Perhaps you would agree that you need to save now and invest in the future to be financially secure. But how can you achieve that if you merely live from paycheck to paycheck? Trying to make ends meet, you might find it hard to regularly set aside an amount for your savings.

If you struggle to save, you’re far from alone. 44% of Americans said they couldn’t come up with $400 for an emergency, according to a 2017 report issued by the Federal Reserve.

That is why financial experts suggest automating the saving process. That is one function offered by savings apps.

Let’s understand how savings apps work, their drawbacks, and what valuable features they offer.

What is a savings app?

It is a mobile phone application that allows you to save money regularly with little effort. Most often, you can customize the app to suit your needs, regardless of your starting balance. You can find various types of savings apps based on purpose. There is an app for saving for a vacation, car purchase, emergency fund, tight budget, etc.

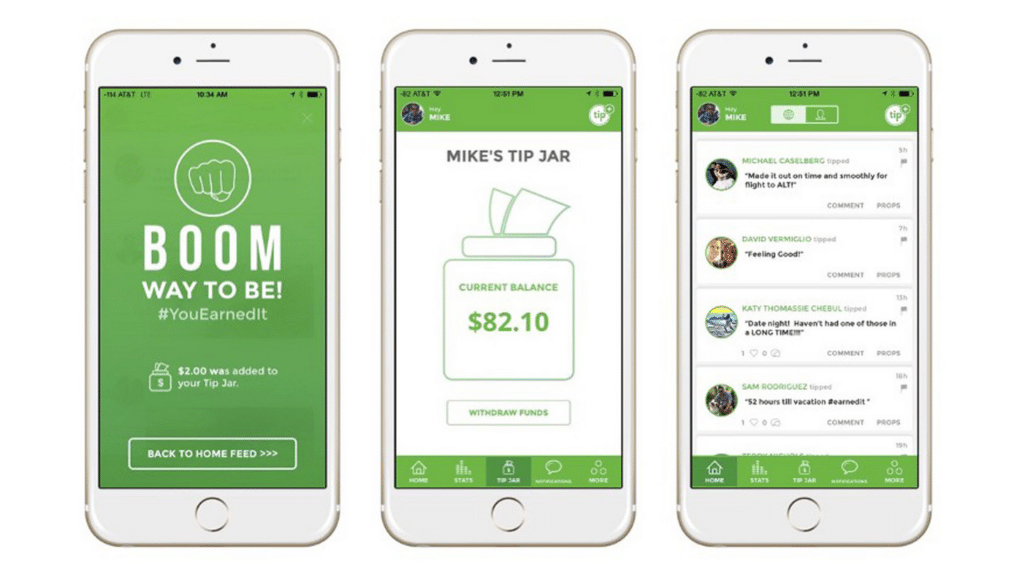

One of the most popular saving apps is Tip Yourself, which allows you to simultaneously build good habits and travel savings. Like you’d tip someone else for excellent service, now you can tip yourself for a job well done. Went to the gym? Tip yourself! Did all your chores? Tip yourself! This app also connects you with a community of fellow tippers who will cheer you on as you go.

Savings tools offer different features, which help you achieve your financial goals the same way you would approach any game. You may start with a small savings goal, work on it until you achieve it. Once you reach your initial goal, you might feel motivated to up your game to hit another milestone. This cycle continues over and over again, improving your financial health in the process.

Features of saving apps

They showcase excellent functionalities, and this section outlines such notable features.

Automatic deposit

You can set the savings app to carry out automatic deposits. First, you must decide on the amount of money to save and then specify when the app will perform the transaction. After the configuration, the app completes the intended action on your behalf without your involvement.

Whenever the predefined date comes, the tool will save the specific amount automatically. You have to check from time to time how much has been saved over time.

Expense tracking

You can input all your expenses every day on the savings app, and then it puts each expense in the correct category. The app organizes your purchases so you can easily see where each dime goes. With this function, you will get an overview of your monthly expenditures in areas such as travel, food, gas, personal care, etc. This way, you will understand if your budgeting is working as you have intended.

Rewards

Savings apps utilize different rewards systems. Some of them allow you to earn interest in your savings. Applied to your total balance, the interest rate can be low, but the interest adds up over time little by little.

One example of this kind of app is Digit, which provides 0.10 percent annualized interest paid quarterly. See the image below. Meanwhile, other apps will let you get points and redeem them for something. This method is similar to the rewards program of credit cards. Try to find the app that offers rewards you love the most.

Micro investing

You can make small amounts of money through micro-investing — an excellent feature offered by many savings apps. They allow you to convert spare change into investment by rounding the amount to the nearest dollar and setting it aside until it accumulates and becomes substantial to buy bonds or stocks. You can choose which investment you prefer. A few cents may not look much, but they could add up fast as you use the app for your purchases.

One app offering this cool feature is Acorns. You can enjoy this app for as little as $1 per month. See the image below.

Despite the varying features, savings apps have one primary purpose, that is, money management. With a savings app, you do not have to spend so much time thinking about savings and investment every time money comes in. With your inputs, your apps can carry out your bidding about savings and investment.

Drawbacks of saving apps

With the number of benefits presented above, you might think savings apps are perfect. That is not true at all. There are some drawbacks and challenges you must be aware of and conquer to use savings apps successfully.

High monthly fees

Be aware that several savings apps are not for free. Some apps are available for monthly subscriptions from the get-go. Other apps offer trial versions for a limited period, after which you should pay to continue using the service.

If you intend to save a massive amount of money and seek convenience, consider getting savings apps with a monthly or yearly subscription. However, before you settle for one app, make sure you do your due diligence. Compare available options and choose one that offers the most value.

Limited transmissibility

The process of putting money in a savings app can be easy. However, if you plan to move money across various platforms, you might end up feeling disappointed. To avoid falling into this dilemma, you must understand your purposes and see if an app can deliver. If not, you will waste time and effort later if you engage now.

Slow deposit processing

Although technology enables the completion of transactions quickly, bureaucracy makes them slow. If you top up money from a bank account to your savings app, the actual transfer might complete in one or two days because of policies and regulations in place by the parties involved in the transaction.

You might not find an easy workaround for this issue. This is something you must accept and live with. That being said, the best policy is to allocate the money you would not possibly need in a couple of days. If you find yourself constantly taking out money from your savings now and then, you may have to reconsider your overall saving approach.

Focus on short-term results

Not all financial experts are familiar with savings apps. Although you can find budgeting apps installed in 30 percent of smartphones among millennials, some users claim that reality does not measure up with the target.

The majority of savings apps focus on short-term results instead of considering long-term outcomes. If you find yourself in this situation, you might need help from a financial advisor to get back on track or reconfigure your savings approach.

Final thoughts

Now you have learned the upsides and downsides of savings apps. You need to do further research or try out some apps you can get your hands on. There is still no substitute for actual, hands-on experience when deciding if savings apps are for you or which ones are worth your time. You can use this primer as your guide when doing your due diligence.