To begin saving money, you do not need to be an adult. Teenagers can start saving money as early as possible to pay for things they want and to get their financial life under control. Unfortunately, a recent study found that 83% of teenagers in the United States cannot manage their money.

Some teenagers are fortunate enough to have their parents fund their expenses, but it is not the case for everyone. Your parents will not afford many things, including a new PlayStation and the latest MJ sneakers.

If you start saving money, you will be able to do so. Below you will find a short guide that will help you to learn some easy ways. First, let’s discuss how teenagers can begin saving money.

Step 1. Keep a check on your expenses

We have parents who take care of mandatory expenses, such as food, shelter, clothes in our teenage years. However, we are still responsible for paying for unnecessary costs. Such as going out with friends.

Take a regular note of how much money you make and how much you spend every month. Once you’ve done that, consider how you can reduce these expenses. A spreadsheet will make keeping track easier. As an alternative, you can use apps like PocketGuard and MoneyDashboard.

Step 2. Open a savings account and start earning interest

As a child, you might have stuffed a few coins into your piggy bank from time to time. You will have to open your own savings account as a teenager or young adult if you’re serious about saving money. The difference between these accounts and a standard checking account is all due to the interest.

In simple terms, interest is what you get if a bank keeps a certain amount of money in your account for a certain period. To save money and choose a savings account that’s right for you, you must get to know the following financial terms and abbreviations.

- Simple interest

The interest rate you will receive from your savings account is a percentage based on how much is deposited. For example, suppose you deposit €1,000 into an account with a 15 annual simple interest rate. After 12 months, you’ll earn €10.

- Compound interest

It is the interest paid by a bank on all deposits and the additional interest. By using the example above, the €1,010 is “compound”. With this new total, interest is earned.

- APY

The annual percentage yield is the total return on interest over a year (assuming no withdrawals are made). A higher interest rate will grow your money faster.

- APR

It is the same as the interest rate you pay on money you borrow from loans, credit cards, overdrafts, etc. Savings account interest is not included in APR.

Step 3. Select a portion of your check to spend

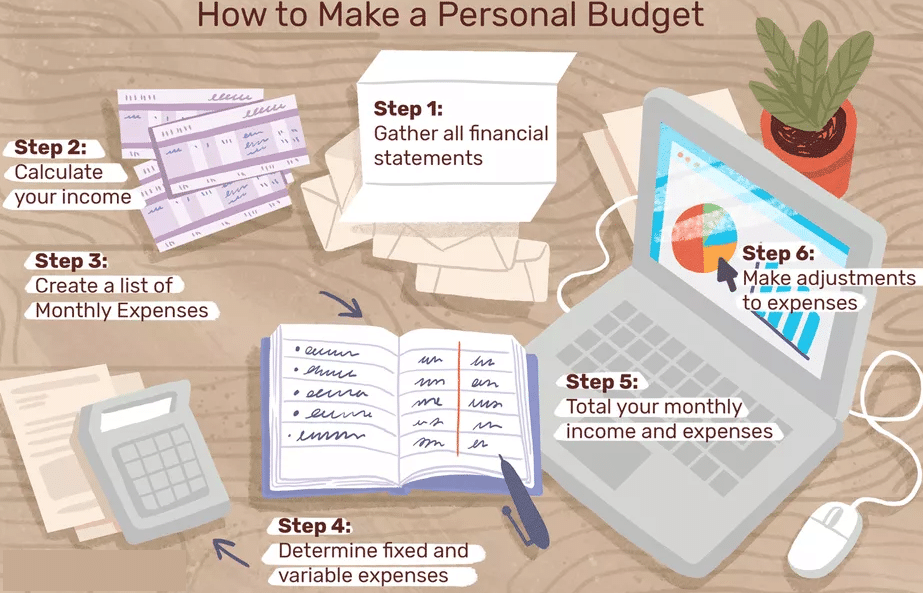

You have to choose how much you save if you are going to save. Saving calculators can help you determine how much of your paycheck should be set aside. To accomplish this, keeping track of your expenses is the first step.

Based on the expenses you have, how much money do you need to take from your check, and how much can you leave for savings? Take this into consideration. If you can save more, you will be happier.

Step 4. Earn extra money

A teenager can also save by earning money and depositing it into one of their savings accounts, which will be safe from their reach. It may be Alliant Credit Union, Comenity Direct, Quontic Bank, etc.

When you want to earn a small amount from your parents, it may be worthwhile to do jobs such as cleaning the house or washing the car. However, if you prefer a regular income, you should consider working part-time in a restaurant or a grocery store.

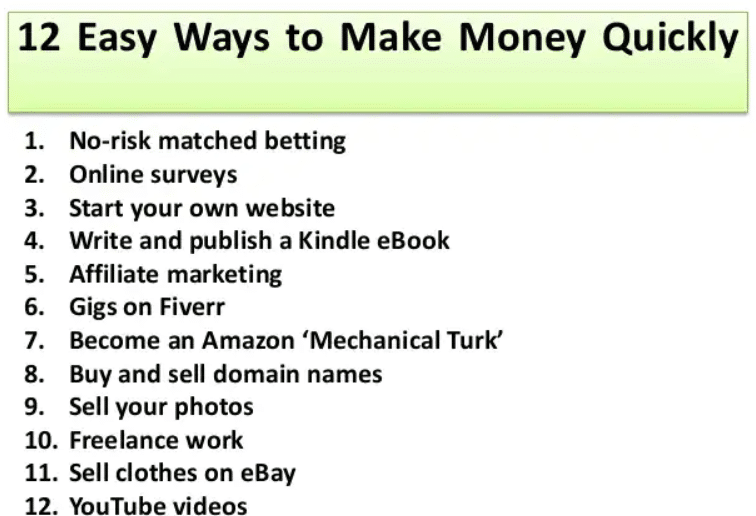

12 simple ways to make money as a teenager

You can also find interesting ways to earn extra income at this time if you are creative. For example, selling clothes and gadgets that you no longer need might be a good idea. Other options include tutoring, house sitting, and dog walking, bringing in a good income.

Step 5. Use discount where you can

Especially if this is your first time budgeting and setting goals, saving can seem daunting. However, study after study demonstrated that new habits take 66 days to become automatic.

Therefore, the beginning can be the most challenging part. However, the good news is that you will become accustomed to saving money over time, and you will do it naturally.

Some people fail to develop new habits after the first 66 days. Consistency and effort are required to establish new habits around money, set goals, and set aside money regularly.

The following tips will help keep you on track:

- Start small

You should set a savings goal that gets you motivated while not becoming unrealistic. Having to make too many sacrifices will make it difficult to adhere to your plan.

- Avoid perfectionism

Everybody can’t be perfect. There is no need to worry if you miss a goal or make an impulse buy. Just see these moments as obstacles you’ll have to overcome. Afterward, reset your goals and recommit to your vision to get yourself back on track.

- Be accountable

Your desire to succeed will increase just as much if you share your goals with family and friends.

| Upsides | Downsides |

| Financial independence. You don’t need to ask for money from your parents unexpectedly. | It is not difficult to stop spending money on the things you value once you get into the saving mindset. |

| You should save up for larger purchases instead of spending money on many smaller ones. Such as a trip or an iPhone. | Historically, savings accounts pay very little interest. The interest rate on some savings accounts is less than 0.01% a year. With $100 in a savings account, you will earn one penny annually. That’s virtually nothing. |

| Invest in college or school tuition/expenses as well. | Inflation in the United States is typically 2%-3% per year. So you’re not making any money if you’re not earning more than 3% interest on your money. |

Final thoughts

Teenagers can easily save money by using some simple steps. If you use these simple methods, you will be able to save a lot of money. No matter what you are saving money for, anyway, it is crucial. Thus, taking this course teaches you how to handle money more responsibly, which you will appreciate as an adult.

It is highly beneficial to be financially capable as an adult. Therefore, we strongly encourage you to try some of these money-saving methods and make money-saving a habit.