The term business risk refers to any situation that poses a threat to the success of our practice. Unluckily, business owners overlook the risks that can derail a long-standing business.

Many people seek help from financial advisory, which includes financial advice. It includes budgeting, estate planning, and investing at such a low cost of 1%. But some people don’t assume the risk is severe, don’t realize it is there, or do not think it will happen to them.

Even though you won’t always foresee what type of chaos will disrupt your business, you can still prepare. The following article outlines five different risks you may encounter when operating a financial advisory firm. You will be better positioned if you understand and address these risks before it is too late to protect your business.

Tip 1: Competition

As the industry of financial planning and advice grows and changes, competition is constantly increasing. IBIS World reports that the revenue of the United States Industry grew by 5.5% over the past five years. Ameriprise Financial, Morgan Stanley, and Wells Fargo are the leading players. In addition, a growing number of firms are offering mobile applications and investing methodologies as robo-advisors.

How to avoid it?

Affluent clients are demanding high-tech, high-touch services due to changing demographics. Millennials make up the largest share of the population. So find ways to reach out to them and emphasize your value compared with the competition. These include service, trustworthiness, and quality relationships.

Tip 2: Revenue growth pressure

Have you listened to the quote? “If you are working as green, you have chances to grow, but if you are ripe, you start rotting.” There is no doubt that you have worked hard to establish a business and reached where you are now.

However, some growth and innovation are still required, enabling you to reinvest in additional client services in this competitive financial market. Also, given fee compression and high competition for client dollars, making ways to evolve is even more important.

How to avoid it?

There are certain criteria to manage this growth, including merging business with other companies, changing infrastructure or introducing new infrastructure, and segmenting services for clients.

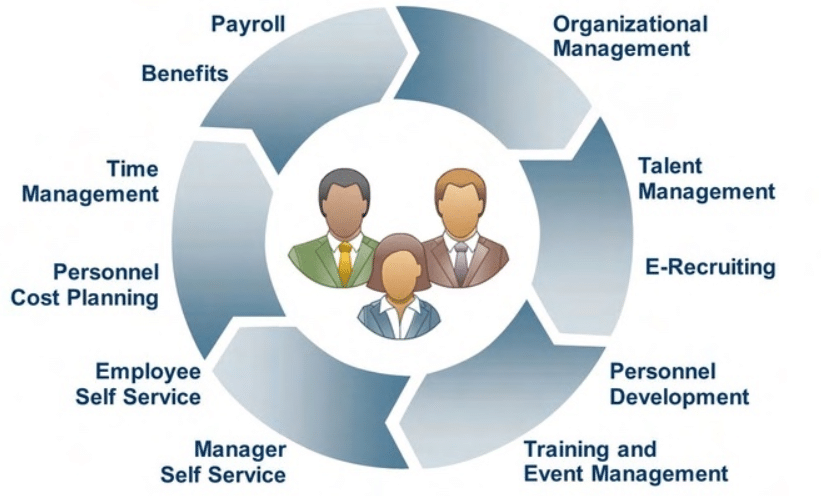

Tip 3: Human capital management

Technology is rising sharply, but the essence of the human touch in the business is still unmatchable. Recent studies provide insights into how the advisors possessing market knowledge, financial planning, and decision-making skills stand out as indispensable and irreplaceable compared to the robo-advisors. But you will need to play your part in assisting clients in recognizing your value by recruiting humans that are among the best to work with the clients.

How to avoid it?

The HR manager can help to ensure smart hiring in the business. If smart ways are not used while hiring employees, your advisory business could face the following plethora of human capital risk:

- Limitations in attracting employees

- Recruitment of the wrong person

- Dissatisfaction of clients

- Increase in turnover

- More absentees

- Accidents/injuries

- More fraud cases

Any of these risks could affect the growth and progress of your business.

Tip 4: Scale and capacity

Advisors tend to encounter painful experiences according to a predictable schedule.

- In general, advisors thinking about staffing up for the next growth spurt need to consider $250,000 of production.

- When the advisor reaches $450,000, they need technical assistance through a paraplanner or a research advisor.

- When advisors reach $750,000, they reach their capacity as solos. They analyze and segment their service model and pinpoint their growth plans to increase efficiency.

How to avoid it?

Can you find a solution to these problems? First, ensure that you create reputable office procedures and know-how to distribute revenue among clients, determine the profitability of watch clients, and find optimum service models. With these strategies, you will have the ability to grow your business and provide clients with the level of service they deserve while still providing growth.

Tip 5: Advances in technology

Technology-enabled financial advice is well documented among millennials. It is reported that 59% of millennials use social media to connect with advisors, and 39% use web collaboration tools-with. These numbers are expected to grow in the future. Consider meeting your clients virtually, or use Twitter or LinkedIn to promote yourself to this group in the same way they use social media to find more about you.

How to avoid it?

In addition to improving trading tools and automation, technology has also enhanced market risk management by enabling timely trades and sophisticated investment strategies. The utilization of these tools can give you a competitive edge in attracting clients. Additionally, technology investments can create efficiencies, drive profitability, and enable you to grow.

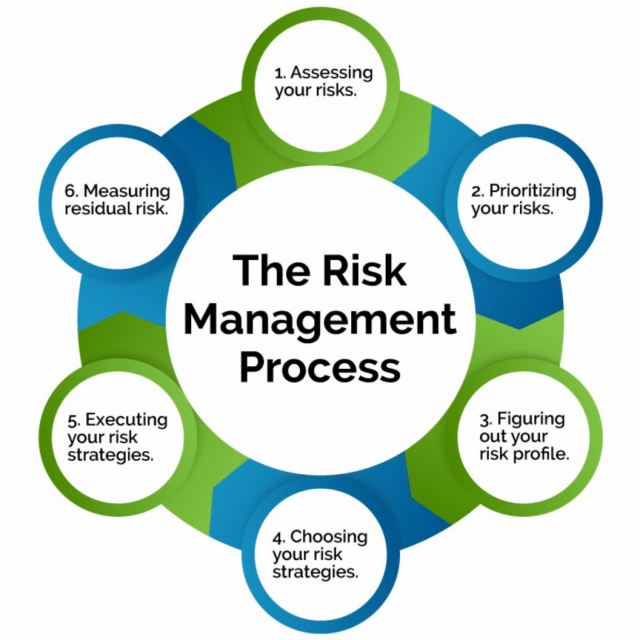

Managing risk at your firm

You are now ready to experiment, now that we have covered some common business risks. To begin, draw a matrix of risk consisting of four quadrants. After that, you should point out the consequences of risk and the likelihood of risk in the row headers. Finally, identifying and categorizing the risks you perceive in your firm might be helpful.

The last step is to develop a business plan for addressing quadrants until you are sure that the major risks have been addressed.

- Create a vision

Where do you see yourself in the coming five years? Do you have any goals in mind?

- SWOT analysis

Learn your firm’s weaknesses, strengths, and opportunities from the inside, as well as what threats it faces from the outside.

- Establish strategic derivatives

What actions will you take to achieve your organization’s vision’s major goals and objectives while keeping risks low in your thoughts?

- Develop meaningful annual goals

Use SMART (strategic, measurable, achievable, realistic, and time-bound) goals.

- Make a plan of action

Outline the steps and deadlines you need to accomplish your goals.

- Implement

Start implementation of your plan of action.

- Review annually

By setting aside time each year to review your plan, you can make judgments accordingly.

Upsides and downsides

| Upsides | Downsides |

| Identifying risks saves from many uncalculated scenarios. | Calculations are complex. |

| Risk assessment boosts confidence in adopting the right methodologies. | Unmanaged losses may exacerbate the situation. |

| Risk is primarily reduced with the right decisions. | Ambiguity in opting for the right choice may deter growth and performance. |

| Reduces costs and saves time. | Relies on external entities. |

| Opportunities for new projects. | Implementation is difficult. |

Final thoughts

You will better be prepared for the future if you are aware of these common business risks. Having a risk and financial advisory with years of experience and knowledge about the possible risk factors, you can save your business in time without facing any loss.