Crypto investing is a risky but highly profitable business venture. While you can build a fortune if you succeed, you could also lose everything when you fail. Be aware of this truth when you decide to engage in this business.

While many cryptocurrencies made a sell-off at the beginning of 2021, the whole market is again gaining momentum. By October 2021, the crypto market reached a capitalization of $2.19 trillion. This makes the market the eighth biggest economy in the world by market share.

While crypto investing is inherently risky due to its speculative nature, no one can deny its potential to produce massive returns in a short amount of time. If you are a person with a risk-taking propensity, this type of investing vehicle might be suitable for you.

If you take this investing route, make sure you risk only an amount you can afford to lose. If you are ready to engage, learn some strategies, you can use in your crypto investing journey.

How does crypto investing work?

To invest in crypto, you must do two things. First, find a place to buy crypto assets. Second, find a place to store your private keys. Investors typically purchase crypto in exchanges, the popular ones being Coinbase, Binance, Kraken, etc. To protect your investment, you must secure your private keys. That is where wallets come into the picture. Among the wallets, you can use mobile, desktop, hardware, and extension wallets.

You can use your savings account to buy digital assets from crypto exchanges. Virtually all cryptocurrencies allow you to purchase a fraction of a coin. When you choose penny cryptos such as Tron and VeChain, you can own hundreds, if not thousands, of coins with a mere $100. That is why you can partake in this business with just $100 or less.

Top 3 crypto-investing strategies

Investing in a volatile market such as crypto without a trading plan is a risky gamble. Although there is no holy-grail method, there are three popular strategies you can use in trading crypto.

Strategy 1. Dollar-cost averaging

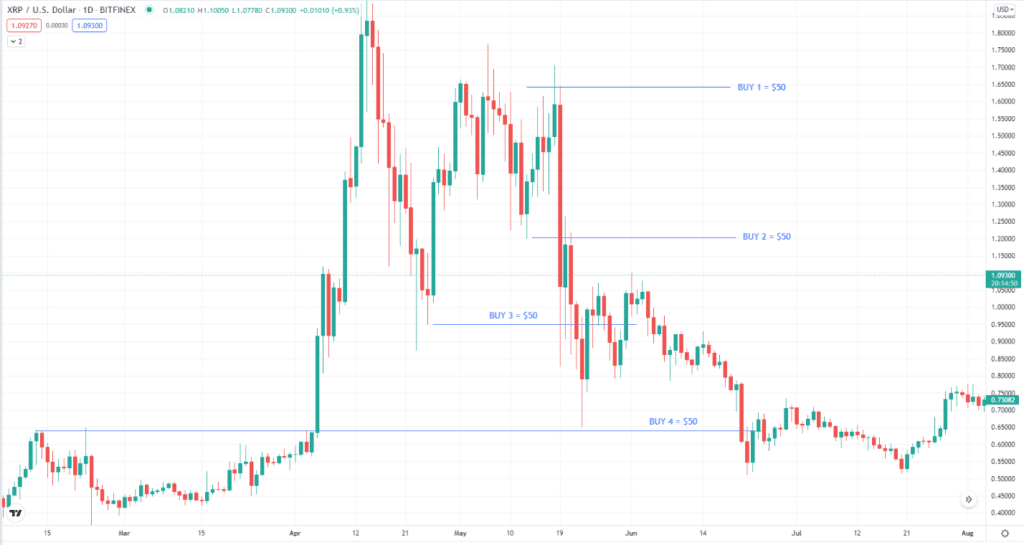

Dollar-cost averaging is a standard tool used by investors in different types of markets, from foreign exchange to stock to crypto. The principle behind this strategy is quite simple. Rather than staking your allocation for one crypto in one go, you divide the allotment into multiple parts. Then you set the schedule for when you will buy that crypto asset. Other investors define the price at which they would add trades to their position. They do this with the use of such tools as swing points and even supply and demand.

The advantage of this strategy is that you control the drawdown of your investment. For example, if you entered your first trade at a high price and then the price went down, your trade would be losing. As a result, your account will go down in value. However, since you do not put everything in that trade, the drawdown is minimal.

Then at some point, you could decide to add another buy trade when the price gets to a potential turning point. You keep adding trades as the price goes down until you put all your allocation in that crypto. See the sample implementation of this strategy in the image below.

Strategy 2. RSI divergence crypto trading strategy

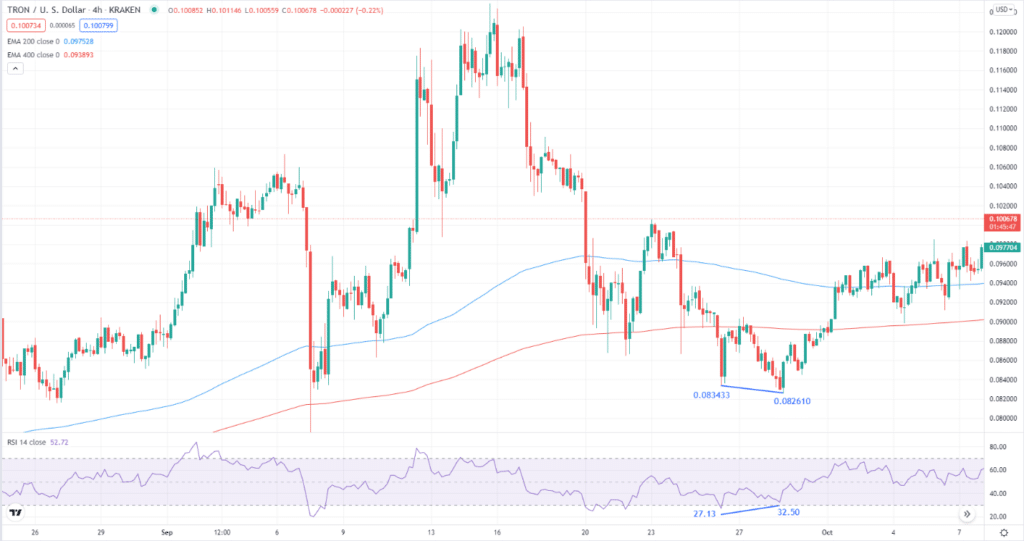

It is a technical method that is useful in predicting trend reversals. It follows the principle that momentum shifts first before price does. Generally, RSI tracks the movement of price. However, there are times when RSI contradicts what price is doing. This is what we call divergence.

For example, when price prints a lower low but RSI displays a higher low, that is a bullish divergence. This signals that the trend could reverse from the downtrend to the uptrend, which could be the perfect time to buy crypto.

It is best to combine the RSI divergence strategy with trend analysis. The easiest way to do that is to use long-term moving averages, such as 200 EMA and 400 EMA. The chart below shows a four-hour chart of Tron. Since the 200 EMA is above the 400 EMA, the trend is bullish. Then we see a bullish RSI divergence next. That could be your perfect entry into this crypto market.

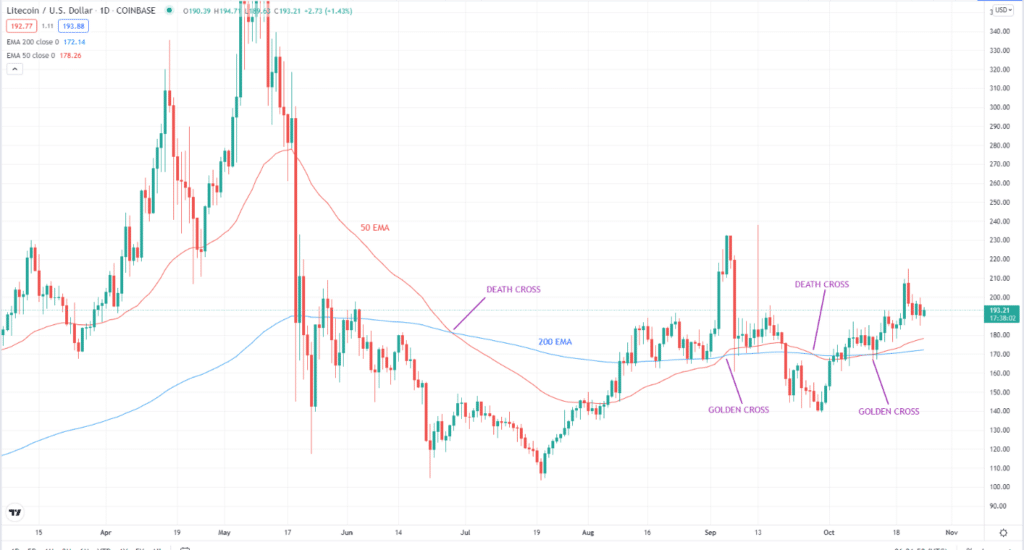

Strategy 3. Golden cross/death cross

The golden cross or death cross is a popular trading strategy in the financial markets. It is a crossover of two moving averages (MA) in the positive direction. A death cross is a crossover of two MAs in the negative direction. The two MAs used are commonly the 50 EMA and 200 EMA. Refer to the chart below.

This strategy works exceptionally well in volatile markets such as crypto. Since you are investing in crypto and not trading, you should consider only the golden cross and disregard the death cross. Since the crypto market has a bullish outlook, it is best to deal with the golden cross when correcting the market. The correction might take some time.

Upsides and downsides of crypto investing

| Upsides | Downsides |

| Identity theft is virtually impossible as no personal data is disclosed during transactions. | It is possible to use crypto for illegal activities, such as money laundering, terrorism financing, black market deals, etc. This is due to the anonymous nature of crypto transactions. |

| Some cryptos, such as Bitcoin, have a limited supply. When the demand for digital currencies increases, the value of crypto rises. This makes cryptocurrency immune to inflation. | The crypto market is highly volatile. Making huge profits and losing big time are all possible. |

| You can trade and invest any time of the day and any day of the week. Crypto is a market that truly never sleeps. | The legality of cryptocurrency is questionable in many countries. This will slow down the market adoption of this security. |

Final thoughts

Investors think of the crypto market as a gambler’s playground, and for a good reason. The chances of winning big time exist, so do the odds of losing big time. If you want to take a risk, invest only the amount you are willing to lose. There is no assurance of making money in crypto, but such is a possibility.