Investing in and retaining a low-priced stock that is projected to gain value includes a certain level of risk. The changes in the value of a stock are referred to as stock volatility. The more volatile a stock is, the more it could move up and down at a price. Investors’ willingness to spend a certain amount of money for a particular share of a company’s stock is reflected in the price. To assess the value of a share, investors use several methods to compare the expected cost per share.

Stock prices may collapse fast in a lousy market when investors abandon ship. After the market closes, significant losses may be incurred if equity is very volatile. The more volatile a stock’s price is, the riskier it is to invest in it. Trading in volatile markets may provide investors short-term rewards, but investors’ chances of long-term success are bleak.

This article will walk you through investing in volatile stocks and the top three most volatile stocks.

Why is it worth investing in volatile stocks?

Day trading volatile stocks may be hazardous, as seen by the previous example of a newbie trader who misinterpreted options. Unfortunately, like gambling addiction disorders, day trading may develop a pathological addiction for some individuals.

If your rent is due and you can’t afford to lose any money, you shouldn’t invest in volatile equities. Don’t risk more than you’re willing to lose since investing in the stock market nearly always results in a loss. In addition, investing in the stock market may be risky, even for experienced traders, and it takes time to learn the market.

For at least a week before investing in penny stocks, keep an eye on the market and do some scrimmaging to get a feel for it. In this simulation, you may test your market intuition without risking any of your own money. This technique is proposed because of the inherent hazard of volatile trading stocks.

How does it work?

Securities are a kind of investment in companies, and the market conditions in which such companies operate impact their profitability. For example, McDonald’s (MCD) can forecast its profitability more accurately than a small business with just a few locations. However, size does not always matter, and specific markets are volatile to volatility by their very nature.

In 2020, practically every stock was volatile; however, volatile stocks exist even in the best conditions. Cannabis, e-cigarettes, and cryptocurrencies all made a big splash in the 2010s. Each provided a wide range of investing options because of legal issues. Because they’re so well-known, they’re significant instances of how to recognize stock volatility.

How to start?

In the world of volatile stocks, day trading is a term that describes the practice of trading for just a few hours at a time. A trader seeks to earn the most significant money feasible daily in day trading. Unfortunately, this means that the number of times you buy and sell throughout a single day has increased significantly.

One of the essential characteristics of a volatile stock is volume. A stock with a high trading volume is easy to buy and sell. Conversely, if the trading volume is minimal, you’ll have to pay for the buy, no matter how cheap it was.

When trading shares that are volatile to volatility, it is crucial to keep an eye on the time. As an investor, you must act quickly to take advantage of an opportunity. Trading volatile equities are challenging, and every second matters during the transaction.

Atreca (BCEL)

52-week range: $1.56-$19.23

1-year price change: the BCEL stock saw a huge downtrend starting from $20 and found the bottom around $2. However, the asset has huge potential to pare losses in a single session.

Forecast 2022: the asset is expected to hit between $11 and $20 in 2022 as the EPS improves. We also expect a cut down in expenses which will raise the profit potential.

Antibody-based immunotherapeutics are the focus of Atreca’s biopharmaceutical research and development. Atreca’s approach opens up previously unexplored territory in the fight against cancer by identifying new antibody-target pairs created by the human immune system during an active immune response against malignancies. These antibodies serve as the cornerstone for first-in-class therapy possibilities, such as ATRC-101, the company’s lead product candidate. Several solid tumor malignancies are now being studied in a Phase 1b study using ATRC-101.

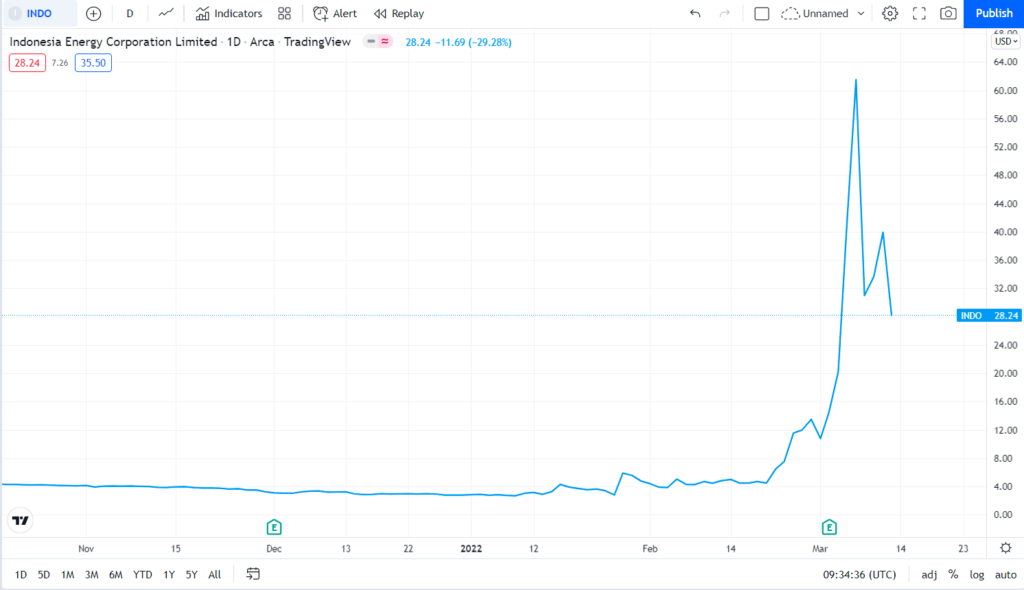

Indonesia Energy Corp Ltd (INDO)

52-week range: $2.61-$49.00

1-year price change: the price has seen a remarkable rise in 2022. Although the asset stayed in a tight range during 2021, the new year proved quite fruitful.

Forecast 2022: the INDO stock may surge up to $70 per share during 2022 as the operating revenues have increased, attracting more investment from the shareholders.

Indonesia Energy Corp Ltd (INDO) is a holding company established in Indonesia. It is an oil and gas exploration and production corporation that conducts all of its activities through wholly-owned operational firms in Indonesia, both direct and indirect. Through its operating subsidiaries, the company holds two oil and gas assets: the Kruh Block, which is a producing block, and the Citarum Block, which is an exploration block.

Kruh Block is managed by the Company’s Indonesian subsidiary, PT Green World Nusantara (GWN). The 258-square-kilometer (km2) block is 25 kilometers northwest of Pendopo, Pali, South Sumatra (63,753 acres). This block produces around 9,900 barrels per month on average (gross). Its Citarum Block, which encompasses 3,924.67 square kilometers (km2) (969,807 acres) and is controlled under a Production Sharing Contract, is an exploration block (PSC) (PSC).

Laix Inc. American Depositary Shares (LAIX)

52-week range: $0.35-$5.36

1-year price change: the LAIX has been downtrend for a year. However, the stock has found a bottom at 0.35 in March 2022 and swiftly jumped above the $5 mark.

Forecast 2022: we expect the stock to outperform in 2022 to hit a high of around $7.50 as the EPS is improving, and there is potential to turn the current losses into profit.

LAIX Inc. is mainly an artificially intelligent English language learning software (AI) provider. English Liulishuo, its mobile application, delivers its products and services. Its platform enables users to enroll in paid courses and complimentary lessons on various topics and cultural themes. In addition, as a result of the company’s artificial intelligence (AI) advancements, students may get personalized language learning assistance and support.

Upsides and downsides

Now, let us take a look at the upsides and downsides.

| Upsides | Downsides |

| Volatility in the market implies more chances to make money in less time. | Volatile stocks have the ability to “become rich quickly,” it also has the potential to “go broke soon.” |

| Risk mitigation strategies such as stop-loss become more critical when more volatile markets. | Investing in high-volatility equities is volatile because you never know what the market will do with your money. You must also understand how to join and leave the day trading market. |

| Shorter-term trading periods have shown to be more successful in volatile markets. | Fear and uncertainty are caused by volatility, leading to bad financial decisions. |

Final thoughts

The stock market has always been a chaotic place. Changes in economic conditions, politics, and legislation have a steady impact on the stock market. There is always a selection of firms whose price movements are more unexpected, putting them among the riskiest stocks to trade, apart from market volatility. We hope this article helped you get clear about investing in volatile stocks.