Stablecoins are digital assets that determine their price in a 1:1 ratio to a substantive financial asset. The most famous stablecoins are pegged to USD. Stablecoins climb to the rank as an advantageous and a ‘stable’ area for investors to deposit their money in a market that trades for 24/7 with horrendous volatility. For each of the crypto trades, investors had no choice but to undergo a prolonged and high-priced process for swapping their digital currencies into fiat money beforehand, stablecoins were launched.

If you want to keep your finds safe from crypto price volatility, you should convert your investment into these assets. Moreover, it opens the opportunity of exchanging cryptos instantly with stablecoins. The following section will cover top stablecoins to invest in now.

Why is it worth investing in stablecoins?

Although cryptocurrencies are still valuable, many investors do not prefer investing in them due to the price fluctuation. Because usually, those price fluctuations are an extravagance to bear. Therefore, most novice investors prefer stablecoins. Currently, different assets have been utilized for backing up stablecoins progressively. However, these assets are the crypto coins pegged by the fiat-money value like a commodity and other cryptocurrencies. These assets play a supporting role in decreasing market volatility so that the currency’s price can be kept more steady.

How does stablecoin work?

To know the undertakings of these assets, the investor must know their types. Mainly, there are three sorts:

- First is the custodial stablecoins; it is the most familiar. These are pegged to a 1:1 ratio by a single organization. A financial company holds onto the equal in US dollars and each entrance of the one USD stablecoin in the crypto market.

- Second is algorithmic stablecoins that utilize various blockchain-based systems to keep up its stable price. These kinds of stablecoins have gained admiration since they are inclined to be more fundamentally decentralized.

- And the third is known as collateralized stablecoins. It utilizes smart contracts for locking up the other crypto assets as collateral for loans. Consequently, new stablecoins are generated by automated programs also, continuing the stability of the price to the fundamental asset.

How to start?

In purchasing stablecoins, an account with a crypto exchange will be required. Digital wallets can also be used. It is possible to buy stablecoins in the digital wallet or crypto exchange’s account. The services may differ according to the locations; hence make sure to cross-check the availability of the features you are inclined to. Crypto exchanges offer some stablecoins; that kind of centralized exchange may only offer fiat-pegged stablecoins. You may also utilize a decentralized exchange for swapping any present tokens for more options in stablecoins.

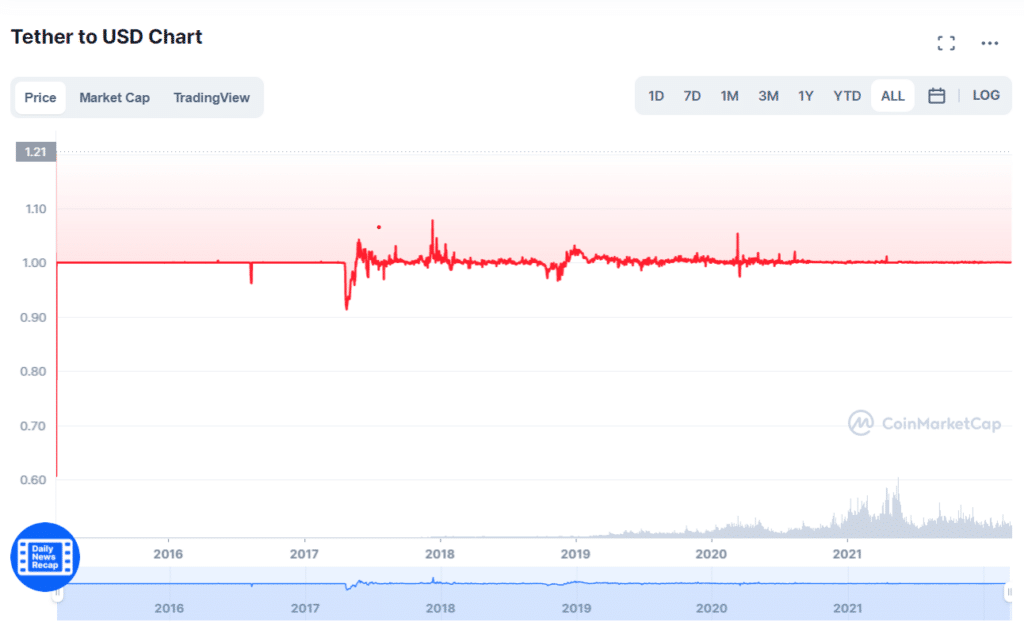

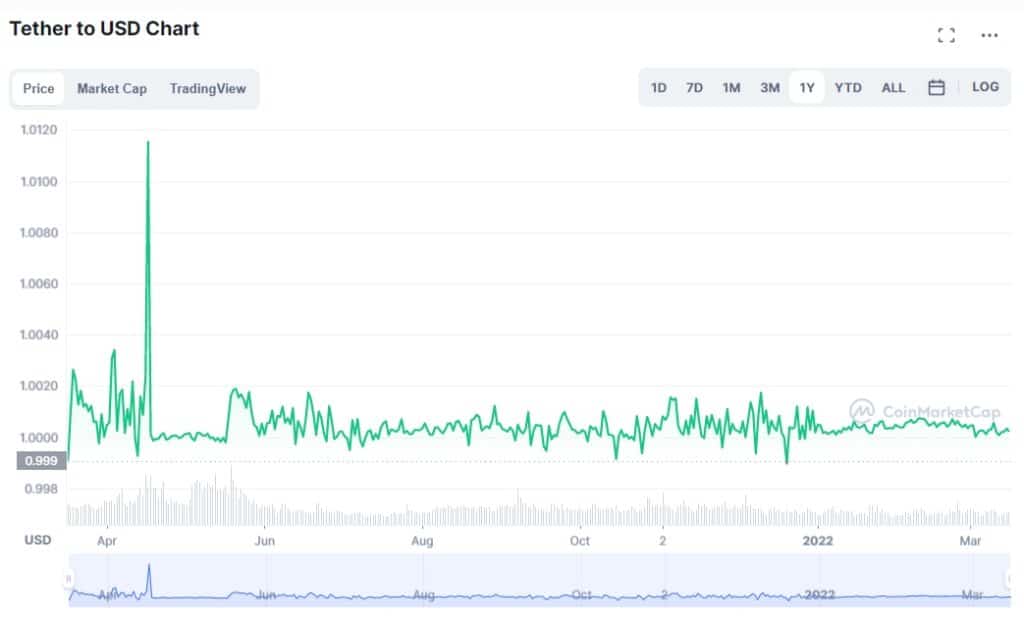

Tether (USDT)

52-week range: $1.01-$0.99

1-year price change: +3.24%

Forecast 2022: $1.00

Tether is the most familiar stablecoin that was primarily introduced in 2014. Tether is the instance of the custodial stablecoins, as explained above. Compared to other stable coins in the cryptocurrency world, Tether has been exploited the most. It is pegged to the fiat money that is USD. The exchangeability with the US dollars is the primary characteristic of USDT.

Specifically, one Tether is equivalent to one US dollar for swapping. Moreover, Tether illustrates low-risk trading accompanying the anti-market impact of the digital market.

However, Tether may not procreate your invested money through a long-term because of being pegged to the USD. Except for exchanges, platforms and wallets are accessible for lending. It means an opportunity is convenient for producing money since it is possible for those lending exchanges, platforms, and wallets offering a high level of interest rates for depositing USDT with their platforms.

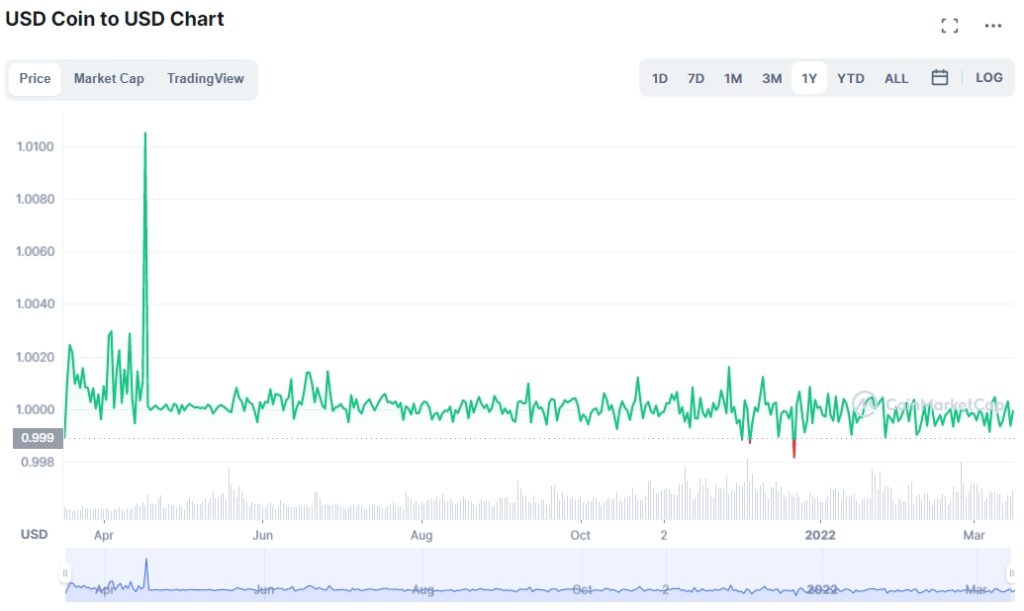

USD Coin (USDC)

52-week range: $1.01-$0.99

1-year price change: +3.30%

Forecast 2022: $1.0050

USD Coin is created via a joint venture that is Circle and Coinbase domain. Like most of the various stable coins, USDC is also backed by US dollars. The stable coin has a use case in a decentralized finance mechanism. Also, USDC stablecoins are in the regulation of the financial institutions of the United States, comprehensively used in the crypto space as well.

Furthermore, USDC’s parent organization proclaims the accessibility for the investor inclined to move from medium to large amounts of money. USDC stablecoins may support cryptocurrencies in making them conventional and more alluring to institutional investors.

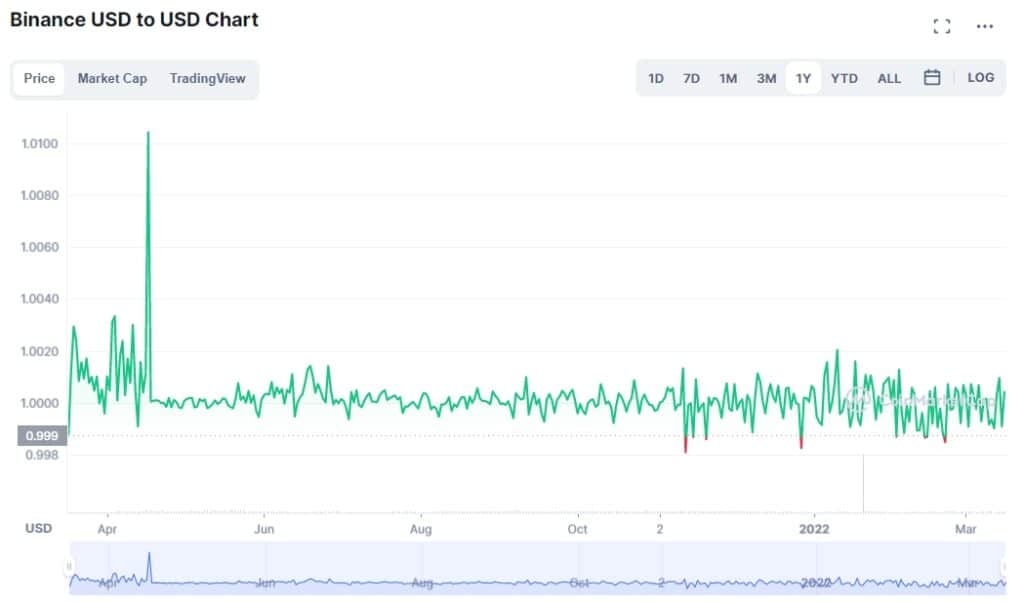

Binance USD (BUSD)

52-week range: $1.01-$0.99

1-year price change: +0.14%

Forecast 2022: $1.0060

Binance USD is stablecoins generated through Binance company. Binance is reputed for developing familiar stablecoins of the crypto space. Especially, the BUSD has pegged to the USD fiat cash. BUSD has utilized technology enormously throughout the past several years.

As per the anticipation of the experts and analysts, BUSD’s price may escalate in the middle of 2022 to 2031. Moreover, these predictions are just an expectation. Cryptocurrency investment is associated with extensively high risk, so the capital will also be at a massive risk. Before plunging in, ensure to accumulate all the essential data and invest wisely.

Upsides and downsides

| Pros | Cons |

| Price stability The value of stablecoins maintains stability in the long term. | Trustworthiness Public preference and trust for the collateralized asset holding organizations impact the stablecoins value. |

| Low volatilie These assets may reduce losses by a significant market drop by escaping from the fluctuations. | Bankrupt possibility Stablecoins may become unable to maintain their value if the collateralized asset holding organization goes bankrupt. |

| Strong background Stablecoins are relatively advantageous due to being backed by regular audits, making them more transparent. | Less profitable Stablecoins require market instability (fiat or commodity) to generate profit. |

Final thoughts

In a nutshell, stablecoins are generally exploited as holding crypto-cash arbitrage settlements but do not produce high-paying returns. They are typically pegged to the assets like other cryptocurrencies, commodities or precious metals, and fiat currencies. These assets are known as considerably more stable than regular cryptocurrencies.

Nonetheless, the advancement of stablecoins is deemed the next big strike in the cryptocurrency world. Stablecoins are valued as the instigator for the digital economy shortly. In addition to that, a great extent of business platforms is setting foot in this sphere for extensive profits.