Treasury bonds are essential for any investing strategy. Bonds generate income, are less risky than stocks, and may help diversify your portfolio.

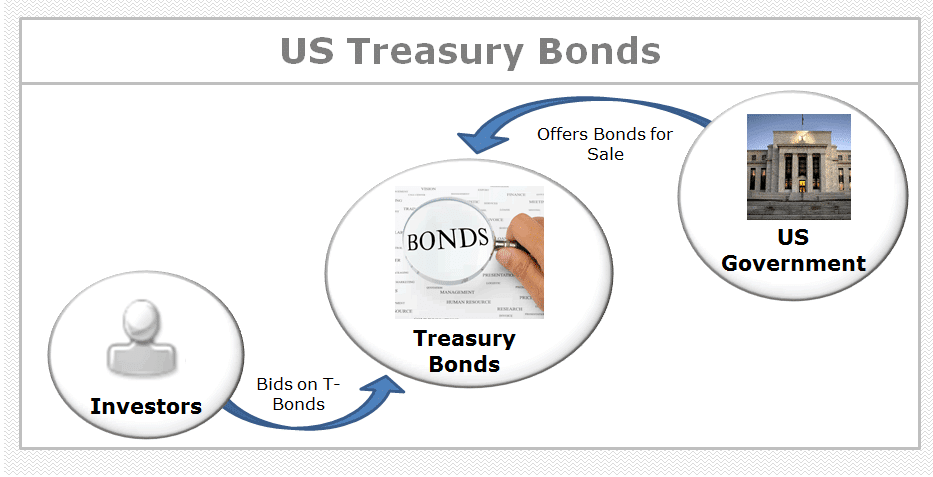

Governments have several options for quickly raising revenue. One such case is to sell government bonds to investors. Continue reading to discover more about how US treasury bonds operate, their reward, and whether this investment is appropriate for you or not.

What are Treasury bonds?

It is a type of debt that the United States government issues with obtaining revenue. Technically, every federal government debt is a bond. However, the US Treasury classifies a Treasury bond as a 30-year note.

US Treasury bonds of all durations are widely regarded as the safest investment globally, providing a practically assured income stream and holding their value in virtually any economic scenario.

Where can you buy Treasury bonds?

Treasury bonds can be purchased directly and electronically via TreasuryDirect using non-competitive bidding. According to TreasuryDirect, non-competitive bidding means you agree to accept the auction yield and are assured of obtaining both the quantity and particular bond you choose.

T-bonds are also purchased through banks, brokers, or dealers through a competitive or non-competitive bid. You designate the yield you’ll take in a competitive offer, and you may or may not acquire the bond you desire. If you receive the Treasury bond, the amount you requested may be less.

Treasury bond auctions occur four times in February, May, August, and November. Treasury bonds must be purchased in $100 increments and purchased for at least $100.

You can acquire up to $5 million in Treasury bonds through non-competitive bidding or up to 35% of the initial offering amount through competitive bidding.

Why are Treasury bonds important?

The proceeds are combined with tax revenues to assist the federal government finance its operations and repaying existing USUS debt. The 10-year Treasury bond, being a longer-term bond, is also utilized as a barometer of investor attitude towards the economy.

The structure of Treasury bonds

Treasury bonds provide investors with the following basic investment structure:

- They have maturities ranging from 10 to 30 years.

- Both the 10-year and 30-year bonds have a $1,000 face value. However, they are offered in $100 increments if purchased straight from the US Treasury.

- They are exchanged in the fixed-income market, a highly liquid secondary market.

- Investors may be unable to purchase T-bonds in the smaller $100 allotments allowed by the government “fixed income” refers to Treasury bonds that pay a fixed interest rate to investors twice a year or every six months.

- Bondholders finally receive a full refund of their investment principal and semiannual interest rate installments.

- When a Treasury bond matures or reaches its maturity date and expires, the investor receives its full face value.

For example, if a bondholder owns a $10,000 Treasury bond, they will get the principal amount and interest on the investment.

Treasury bonds are liquid, which means they may be sold before they mature. Alternatively, the bondholder might maintain the Treasury bond until it matures. Treasury bonds are commonly seen as a risk-free investment since the United States government eventually guarantees them. Even US government bonds are exposed to interest rate risk, which investors should know. In other words, when market interest rates rise, the market value of these bonds falls.

Explanation of the 10-year Treasury yield

A yield measures the return on a bond that an investor receives. Bond prices often have an inverse connection with their respective yields, similar to the inverse relationship that bond prices have with interest rates.

Tips for investing in Treasury bonds

Treasury bonds mature on the maturity date, the date you will get your investment return. So before you commit your money, find out how long your money will be locked up in the bond.

Bond’s rating

The rating of a bond indicates its creditworthiness. The lower the grade, the greater the possibility that the bond will fail and you will lose your investment.

Examine the track record of the bond issuer

Knowing a company’s history might help you decide whether to invest in its bonds.

Determine your risk tolerance

Bonds with a lower credit grade usually have a higher yield to compensate for the increased risk. Consider your risk tolerance and avoid investing purely for the sake of profit.

Consider macroeconomic hazards

Bonds lose value as interest rates rise. Therefore, the possibility that interest rates will fluctuate before the bond’s maturity date is known as interest rate risk. Avoid timing the market, as it is difficult to foresee how interest rates change. Instead, concentrate on your long-term investing goals. Bonds are also vulnerable to rising inflation.

Support your overall investment goals

Bonds can help diversify your portfolio and balance your investments in stocks and other asset types. However, it would help if you used an asset allocation calculator based on age to ensure that your portfolio is balanced correctly.

Know the fees

If you’re thinking about investing in a bond fund, look into the fees and the included types of bonds. Unfortunately, the fund’s name may only reveal half of the information; for example, government bond funds may also hold non-government bonds.

Buy closer to retirement

For a reason, wealth is more about capital appreciation throughout your saving and investing years and capital preservation during your retirement years. Investing in higher-risk, higher-reward equities when you’re young generates financial appreciation.

In summary, your stock investments are generating long-term wealth. However, when you are approaching or have reached retirement age, you want to protect the riches you have built. As a result, capital preservation measures such as T-bonds and lower-risk assets may be used to reduce your risk of losing money during a market collapse.

Upsides and downsides

| Upsides | Downsides |

| A particular rate of return on your investment is guaranteed. | If you buy bonds at auction, you can only purchase up to 35% of the initial offering. |

| Bonds provide a predetermined amount of revenue at regular periods in coupon payments. | Liquidity risk is the probability that an investor wishes to sell a bond but cannot find a buyer. |

| Treasury bonds in various formats with maturities ranging from four weeks to 30 years, depending on their needs. | Some treasury bonds feature call clauses that allow the government to redeem them before specified maturity. The government does this when interest rates are low. |

Final thoughts

Treasury bonds provide a good hedge when the stock markets look uncertain. Typically, they are less risky than stocks, and you can diversify your portfolio with them.