For some market participants, trading in a foreign currency provides an exciting chance to bet on currency exchange rates all across the globe. But it is risky, and many people may benefit from foreign exchange, often known as FX.

Forex trading enables you to benefit from the marketplace in as little as an hour per day. As in day trading, you don’t have to sit in front of the monitor for days, but positions are closed in 5-7 days instead of the positional trading strategy, where transactional durations might last several weeks.

Stock speculator Alan Farley employed forex trading effectively and, as a result, became a co-owner of CNBC, which is frequently viewed by 84.27 percent of Americans who have television. Let’s look at the fundamental principles that will help you understand FX trading and examine how to make profitable trades with this platform. Here’s what you need to know if you’re new to investing in foreign currency.

What is foreign currency investing?

When traveling worldwide, you may not always be able to make transactions with US dollars. Alternatively, you must exchange your money into euros, yen, or whatever currency the region you are traveling uses.

You’ve probably observed the exchange rate when purchasing or selling money to visit. This shows how much of the other currency you get for each dollar, and inversely. These rates fluctuate often. Price movements are influenced by financial events, forecasted economic statistics, and other causes.

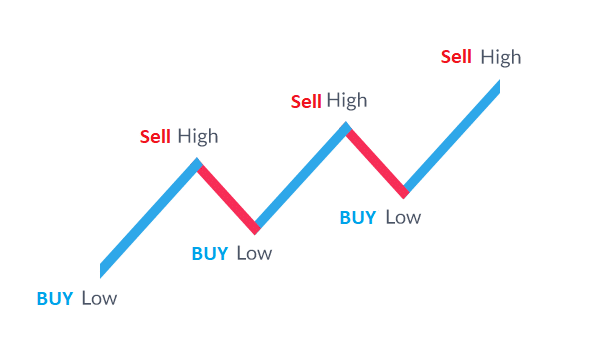

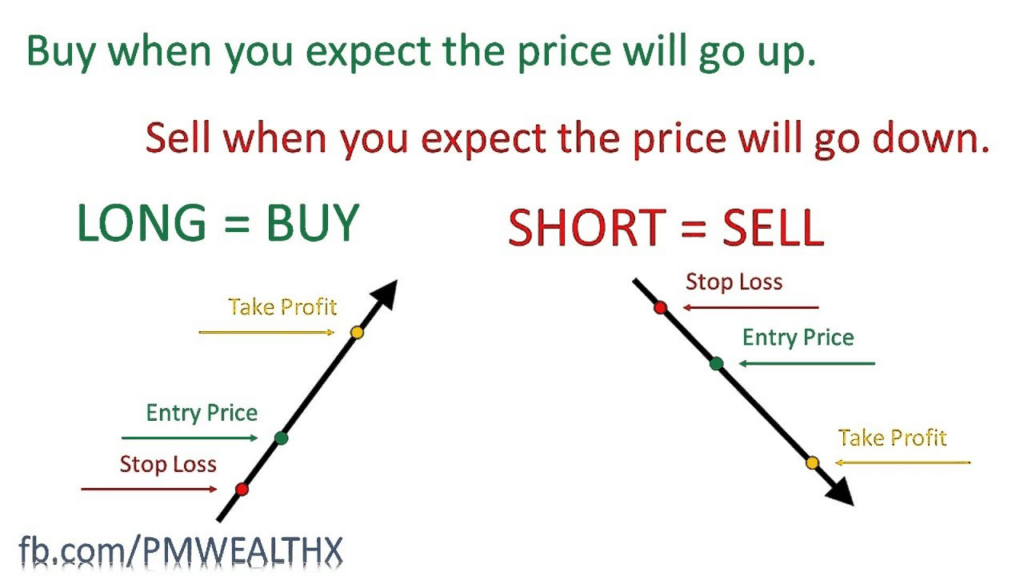

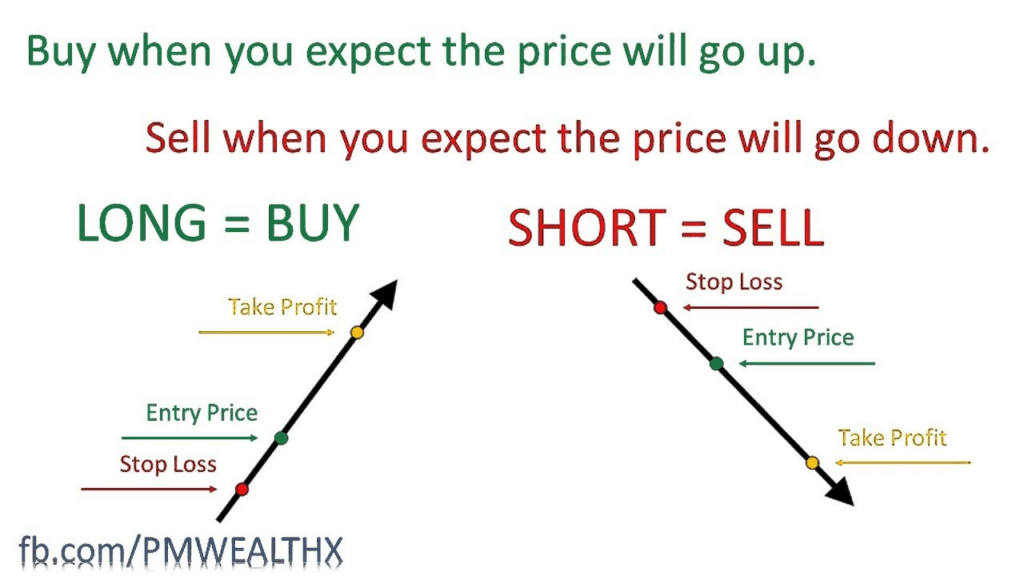

You purchase a great amount of foreign currency in the FX market the same way you would buy a share, commodity, or equity funds. However, rather than benefiting from an increase in the value, you hope that the currency pair will move in the desired way. When it does, you make money when you change the value back into dollars.

Begin your trading experience by gaining a thorough analysis of the business marketplaces, and then study charts and follow price movements to create a plan relying on your views. Paper trading is an excellent way to put these methods to the test while assessing the outcomes and making modifications on the fly. Then, finish the first leg of your journey with money risk, which pushes you to deal with trade marketing and strategic psychology challenges.

What should I know before investing in FX?

Before buying in FX, it’s crucial to know the risks and how you intend to earn. Going in without a solid plan might result in reduced execution and significant losses. Before you make your first FX investment, keep the following points in mind.

1. Investment risk

Begin by determining your investment fund risk. The risk profile of USD/CAD differs significantly from that of USD/BRL. This is because every currency pair in the forex market is unique, much like every firm in the share market.

2. Trading fees

Some brokers conceal trading commissions under spreads or the gap between buying and selling prices for a currency pair. Others demand regular transaction fees based on transaction size, trade nature, or currency pairing. Know how much you’re going to spend for each exchange.

3. Leverage

It is employed when you subject yourself to more than one dollar of risk for every single dollar. This may hasten both losses and gains, so be aware of how much leverage you’re deploying.

4. Margin requirements

Margin, like leverage, can result in excessive losses and gains. Therefore, if you trade on margin, be aware of your account’s charges and margin requirements.

5. Profits or losses per pip

Currency values fluctuate in little amounts known as pips. Know how much money you will get or lose each pip change in the exchange rate.

Use of investment strategy

A trading strategy is a series of rules and guidelines that describe a trader’s entrance, leave, and financial education considerations for each buy.

With present technology, it’s simple to put a trading concept to the test before putting actual capital at risk. Backtesting is a process that allows you to evaluate your trade concept against previous data to see whether it is practical or not. Once a strategy has been designed and back-tested successfully, it may be deployed in live investing.

Upsides and downsides

| Upsides | Downsides |

| Broaden your investment Many traders place a strong emphasis on equities and bonds. However, trading is a popular way to broaden your wealth. | There are a lot of terrible investing alternatives Investor Junkie advocates engaging with trusted organizations to handle your money. Unfortunately, some unethical individuals in the market sell inferior products with extremely high risk, exacerbated by margin trading. |

| Profit from global financial news Those interested in news and data may create strategies based on news broadcasts, politics, and other news affairs. | High volatility Word spreads swiftly among traders, and these markets change very quickly. As a result, the FX market is frequently more unstable than equities and bonds. |

| Trade 24 hours a day, seven days a week Unlike the stock market, which has set hours, financial markets are virtually always open someplace. In addition, some FX systems allow you to trade 24 hours a day, seven days a week, so you never have to wait for the markets to open. | Less predictable markets When investing in US equities, you may rely on business advice, annual statements, and other forecasting statistics. FX may see large fluctuations with little notice. |

Final thoughts

Trading comes with both risks and rewards. Before making any decision, you should weigh all your options carefully. You can practice it without putting your own money at risk by working with a paper trade firm similar to a stock market business.