Risk is all around us, be it in our daily life, business operations, traffic, or investments. Simply put, a risk exists because not all factors that influence our lives are under our control. On the other hand, that doesn’t mean that we have to sit idle and look at the world as a giant roulette wheel, relying solely on luck.

There are various approaches we take to get the risk to the lowest degree possible. In business, we do background checks for our partners or clients. In traffic, we follow the rules and the traffic signs to avoid a collision. Similar to the last two examples, in investment, we apply risk management strategies.

Overview on risk management

In the world of finance, risk management means finding out how “risky” your investment decisions are. In other words, you analyze how much uncertainty your investment brings and determine if there is a way to decrease the amount of risk it poses in line with your investment goals.

Common misconceptions

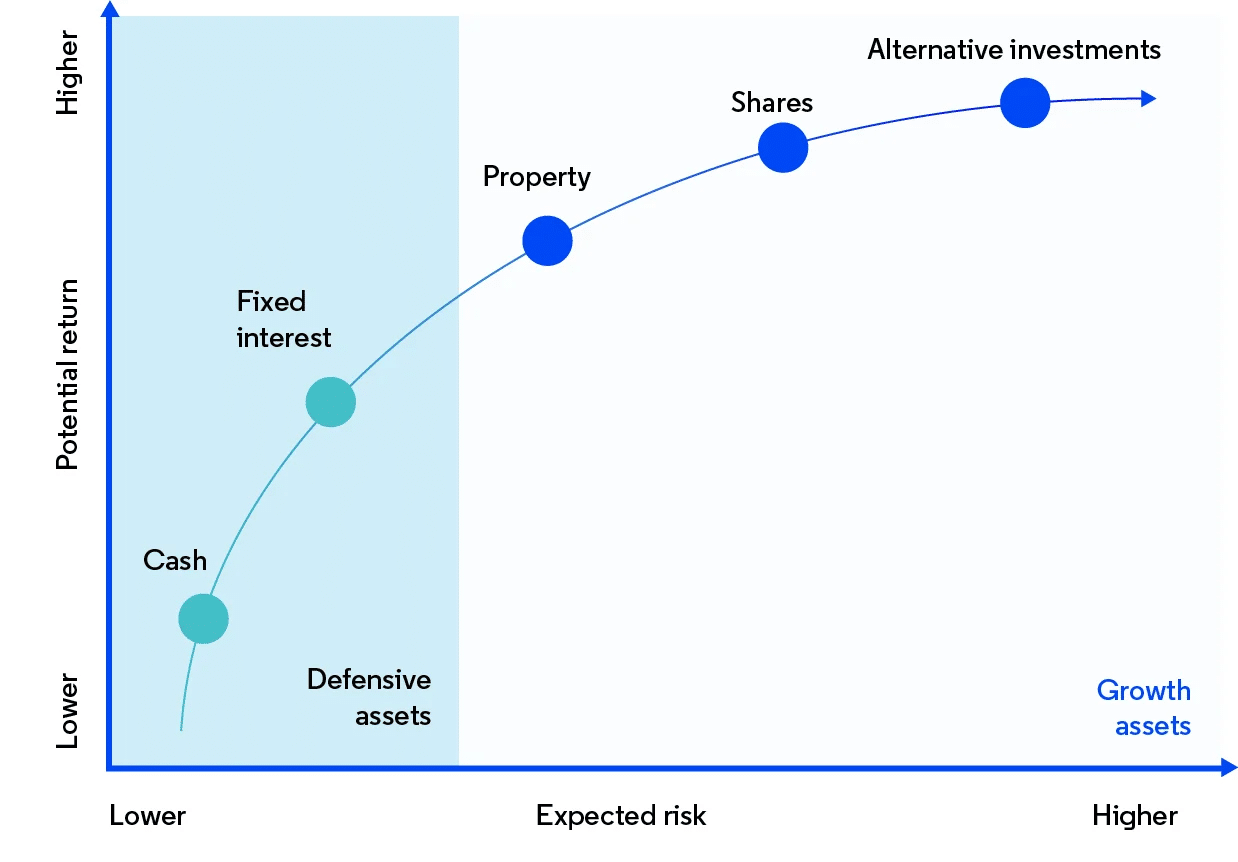

There are two misunderstandings that people have when it comes to risk and risk management. The first one is that risk means gambling. The statement in itself doesn’t make much sense. Any investment comes at a risk, and so does everything else in life. And, like in life, the investments that carry the most risk are the ones that can bring you the largest returns.

That brings us to the other misapprehension, and that is that there is a way to shelter from risk completely. This statement is not entirely untrue, as there are securities, such as United States Treasury bonds, where the risk is almost non-existent. On the other hand, the return you can expect on those investments is hardly enough to meet your investment goals.

How does risk management work?

We have already established that risk comes with the turf if you seek returns that could quench your investing appetite. On the other hand, that doesn’t mean that you should go head-over-heels and buy stocks of newly-established startups to seek as high a return as possible.

How do we do that, you ask? Well, there isn’t an ironclad consensus on the matter, and the opinions tend to differ. While risk management always looks to maximize gains over losses, there is more than one way to get there. Seeking the middle ground is usually the best and the most efficient strategy. And it usually takes more actions that work in unison to get you where you want to be.

Some of the best strategies to manage your investment risks

- Lowering portfolio volatility

Put, more volatile portfolios perform worse than their less volatile counterparts. It is just a statistical fact.

Look at it this way:

- If you invest $100, and your quarterly return amounts to 50%, you will earn $50 and now have $150.

- If the tides turn, you lose 50%, you won’t go back to having $100, but $75. Mathematics of compounding can be ruthless, which is why Investors can’t ignore them.

- Create a probable maximum loss plan

There is nothing as devastating for an investor’s morale as a loss they didn’t see coming. To prevent that from happening, you can create a probable maximum loss plan that will help you anticipate, and at the same time prepare for, the worst-case scenario in your investing bouts.

Furthermore, once you have a plan in mind, it will help you take calculated risks easier and experience a possible downturn as less stressful of an event. This brings us to our next strategy.

- Focus on smart asset allocation

We all know that line from real estate: location, location, location. Well, if you wanted to sum up investing into a single term, the word would be — diversification. In other words: do not rely on a single asset, regardless of how well it is performing at the moment.

Finding out new assets you could include in your portfolio, especially those that seem undervalued, should account for the most time you spend investing. At the same time, be sure to rebalance your portfolio to spend less money on resources that are not performing that firmly in the given period.

- Make sure you have a safety margin in place

To put it in simple terms, the margin of safety is a discrepancy between the value of a security and the price you have to pay for it. In even simpler terms, the larger the safety margin, the smaller the risk.

Pursuing this strategy will leave you with plenty of maneuvering space and grant you room for error, as you can accommodate minor shifts and balance your portfolio on the go.

- Rethink your time horizon

Most people who end up dissatisfied with the returns they get from their investments and the ones that record significant losses are usually those who try to profit in too short of a time frame. Always remember: investing is not a sprint but a marathon.

The best thing you can do for yourself is to focus on the long-term strategies that almost always grant higher chances of generating wealth instead of trying to outrun the market by making a slew of rash decisions. Patience is a virtue.

Final thoughts

The idea behind risk management is not for you to believe there is no uncertainty in investing. Risk is, and always will be, present during the decision-making process of any kind. What is important to remember is that just because there is a risk, it doesn’t mean that you have to fret over losing everything in a blink of an eye.

It simply means that you have to be smart when seeking out securities with a solid safety margin and pay extra attention to the way you allocate your assets. If you add lower portfolio volatility in the mix, along with the idea that you can’t make all of the gains you desire in a single year, you should be in the green.