Crypto tax software is an application that can sync transactions on many exchange platforms to calculate tax & profit-loss reports. Crypto users seek and use the best platform to calculate taxes and other parameters, including DeFi staking rewards, airdrops, ICO participation, staking, and mining.

There is plenty of crypto tax software available with different features. Therefore, it is mandatory to have some research and comparison between these apps when determining the feature-rich or best crypto tax software. Therefore, this article will list the top five crypto tax software and the primary info of this software.

Best five crypto tax software

Different tax rates are applicable depending on your holding duration, such as long-term and short-term. Any holding that lasts longer or equal to 365 days are long-term holdings, and holdings lesser than are considered short-term holdings. We do sufficient comparison and research when listing these top five crypto tax software. Our research suggests the top five among these are mentioned in the list here:

- Accointing

- Kolnly

- ZenLedger

- TokenTax

- TaxBit

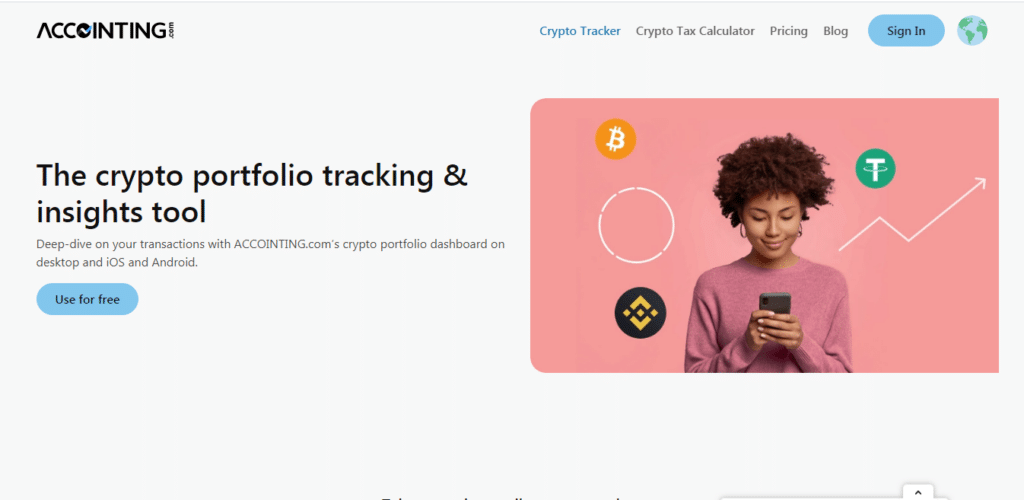

Accointing

It is one of the best crypto tax software in the market that has 4.3-star ratings in the Google Play Store and 4.6-star ratings on the Apple App Store. The algorithm of this software can report, manage, and track users of all crypto transactions across different places on a single platform. You can analyze your performances and real-time transactions through the dashboard of this software.

Features

- Allow users to explore the crypto marketplace.

- Creates tax reports and enables downloading for filing tax purposes.

- Enable tax-loss harvesting for users.

- Contain tools to analyze tax so users can make more efficient moves in the future.

- Calculates users’ gains and losses.

- Able to connect with more than 300 exchanges.

Verdict

This software offers a free version that is usually beneficial for new users as it reports tax for 25 transactions.

Pricing

- Free tax: $0

- Hobbyist: $79

- Trader: $199

- Pro: $299

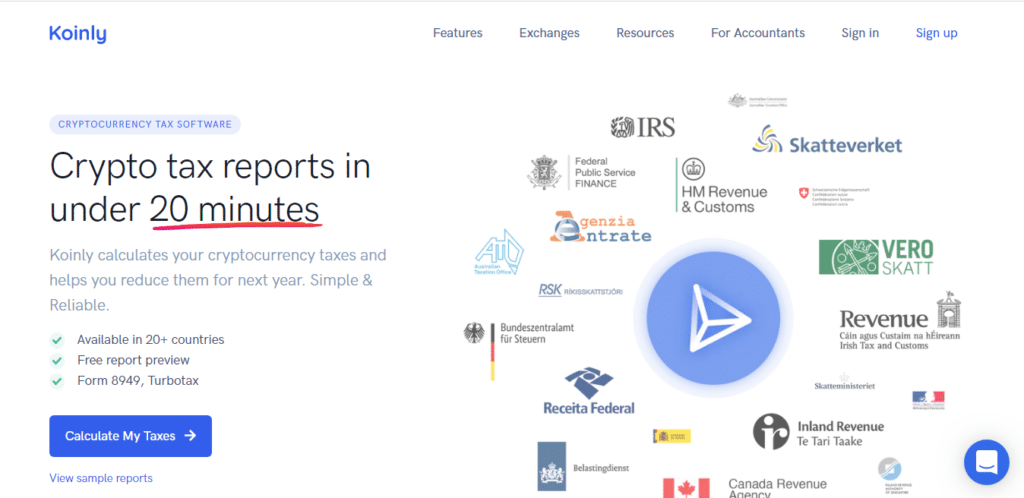

Kolnly

It provides a tax solution for accountants and crypto investors by connecting users of all crypto exchanges, wallets, blockchain services, and addresses to provide the actual image of your total investment in different platforms. For anyone who uses multiple exchange wallets and accounts, Kolnly is the best solution for them to generate tax reports. Users only need to connect the exchange and wallets with this software, and it determines their capital gain.

Features

- Able to sync user data from all sources.

- Enable exporting data to other crypto tax software such as TaxAct, TurboTax, etc.

- Able to connect with 14 blockchains, 74 wallets, and 353 crypto exchanges.

- Tracks user portfolios across all wallets and accounts and displays real-time tax liabilities and profit/loss info.

Verdict

Kolnly simplifies the process of crypto tax by calculating liable tax info on different exchanges. Any user can easily export tax info to other tax software that uses Kolnly. Moreover, we get a fine image of this crypto tax software by checking user reviews.

Pricing

- Newbie: $49/ tax year

- Hodler: $99/ tax year

- Trader: $179/ tax year

- Pro: $279/ tax year

ZenLedger

It is another top leading software platform that focuses on crypto accounting and tax management. The foundation period of this platform is 2018. This software aggregates transaction information of users across numerous exchanges, tokens, and wallets in a dashboard to make tax liability calculation easier. ZenLedger provides this simplifying service of crypto tax calculation for both tax professionals & crypto investors. Currently have 15k+ active users.

Features

- Able to integrate users with 40+ DeFi protocols, including NFTs, 50+ blockchains, and 500+ exchanges.

- Allow users to integrate with TurboTax.

- This software contains unified accounting reports & tax-loss harvesting tools.

- Calculate users’ profit/loss on crypto assets with transaction history data.

- Users can access tax pro with all of the plan offerings.

Verdict

ZenLedger offers a free plan for users to access Tax Pro. It only tracks 25 transactions when anyone uses this free plan; it can benefit investors who may hold an asset for more extended periods.

Pricing

- Free: $0/ year

- Starter: $49/year

- Premium: $149/ year

- Executive: $399/ year

TokenTax

It is another top leading crypto tax software that can calculate and provide tax evaluation and full service accounting for any individual, firm, or institution that deals with cryptos or blockchain products. In addition, this software offers an automation feature that makes tax reporting exceedingly simple and easier to handle.

Features

- The best part of this software is that TokenTax declares that it can connect with every exchange platform.

- Provides users audit assistant.

- Automatically integrates with exchanges to collect users’ data.

- Enable tax-loss harvesting for users.

- Able to do both calculate and file taxes for users.

- Enable getting help from a crypto accountant.

Verdict

TokenTax is a highly recommendable crypto tax software as it involves various positive and attractive features to calculate as well as file users’ crypto tax easily.

Pricing

- Basic: $65/ tax year

- Premium: $199/ tax year

- Pro: $799/ tax year

- VIP: $2,500/ tax year

TaxBit

It is the last of our top five crypto tax software list. You can consider it a crypto accounting & tax software that automates calculating & reporting tax for digital assets across various exchanges. Users usually have to do nothing as this software offers an automation technology feature to sync users’ transaction data and provides tax reports.

Features

- TaxBit supports 150+ exchanges and 2000+ currencies.

- It contains a powerful dashboard that provides users with tax position, unrealized profits/losses, and asset balances.

- Allow users to export their tax reports.

- Enable performance analysis for the portfolio alongside the tax-loss harvesting.

Verdict

TaxBit is an easy-to-use software, and the user review is also so satisfying as we check.

Pricing

- Basic: $50/ year

- Prus: $175/ year

- Pro: $500/ year

Final thought

Cryptos have become desirable investments in the recent few years. Many investors make enormous amounts of money, so it makes sense that you are interested in trading crypto assets. When you trade these digital assets, you must pay tax; to do that requires calculating gain/loss accurately. Crypto tax software enables doing that most simply and efficiently, and this article has already introduced you to the top five crypto tax software.