There are various ways to invest your money to generate $1,000 each day. Sure, it will take time and a lot of effort, but it is entirely possible. For instance, the S&P 500 index can give investors, on average, a 12 percent yearly return. Earning $1,000 per day is equivalent to $365,000 per year. To earn this much, you need a capital of $3,041,667 ($365,000/0.12).

Putting together such a huge capital is going to take much time. That is for sure. Keep in mind, though, that you are not going to put all your money into one type of investment. You can diversify your investments, each one contributing varying return rates.

What is important is you start investing. You can do this by putting any spare $100 cash in investment and keep adding until you reach a sizable capital. Then you can consider another type of investment. Let us look at the various investments you can put your $100 and work toward earning $1,000 each day.

How can I invest 100 dollars and make $1,000 a day?

If you feel sorry for yourself for not having enough money, you are not alone. Often, the problem is not about being penniless. The real problem is not knowing where to put the money when you do have it. When we earn money, most of us direct it to one thing, that is, expense. Not many think about saving, much less investing.

If you want to get out of your dire situation, it is time to think long-term. So the next time you have $100 extra cash, put it in an investment. Keep doing it for five years or more. You will be surprised at how much money you have and its impact on your financial life.

Five ways to invest $100 make $1,000 a day

This section has listed five ways you can invest your $100 and earn returns passively. This is how you are going to make money work for you.

1. Invest in index funds and ETFs

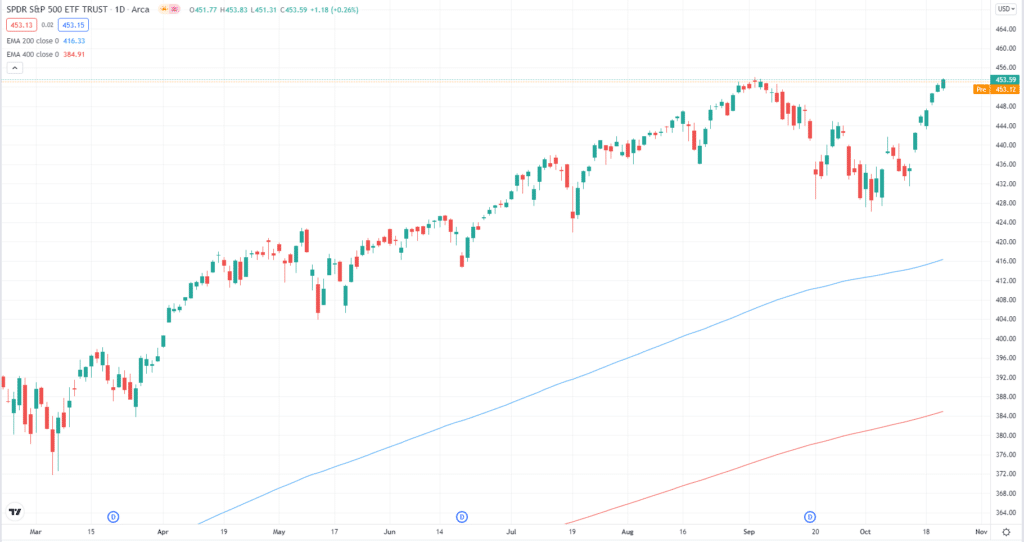

Stock investing is one of the best ways to grow your money. However, if you invest only $100, the return you will get might not be worth the wait. In this case, you can change gear and shift to index funds. When you buy an index fund, you own a portion of each company contained in the index.

For example, the S&P 500 ETF contains the 500 large companies held in the S&P 500 index. This index fund provides automatic diversification and great assurance of investment return so long as you stay invested for the long term. The current price of this ETF is shown on the chart below.

2. Invest in fractional shares

It is now possible to buy stocks with $100 or less, thanks to fractional shares. When you buy a stock, you usually indicate how many shares you want to buy. In contrast, when you buy fractional shares, you specify the amount of money, in dollars, you want to stake in a particular stock. Then your broker will initiate your investment for you.

For instance, if you buy $100 worth of Netflix (NFLX), which now trades at $653.16, your account will show that you own 0.1531 shares of that stock. See the chart of Netflix below. Another good news is that fractional ETF shares are also available for starting investors. Such is also supported by brokers who provide fractional stock shares.

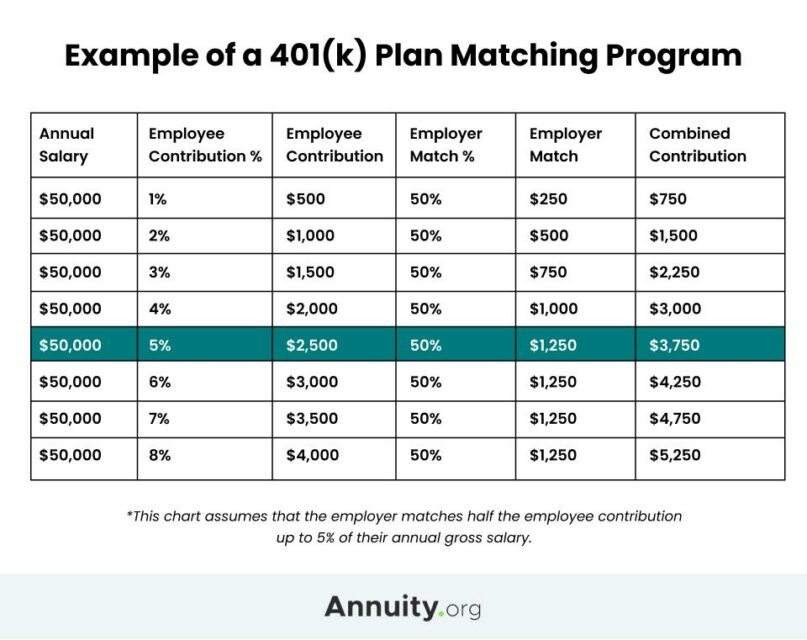

3. Invest in 401k plan

If you are an employee and have a retirement plan sponsored by your boss, such as 401k, it is one way to get your $100 working for you. Plus, your employer may provide matching contributions that could boost your plan. See sample matching programs in the image below.

Another attraction of such plans is low tax. Every amount you put into your 401k is not taxed on the year you contribute. The only time you start paying for your taxes is when you begin withdrawing funds from your 401k. Then your investment grows tax-free.

If you are self-employed, your option is a solo 401k. Unlike an employer-sponsored plan, you will not get matching funds from someone else as free money to your account. Still, you can benefit from tax breaks and tax-free investment while you grow your account.

4. Invest in an IRA plan

Do you have a spare 100 bucks to invest in a retirement plan on top of your workplace 401k? Go for an IRA (or individual retirement account). Let us assume you save $100 monthly in an IRA in 30 years. If your money is invested in the S&P 500 index the whole time and considering the index’s performance, your total savings of $36,000 will amount to around $180,000. That is because compound interest is working its magic.

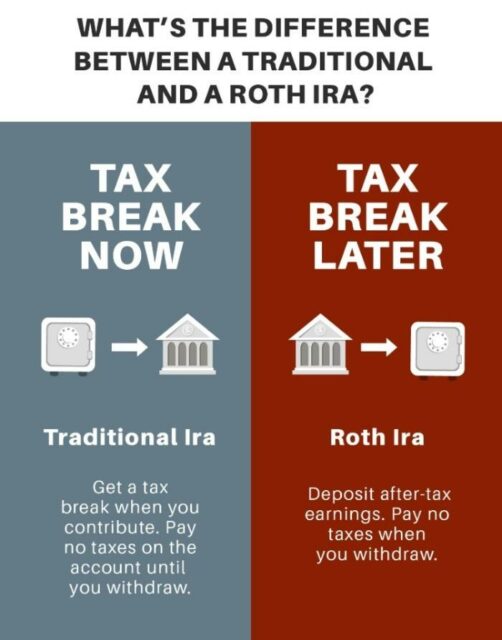

You might ask why to choose an IRA. The reason is taxes. A regular IRA has the same tax benefits as a traditional 401k. You will enjoy a tax break while making contributions and tax-free investments. The only time you pay taxes is when you start withdrawing funds from your account on your retirement.

The graphic below compares two types of IRA. The main difference between a regular and Roth IRA is the tax break effectivity.

5. Invest in a robo-advisor

If you want to generate an income passively, consider using a robo-advisor. The good thing is that this investment option will not require huge capital and market knowledge upfront. Several online stock brokers provide investors an option to use a robo-advisor in their investment operations.

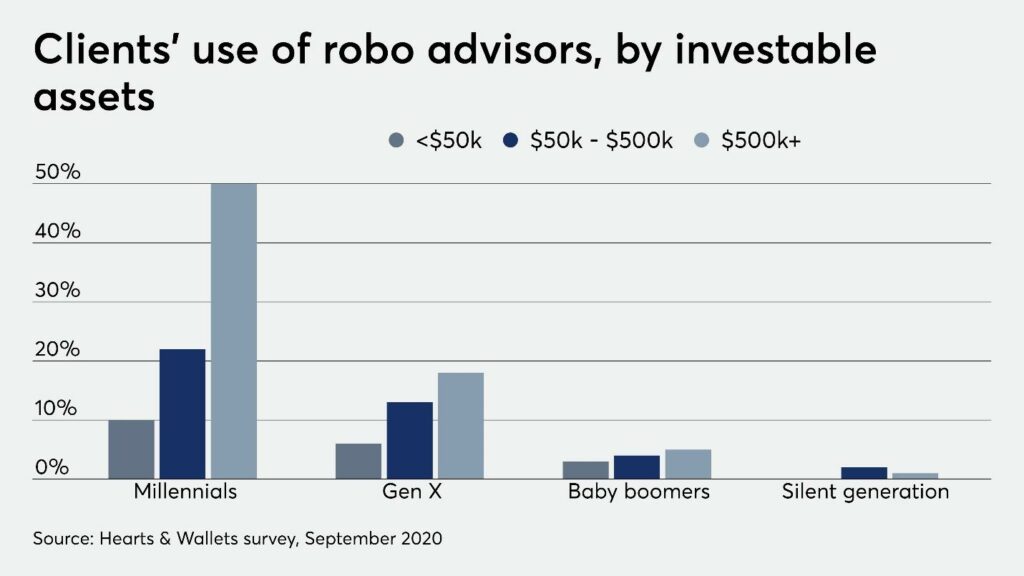

Robo-advisors have become mainstream nowadays, especially among millennials. Similar to human, financial mentors, genuine robo-advisors are licensed to operate by the SEC. Therefore, you can expect the robo-advisor to uphold your best interests as an investor.

Final thoughts

If you have the means, do not dilly dally with your investing plans. Pick one or two investment options from our list and begin putting your $100 to work. The sooner you start, the faster it will take to reach your goal of generating $1,000 a day.

Of course, you need patience while you build your financial future. Just enjoy the journey and keep on learning. There are various other ways to generate an income passively.