- Why should I save money?

- What is an ideal time for saving money?

- How to save money if my income is low?

As daunting as it may seem, saving $10,000 in a year is very simple. If you want to save money, you don’t have to cut down on your coffee or eat ramen every night. Instead, when building money, we should speak about integrating wise habits into our daily routines. Specific strategies will demand you to put in some effort, while others are passive so that you don’t feel overwhelmed.

Why bother saving money in the first place?

Knowing that you have money set aside in an emergency will make you feel more comfortable. You don’t want to find yourself in a situation where you’re unable to go to the hospital, or your vehicle breaks down because you weren’t prepared.

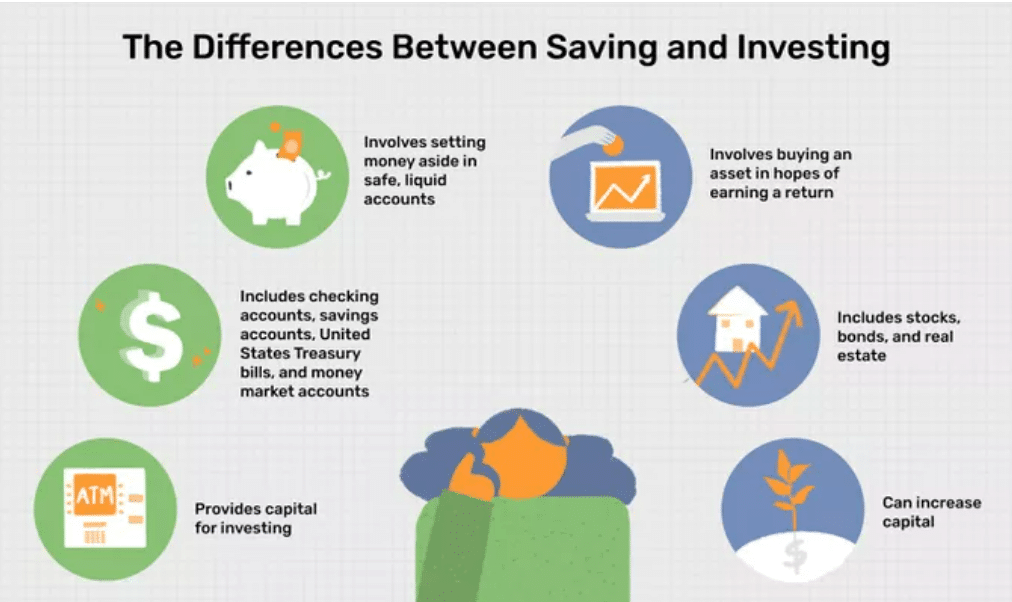

Investing in your savings is another good incentive to do so. You may think that investing is the only method to generate money. However, inflation will eat away at the value of your savings, so you won’t become richer just by saving money.

When starting a savings plan, you may need to make a little adjustment to your budget. However, to get into the habit of saving, you don’t need to change your lifestyle completely. You may save money even if you’re on a tight budget by following a few easy rules. In the next part, you’ll discover everything about that.

The coin bank is an example of an antiquated method of saving. Of course, you may not do the same with your savings, but the principle of beginning small and being persistent is crucial.

Let’s get started on what you need to accomplish this goal.

1.Make a commitment to yourself first

Make a resolution to save $10,000 this year. Setting objectives for yourself will help you achieve your desired outcome. You must first make a vow to yourself before effectively applying any savings actions. This will help you stay on track and provide you with goals to strive towards.

Creating a savings goal is simple if your income is stable. For example, if you take $10,000 and split it over 12 months, you earn $833. To meet your target, you’ll need to develop an additional amount of money each month. Even if your savings goal is $10,000, you need to know your target amount before you even begin.

2.Take advantage of compound interest

It is possible to earn interest on both the money you’ve invested and the money you’ve earned. Compound interest builds up over time, so the longer you keep your money in an account, the more you’ll make. So it’s crucial to keep an eye on your finances throughout the year to ensure that they aren’t stagnating.

Compound interest may give you access to thousands of money you didn’t have previously in this way. In addition, individuals may begin investing and reaping the benefits of compound interest over the year if they have a large quantity of cash in a non-interest-bearing account.

If you understand how to invest your money effectively, you’ll get $1,500 that you didn’t have before.

3.Put your own needs first

Putting money aside for yourself each month is another money-saving tip. To put it another way, as soon as you receive a paycheck, put some of it away for the future. You’ll be more likely to spend it if you allow it to enter your bank account. Even if you don’t see the money, you’ll be more likely to find a method to preserve it if you don’t see it.

These days, there are so many options for automating savings that putting it off is almost impossible. Increase a mobile app for your bank or smartphone, and you’ll watch that figure get closer and closer to your target each month.

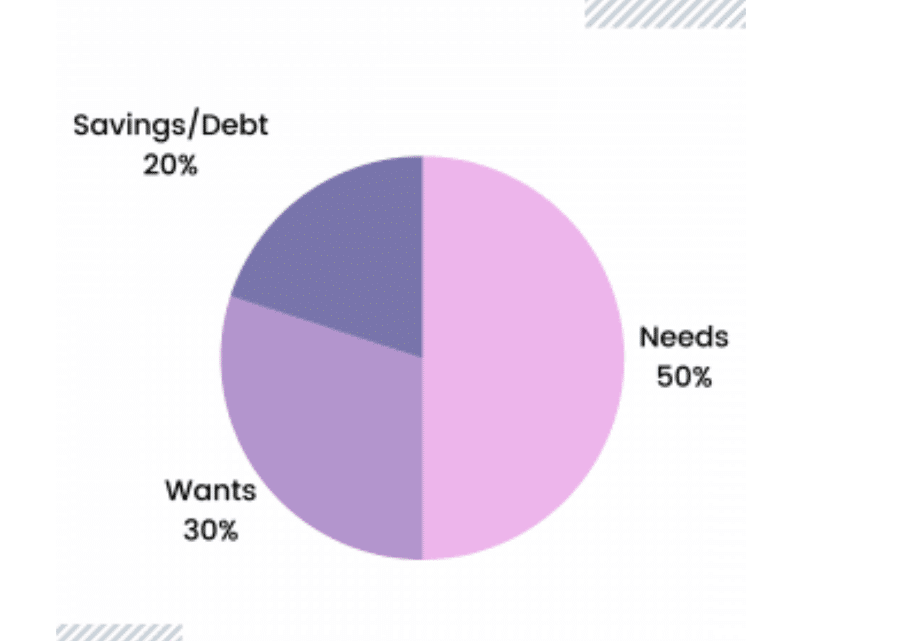

In addition to your savings goal, you’ll need to set a monthly budget for yourself. You must exercise self-control when it comes to your expenditures. Assign a monetary value to each of your expenditures by creating categories.

With this information, you may calculate how much you can afford to set aside each pay period. Waiting till the end of your pay cycle to save is more likely to result in a tiny or non-existent savings fund. If you want to put an additional $10,000 in savings this year, you need to start saving first.

4. Make a side hustle out of your passion

You may save money by cutting down on your expenditures, but you can also make a difference by increasing your income. Think about how you can make money from a pastime or interest you already have. Perhaps you spend some of your spare time building things out of wood…

Try to make a little money each month by selling a little anything. No matter what you choose to do as a part-time job, various options are available, such as photography, dog walking, eBay selling, or driving for Uber. Working from home as a virtual assistant, for example, is an option even if you just want to do it part-time.

The bottom line is to use your imagination, start earning more money, and then put it all away in a savings account. Avoid wasting it.

5. Create a financial road map

A well-thought-out strategy is essential for putting money aside and making investments. In addition, maintaining momentum month after month is essential if you want to attain your $10,000 target by the year’s end.

Final thoughts

It’s impossible to exist without a few essential expenses. That doesn’t mean, though, that you can’t cut down on those costs. If you can reduce your recurrent payments, you’ll be able to save more money regularly. Be mindful that saving for the future is a process that takes time. Because of this, it is best not to rush into choices that might have a long-term impact on your life. For example, you may not want to cut down on your insurance coverage. In the meanwhile, even little alterations to your spending habits might add up over time.