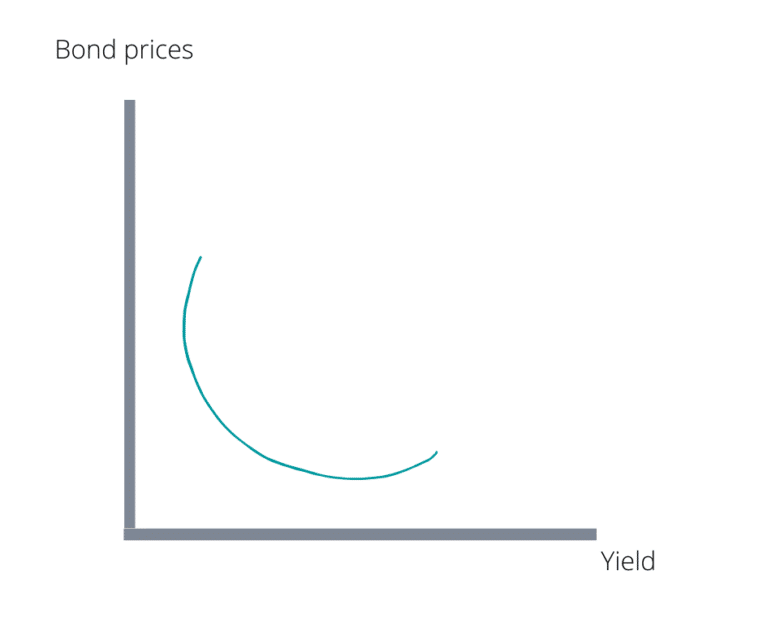

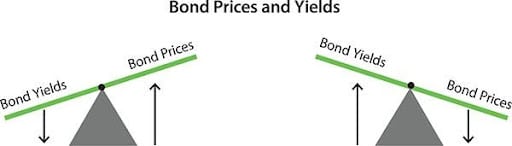

They are like north and south. They have inverse relations with each other, which can be puzzling if you are a beginner, but there’s no need to fret.

Think of them like a roller coaster: as bond yields surge, prices fall, and when bond yields plunge, prices jump.

For instance, an increase in the yield of US treasury bonds is a negative situation for the overall bond market, as the bond’s interest rate increases while the bond market drops. This is because the law of supply and demand drives the bond market.

As an asset buyer, you may return to the market when interest rates hikes. This will cause prices to climb and rates to drop. In contrast, any drop in the bond’s interest rate reflects strong market performance. Remember that bonds are traded when issued until they expire, where prices and yields fluctuate constantly.

As a result, rates fall to a point where you receive the exact yield for the same level of risk. So you can’t buy a US Treasury note with a 10% yield to maturity when another has a 3% maturity period.

It operates like a retailer can’t charge $10 for a chocolate bar when the store across the street costs only $3.

Along came interest rates

If interest rates go up by 10%, the price of the asset will tumble if you choose to sell it.

Assume that bond interest rates grow to 12%. However, the bond still has a $1000 coupon payment, which would be unappealing to you, who can now acquire bonds that pay $120 because interest rates have risen.

If the asset owner decides to sell it, the price can be reduced so that the coupon rate equals an 11% yield. If interest rates plunge in value, the bond’s price increases because the coupon payment becomes more appealing.

Which bonds yield to choose?

There’s a common question which one should you choose — low yields or high yields.

Well, like any investment, it depends on one’s circumstances, goals, and risk tolerance.

- Low-yield assets may be better for those who want a virtually risk-free asset or those who wish to have a mixed investment portfolio.

- On the other hand, high-yield assets are better for those keen to accept a degree of risk in return for a higher return. The danger is that the firm or government issuing the bond will default on its debts.

You’ll be able to diversify your portfolio while enhancing expected returns. For instance, if interest rates fell to 6% for comparable investments, the bond’s price would grow if rates fell further and vice versa if interest rates climbed up.

In either case, the coupon rate has no meaning for new investment. However, by dividing the annual coupon payment by the bond’s price, you can compute the present yield and obtain an approximation of the bond’s current yield.

Final thoughts

There’s not much rocket science in bond pricing and yields. When the assets increase in price, the yield falls. One thing you need to consider is the interest rates. Annually, bond issuers pay 10% in interest, so assets will fall if the interest rises above 10%.