Bond and stock are stapled assets among serious investors. While the stock market offers massive returns, bonds guarantee profits. The stock market has had an average yearly return of around 15 percent for the last five years, counting from 2016 until 2020. On the other hand, government bonds have a five to six percent yearly return for investments with long-term maturity.

Why should you invest?

Probably the most important reason is to achieve financial independence. Said another way, you want to get rich. You do not want to depend on someone else for your subsistence in your old age. You want to leave the employment world on your retirement.

Why are people investing in these assets? You will find the answer in this article and understand how they differ, how to start investing, how to manage risk, etc.

How do stock and bond differ?

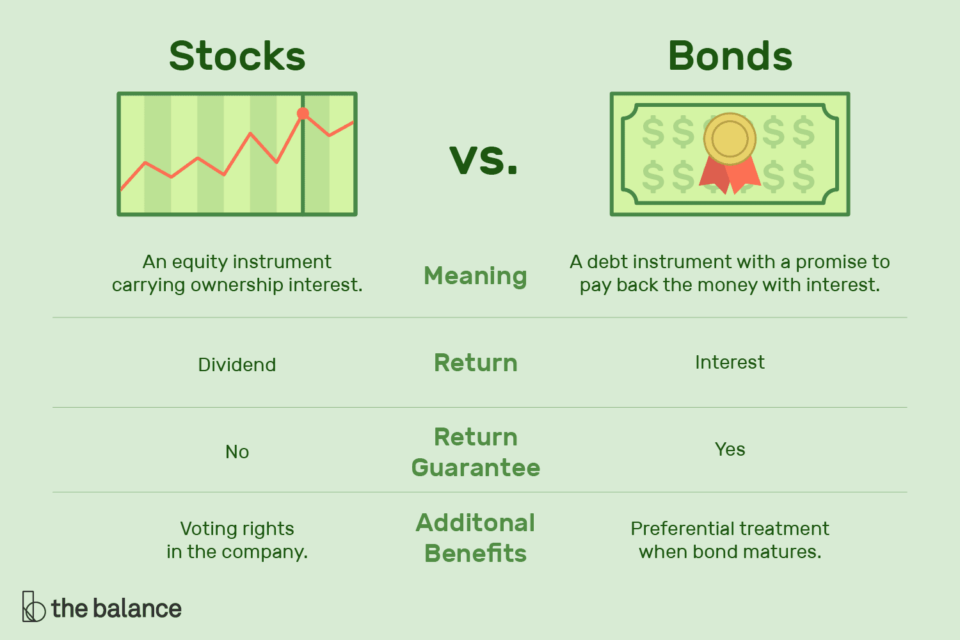

The main distinction between the two assets is the manner of profit generation. When you buy stocks, you own shares of companies. Meanwhile, when you take bonds, you loan money to the bond issuer. You must buy them at lower prices and sell them later at higher prices to profit from stocks.

In contrast, bonds provide interest to money owed, similar to loans. You will retrieve your capital along with interest at the end of the bond term. Another distinction is that stocks fluctuate more than bonds do, while bonds are safe havens for investors. The other distinctions are shown in the image below.

How to start investing?

Stock investing often involves taking the following steps:

- Find a brokerage firm offering your preferred stocks.

- Register an account with this broker and verify it.

- Fund your account through various methods such as wire transfer or bank deposit.

- Determine the number of shares you want to buy for each stock.

- Place your orders using market or limit orders.

To take bonds, work with the bond issuers directly. For average investors, though, they often purchase bond products from one of the three providers below:

- Brokerage firms

You can buy bonds from brokers who sell stocks. This is how you are going to purchase individual bonds. However, you need to do your research to determine if a specific bond is worth buying. One great broker for bonds is Interactive Brokers. It offers desktop and mobile applications for your investing.

- Mutual funds

The advantage of mutual funds is that you do not need to pick particular bonds in your bond portfolio. The fund company will do it for you.

- US Treasury

If you want to buy Treasury bonds, you can do that online through a web portal provided by the federal government. This portal is known as Treasury direct. With this direct access, you will not pay any middleman commissions.

How to handle risk?

Your investment portfolio should include bonds and stocks, as well as other investments. Regarding asset allocation, it entirely rests on your time horizon. If you are younger, you can allocate more funds to stocks.

This allows you to grow your account fast. If you are older and nearing retirement, you should tip the balance in favor of bonds. This is because bonds tend to have more stable returns than stocks due to lower volatility.

Upsides and downsides

| Investment | Upsides | Downsides |

| Stock | •Capital growth You can grow your money fast through stock investing. Although it can go through a bear market, the industry is bound to recover after it reaches a bottom. As long as you diversify funds, you can develop a portfolio that can survive market setbacks. | •Volatility risk The stock market can be volatile at times. It depends on the prevailing market sentiment. Volatility can be good or bad, depending on your situation. If you are nearing retirement and are looking for stable income, stock investing could bring you an intolerable risk. |

| •Dividend Some stocks offer dividends. For these stocks, you can make money in two ways. Therefore, you can make it your investing strategy to focus only on stocks paying dividends. | •Bankruptcy If a company goes out of business, stock investors are often paid last, while others are paid first | |

| •Diversification You can achieve diversification of your stock investment in many ways. You can focus on companies operating in specific sectors or locations, have a certain market cap, etc. | •Time investment You need to spend time learning about your preferred stocks before you buy. For example, you must know how to read financial statements and quarterly reports. | |

| Bond | •Fixed return Bond yields are fixed. You know how much you stand to gain at the end of the bond term. This is because the interest rate is already set and decided at the start. | •Fixed return Bonds’ having fixed returns has positive and negative implications. When you choose to put money in bonds, you cannot expect to earn more than the anticipated interest at the bond’s maturity. |

| •Security It is safer to invest in bonds than in stocks for two reasons. First, the value of bonds is stable. Second, in the case of liquidation, bondholders are paid before shareholders are. | •Huge capital needed To start investing in bonds, you need to put up a large capital. While some bonds are available for as low as $1,000, most bonds are pricier severalfold. This makes bond investing out of reach for the average investor. | |

| •Lower volatility Due to less volatility, bonds make sound investments for investors with low-risk tolerance. | •Interest risk Interest rate changes heavily affect bonds. This risk is not present in stocks. |

Final thoughts

When you invest, your objective should strike a balance between growth and risk. In addition, you should put investment funds in securities with positive return potential. Stocks and bonds are two such assets. These two securities should make the majority of your fund allocation. While your stock investment focuses on capital growth, bonds provide security and stable profits.