The most reliable bonds in the world are US government bonds. They are also called Treasuries. The likelihood that the American government will not pay its debts or default, as professional investors say, is minimal. US Treasury bonds are considered risk-free, so the rate on them is used as a reference (benchmark) to determine the yield of all other bonds.

Understanding bond risk for wise investment has become the need of an hour with increasing market price fluctuations. But, above all, investing in bonds is considered risky in terms of losing due to various factors.

These risks are similar for both the individual holders and those who manage bond funds. Following are some of the most common bond risks that are important to understand to invest wisely in 2022.

Interest rate risk

It is the risk of fluctuating rate movements. When the interest rate decreases, it causes an increment in bond prices and vice versa. The risk here occurs when this change in this rate also negatively affects the bond’s value in the market. Undoubtedly, it can also increase the bond value. It is also known as the market risk. It may increase the time of holding that bond.

For example, you have a ten-year-based $1000 bond with a 4% rate, and later it increases to 6%. So, if you want to sell this bond, you should also look for bonds giving a high-interest rate. You will note that the bonds offering a higher interest rate reduces the demand of the older ones in the market. It means that you will receive less than the actual value, leading you to a loss.

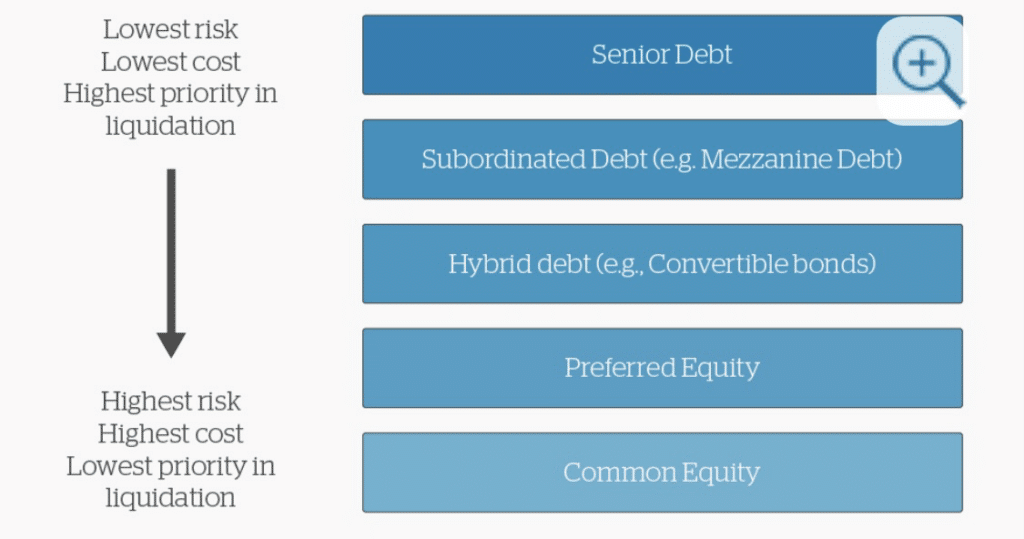

Default and credit risk

If you have ever given a loan to someone, chances are you thought about whether he will repay. This is because some loans are indeed riskier than others. The same is true when you invest in bonds.

In essence, you are taking a chance that the issuer will honor its commitment to repay principal and pay interest on the dates and terms agreed to in the contract.

Although most US Treasury securities are default-free, there is a possibility of default on most bonds. The bond owner will either pay creditors late, pay a negotiated reduced amount. In the worst-case scenario, be unable to pay at all.

Call risk

Here the bond issuer redeems the bond before maturity. In this way, the one holding a bond gets the payment according to its value and can even reinvest it generally when the interest rate is low.

However, there is a call protection period. During this, the investor can’t redeem a callable bond. After it expires, the first date after expiration, when you can call the bond, is known as the first call date. Here, the risk arises if the bond expires before on-call dates.

Suppose you have a callable bond with a coupon of nearly 5% in 10 years. The first four years are called protection that means the issuer can’t redeem the bond irrespective of the interest rate. As soon as call protection expires, either the issuer can face the loss if the interest rate falls or gain profit in case of increment in interest rate.

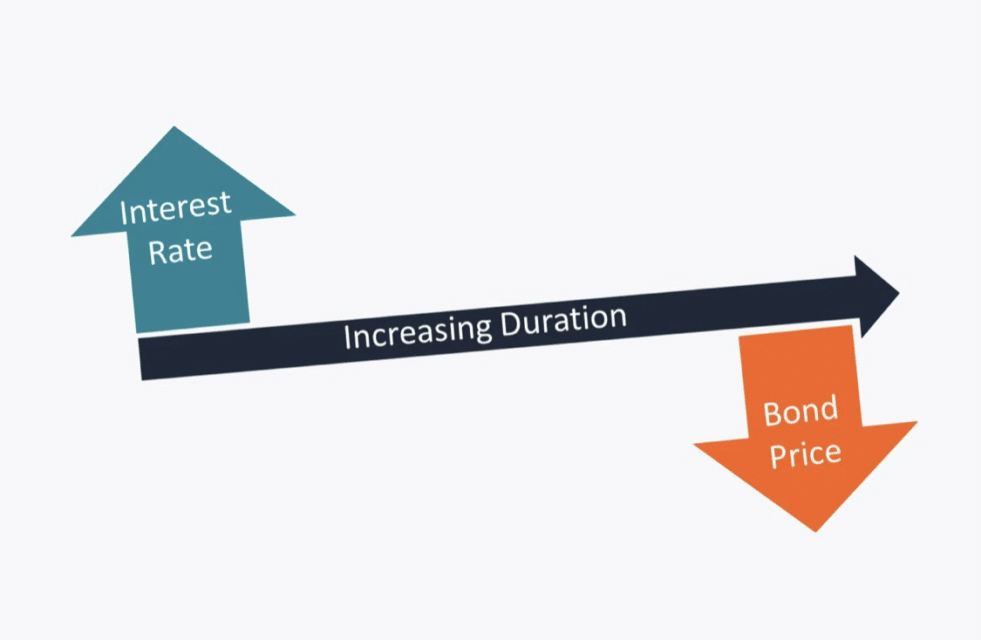

Duration risk

The duration of a bond is a certain period until the moment of the total return of the capital invested in purchasing this security. If you own bonds or your money is invested in a bond fund, you need to understand what duration is.

It can be measured in years, but it is not just a measure of time. Duration signals how much the price of your bond investment might fluctuate when interest rates go up or down. The higher the duration, the more sensitive your bond investment will be to changes in interest rates.

It is the risk associated with a bond’s price sensitivity to a one percent change in interest rates.

Inflation

It so happens that the yield on a bond is lower than inflation. For example, inflation is 6% per annum, but a bond gives 5% per annum. By purchasing it, you will receive negative real profitability. That is, you will lose money, not earn.

Inflation is also known as purchasing power risk. An inflation risk occurs when a bond’s yield doesn’t keep pace with the cost of goods and services. For instance, if you buy a five-year bond with a coupon rate of five percent, but inflation is eight percent, the purchasing power of the bond interest has decreased. All bonds, except those that adjust for inflation, such as TIPS, are subject to inflation risk.

Liquidity risk

It is possible not to find a buyer for a bond you plan to sell quickly. Investors generally measure liquidity through the level of trading activity. A bond traded frequently on a given trading day is significantly more liquid than one that only shows trading activity a few times a week.

Many people are interested in buying and selling securities such as US Treasury bonds at any time, so such assets are pretty easy to sell. These are liquids. FINRA’s Market Data Center allows investors to check corporate bond trading activity and, therefore, liquidity. An investor can access trade data from the Municipal Securities Rulemaking Board website to gain insight into municipal bond liquidity.

Country risk

This is the degree of risk that a particular state will default on its obligations or affect the ability of the debtor from this country to service its debt.

To assess country risk, many factors are considered, which can be divided into two groups:

- Political: risks of instability, for example, when the new government refuses to pay the old government’s debts or prohibits the withdrawal of capital, which is terrible for international investors.

- Macroeconomic: the level of public debt concerning GDP, budget deficit, etc.

For example, if a country already has a high level of debt burden, this could negatively affect its ability to pay off its debts in the future.

Upsides and downsides

Following are some of the upsides and downsides of such investment despite being risky.

| Upsides | Downsides |

| The assets are considered as better investments than the bank. | Larger investment sum needed for investing in bonds. |

| They provide you with more income. | Bonds are considered less liquid. |

| The asset reduces the amount of return relative to the risk. | Prepayment risk may occur in bond investments. |

Final thoughts

Investing in any of the assets is risky so is for bonds. Multiple risk factors affect bond prices. Therefore, it is better to have a comprehensive understanding of what each risk holds in it to save yourself from excessive loss.

The safest thing is to invest in bonds of reliable companies with stable businesses and good credit ratings and hold them until maturity.

Understanding all forms of risk, benefit in calculated and informative investment. With the frequent price fluctuations, understanding these risk factors is significant enough to crack investment strategies in 2022.