When considering Bitcoin and other cryptocurrencies, “volatile” comes to mind. Cryptocurrency prices spike and then seem to fall almost as quickly as rumors, mood, and fundamental events price into the market.

Bitcoin’s value has plummeted to below $30,000 after only three months. For instance, Bitcoin surged to an all-time high of approximately $64,000 in April 2021. Finally, Bitcoin hit a new all-time high of $69,000 in late November, then plunged by more than 40% in late January.

Profit-seeking traders love this volatility, but it may be a source of anxiety for new investors. Moreover, traders should prepare for much greater volatility in the future as new cryptocurrencies emerge and old ones go away.

Now, let’s look at some tips on saving money during the crypto crash.

Tip 1. Consider the possibilities

Even if the price of a cryptocurrency plummets, there may still be opportunities if you know where to search for them. Others see a new chance to acquire their favorite assets at a discount and benefit from the crypto market’s downturn.

- Traders who believe they have been priced out of recent gains may “buy the dip” to join the market or increase their current holdings.

- Although the market is downward, it will fluctuate and have few peaks and troughs. These short-term fluctuations may be predicted and profited from by traders who have a good grasp of technical analysis, which will allow them to buy cheap and sell high.

- Investors may earn from short selling during market downturns.

- Staking and DeFi yield farming may be able to level out profits and sustain your actual crypto balance even in a down market or downturn.

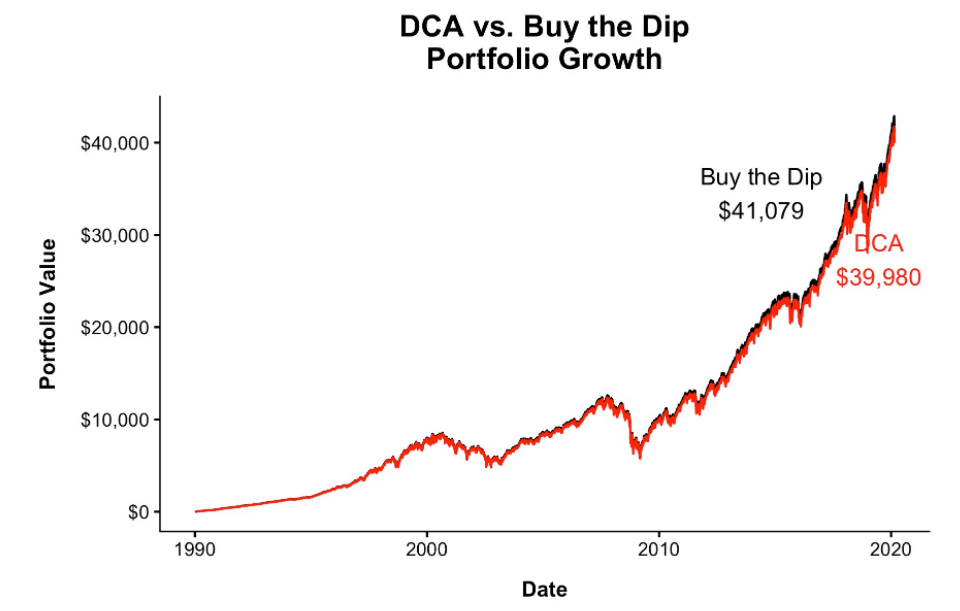

- You may use dollar-cost averaging whether markets are rising or falling if you believe an asset will be worth more in the long run. You get more BTC for your dollar at lower prices than higher prices.

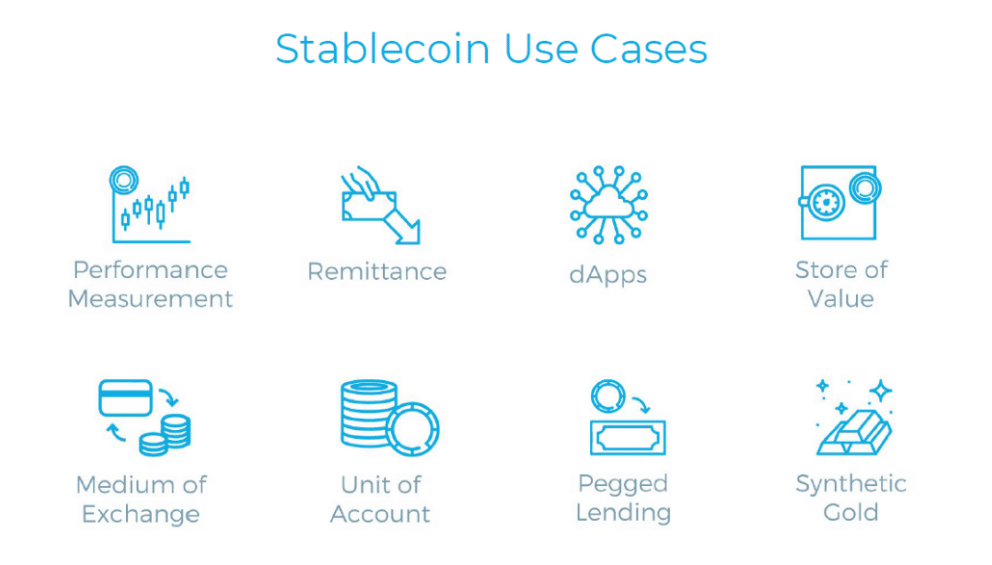

You can also convert crypto holdings to stablecoins. It is the closest thing to money that the crypto sphere offers in terms of stability. Stablecoins like Tether (USDT) and others give a level of stability that other cryptocurrencies can only dream of in today’s market, despite the poor press that Tether has received in recent months. Stablecoins allow you to quickly and easily re-enter the market while also guaranteeing that the value of your holdings remains stable.

Tip 2. Keep a long-term perspective in mind

Cryptocurrency investing is fraught with peril. According to the data, significant price reductions already occurred in 2021. However, after each decline, the value of cryptocurrencies recovered steadily to new highs.

Avoid obsessing over the 24-hour charts. Instead, expand your view to include the whole calendar year. The ups and downs are more extreme for new and unproven investments like Bitcoin. As long as you haven’t put money into investments, you will need it soon, and you can wait out the slump.

Tip 3. Don’t sell in a panic

You may want to sell your crypto assets when the value of your investments decreases. It’s natural. However, this often means selling at a low point and missing out on any later rebound.

Assume you’ve seen a 20% decline in the price of Bitcoin and have decided to liquidate your holdings. Do you have any plans in place in the event of a price surge? You may be reluctant to make another buy after suffering a 20 percent loss on your first investment.

In the short term, there is no way to predict price changes. They may continue to fall, but they may climb quickly as well. Put your trust in your original research and investment theory as a consequence of this. On the other hand, if you believe in the long-term value of BTC, you should be optimistic about the return on your investment.

Tip 4. Consider buying the dip

Many people talk about purchasing cheap and selling high, but it’s almost impossible to do so successfully. You don’t have to worry about short-term price fluctuations when you exclusively buy assets that you believe will rise in value over the following five or ten years.

You may have had tokens on your wishlist for a while but have been waiting for the right time. Drops in price are an excellent opportunity to stock up on your favorite tokens at a lower cost. Additionally, you may want more of the tokens you already own if you feel they have a bright future.

Contrary to popular belief, you should avoid making impulsive purchases in the heat of the moment. The only reason to buy anything just because it’s cheap is if you haven’t done your research and don’t want it. If you can avoid it, do not purchase the drop with the cash you need to meet other financial obligations, or worse, borrow the money.

In addition, there is still a lot of uncertainty around cryptocurrency investments, particularly as the possibility of increasing regulation grows. The risk is that if you buy the dip, prices will fall even further before you get your money back.

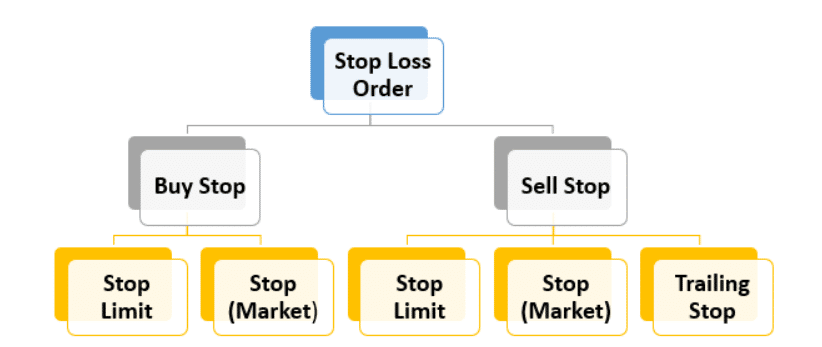

Tip 5. Stop-loss orders

Automated loss-reducing sell orders are available on several exchanges, albeit more valuable to traders than the typical investor. The user specifies the lowest price they are willing to pay for their items by entering a price level. If the asset price goes below that level, the assets are immediately liquidated, giving customers peace of mind.

For instance, any time the price of Ethereum goes below $90, a stop-loss order kicks in and sells all of the customer’s Ethereum holdings in exchange for the customer’s cash or BTC equivalent.

Final thoughts

Do not panic if you are experiencing your first dip. Cryptocurrency crashes are an inherent part of investing in this manner. Therefore, you may come to the fair conclusion that investing in cryptocurrencies is too stressful for you. However, avoid making hasty decisions. Don’t start selling until you’ve given yourself and the market some breathing room.