The majority of individuals are accustomed to borrowing money in some form. One can consider taking out a mortgage or enlisting the help of a friend. If you’re searching for a high-yielding investment with inflation protection and the security of government backing, series I bonds might be a good fit for your portfolio.

Let’s discover everything you need to know about bonds right here.

Why is it worth investing in I bonds?

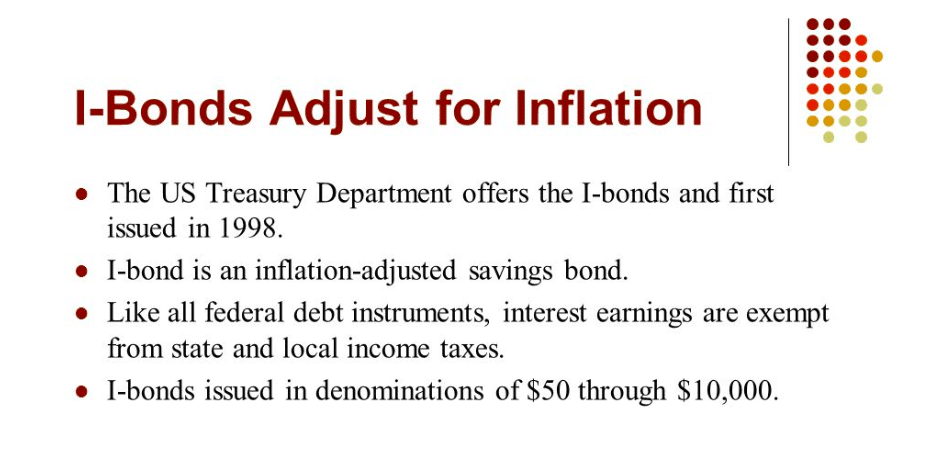

I bonds’ interest rates climb in tandem with inflation, providing that your dividend keeps pace with rising costs and doesn’t lose buying power over time. In recent years, this inflation protection on I bonds has sparked interest among savers, as inflation has risen to its highest level in over 40 years.

Bondholders receive the total principal if a bond is held to maturity. Bonds can also mitigate the risk of investing in volatile stocks.

How does it work?

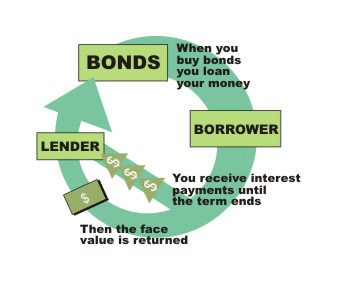

When you purchase a bond, you make a loan to the issuer. A state, township, or company can be the issuer. The issuer commits to providing you with a fixed interest rate and redeeming the principal at the end of the bond’s term. When a bond “matures” or comes due after a predefined time frame, it is also called “face value” or “par value.”

How to start?

People can’t buy I bonds through a brokerage account; they have to go to the website of the US Treasury Department, and there is a limit to how much they can invest. You can typically buy no more than $10,000 in I bonds every year, plus an additional $5,000 if you invest your tax refund in paper bonds.

Some helpful insights for an I bond investing

- Know when your bonds will mature

Your I bond will mature when you receive your money back. Before you pledge your finances, you should know how long your money will be connected to the I bonds.

- Learn about the ratings of the I bond

The creditworthiness of an I bond is determined by its rating. The lower the ratings, the greater the chance of the bond defaulting. Ultimately, your investment is lost. The maximum possible rating is AAA. A low-quality or junk bond has a rating of C or lower. It is the one that is most likely to default.

- Check the history of the bond issuer

When deciding whether or not to buy bonds from a company, it can be helpful to know about its past.

- You should be aware of your risk tolerance

Bonds with poor credit grades often have greater yields to offset the higher risk. Consider your tolerance for risk before investing based on returns alone.

- Taking into account macroeconomic risks

Bonds fall in value as interest rates increase. The risk of interest rates changing before the I bond’s maturity date is known as interest rate risk. However, do not attempt to beat the market. Interest rate movements are difficult to forecast. Rather, concentrate on your financial goals. But unfortunately, bonds are also threatened by the rise in inflation.

- Help you achieve your long-term investment objectives

Bonds should aid portfolio diversification and balance out your stock or other asset allocation. Depending on your age, you might want to use an asset allocation tool to ensure that your portfolio is well balanced.

- Pay close attention to the prospectus

If you’re thinking about contributing to a bond fund, look into the charges and the associated I bonds. The fund’s title may only provide a portion of the story.

- Use a bond broker

If you’re buying individual bonds, select a firm that understands the bond market. Locate reputable individuals who can assist you in opening a brokerage account.

Is it worth investing in bonds right now?

I bonds might be an excellent addition to your portfolio if you’re not comfortable with stock market volatility but still want a high return. During times of rising inflation, investors should have a plan for investing in assets that usually do better than the market.

It would help if you spread out your investments, but it may be smart to buy more bonds or other types of securities when inflation hits. I bonds are a common way for investors to hedge against inflation since the principal is modified based on inflation.

So, they are an excellent investment for anyone who wants to make sure the fixed-income part of their portfolio keeps up with inflation.

Upsides and downsides

No doubt, investing in bonds provides numerous benefits. However, there are also some risks associated with it.

| Upsides | Downsides |

| The primary benefit of investing in bonds is the preservation of capital. It means to protect the total value of your investment with assets that guarantee a return on principal. | Bond prices decline as interest rates climb. As a result, your bonds may lose value. Interest rate changes mostly cause bond market price volatility. |

| It allows diversification. You can develop a portfolio by investing in stocks, bonds, and other asset classes. | Inflation is the gradual increase in the cost of services and goods. If inflation is higher than the fixed amount of income from a bond, the investor’s purchasing power goes down. |

| It is a fixed-income source that is generally less risky than stocks. It is because fixed-income investments are less susceptible to macroeconomic concerns. | Liquidity risk is the probability that an investor intends to sell bonds but can’t find a purchaser is liquidity risk. It may make it difficult for them to purchase or sell whenever they wish. |

Final thoughts

Bonds can be a worthwhile option for you if you’re the type of person who can’t stand the notion of losing money. In addition, an I bonds help diversify your portfolio and hedge against market fluctuations. So here is everything you need to know before investing in bonds.

You don’t always have the time to ride out stock market recessions if you’re nearing or have already retired. In that instance, bonds are a more secure investment.