Many experts recommend incorporating cryptocurrencies into retirement plans as institutional adoption and knowledge about them grow. However, experts say that diversifying your retirement portfolio can help improve financial security for your future even if you lose your retirement savings if you bet on a digital currency, entrepreneur reported.

According to entrepreneurs, the average American will require more than $1.8 million to retire comfortably. However, sentiment regarding digital coins and cryptocurrency varies more for older workers than younger ones.

Despite this, it shouldn’t be a surprise that around one in ten Internet users in the US owns the digital currency. The crypto industry has undoubtedly made many people wealthy, but what price? If you have heard about how the costs of different digital currencies skyrocketed overnight, you know how millions of individuals doubled their fortunes. Their wealth grew as fast as their losses. Finally, you must remember. That is, investing in crypto is a gamble.

Tips to save money for retirement using cryptos

Use the following tips if you want your retirement tension-free after saving cryptos.

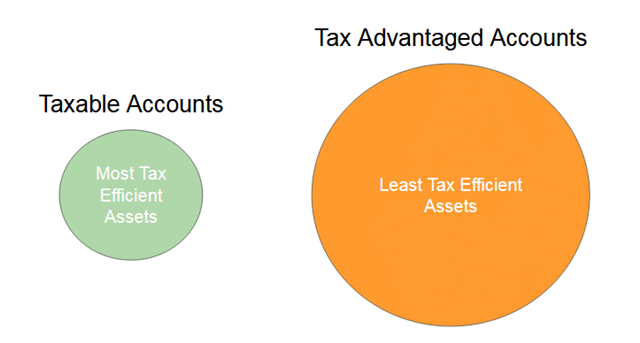

1. Maximize each tax-advantaged account

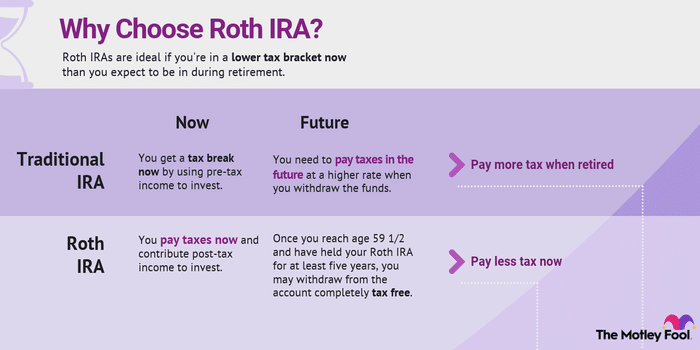

Two factors will eat away at your investment gains: taxes and fees. We will discuss costs later. However, let’s discuss taxes first. The federal government has created tax-advantaged products to encourage Americans to become self-sufficient in old age.

Tax-advantaged accounts fall into two categories:

- Some give you a tax break when you save.

- Some give you the tax break years later when you withdraw your money.

401(k)s and IRAs are tax-deferred retirement plans, meaning you do not pay taxes until you withdraw money.

Consider earning $100,000 and investing $15,000 in a 401(k) – your taxable income will be limited to $85,000 that year. And that $15,000 growing at 6% annually will increase to almost $50,000 after 20 years and more than $90,000 after 30 years. Any withdrawals, including certain mandatory distributions, will be subject to tax.

On the other hand, Roth IRAs are tax-exempt, which means that funds invested will incur taxes in the current year. Nevertheless, additional tariffs will not apply once the funds have been retired, as long as certain conditions are met, including the investor’s age.

The contribution limit for traditional IRAs and Roth IRAs is much smaller than for 401(k) accounts, and tax benefits are reduced or eliminated for high-income couples and individuals.

2. Consider the long run

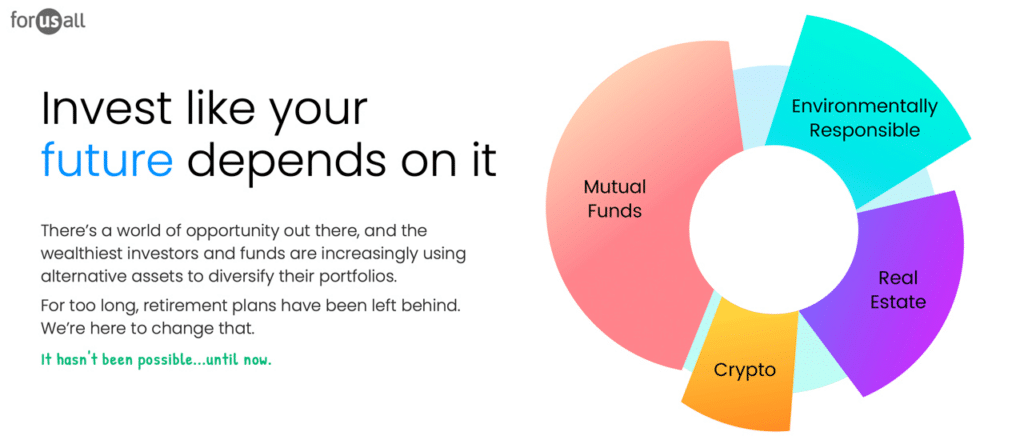

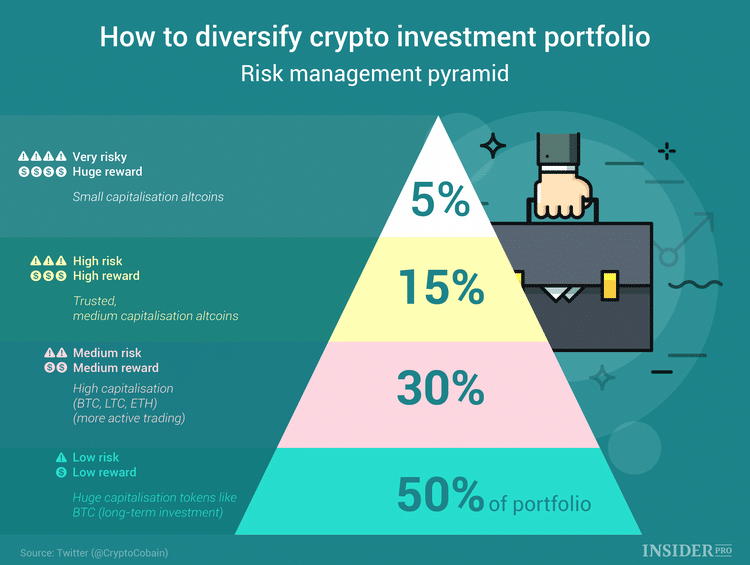

Most cryptocurrency investors are tech-savvy, young traders willing to take a risk when investing in such a volatile market. However, crypto may be costly, so diversify your retirement funds before investing a significant portion of them in crypto.

Considering this, remember that, even if you’re trying to make up for lost time, cryptos are long-term investments. It costs a fortune when you buy a home, but you realize its real value after paying off the mortgage. The same is true of cryptography.

3. Invest in less riskier cryptos

Diversifying your portfolio with less hazardous assets is advantageous regardless of your age. In addition, with an increase in your investment, you may earn a higher annual interest rate by investing in a mutual fund.

Despite today’s economic climate, stocks and government bonds remain strong and may offer substantial benefits. However, they will protect your assets at most negligible. It may be in the interest of intelligent investors to decide if they want to do this independently, which may require additional expertise. A broker can also be hired but will have to charge a commission.

4. Roth individual retirement account

Millions of Americans participate in this type of retirement plan. In addition, the tax advantages of Roth IRAs may be a suitable solution for you if your employer or business doesn’t provide any retirement benefits.

You can find IRA alternatives at several banks, financial institutions, and investment brokerages. In addition, you gain a little more control over your retirement savings and tax benefits from it.

5. Take risks at a young age

A big reason for the popularity of cryptocurrencies is that they are decentralized and unregulated. Investors who desire high levels of anonymity and security will love this new development. Additionally, crypto community security ensures that digital assets are safeguarded and kept.

Recent crypto security incidents have left assets exposed in too many instances. There are numerous incidents of hacked digital wallets, companies going bankrupt, and losing millions in Bitcoins to software infections resulting in significant data breaches.

If you purchase crypto, you still risk losing it. This isn’t due to a volatile market but rather unforeseen security problems.

While it may have cost you a significant part of your retirement savings to invest in crypto, you can lose almost all of them almost instantly without the notice.

Using cryptocurrency to supplement your retirement savings

You can put a portion of your budget into cryptocurrency investments. You might be interested in investing in cryptocurrency to supplement your retirement savings.

However, don’t let it make up too much of your total investment strategy. Although crypto does have a high potential for short-term gains, its high loss risk also means it has a high potential for short-term losses. As an investment vehicle, its reliability is still in the balance in the long run.

It’s essential to understand the risks and rewards of investing for the long term and retirement and create the right strategy for you. If you’re not sure what to do, consult with a financial advisor for assistance.

Final thoughts

Whether you are trying to make up lost time, investing in digital assets, following the crypto craze or just trying your hand at the market is a high-risk, volatile investment that should not be part of a retirement portfolio.

Diversification is still essential, but consider selecting assets you can control and understand how they work. Companies go bankrupt and lose millions in Bitcoins to software infections resulting in significant data breaches.