The subject of whether or not robots can generate passive income for you is currently the talk of the forex town. It appears that everyone is talking about it on YouTube, blogs, and social networking sites. All of this commotion perplexes some of you.

So, to cut through the clutter, we sought to provide you with a straightforward explanation of whether or not a forex robot can generate some magical figures for you.

What are forex robots anyway?

A forex trading robot employs a range of forex trading signals to help you decide to buy or sell a currency pair at a certain time. These robots use MetaTrader and the MQL programming language to create trading signals, place orders, and deal with transactions.

The forex robot operates automatically with a single click, conducting trades based on historical data. In other terms, whether you’re in front of the computer or not, they automate the process.

For instance, if you decide to go short on GBP/USD and set the robot to enter and exit the trade at a specific price at a particular time, a forex robot will do it for you.

Many traders are drawn to them just because they appear to be something you can turn on, walk away from, and earn while resting on a seaside.

Can you trust a forex robot?

The answer to this question depends on several factors. For a robot to generate a passive income, it has to tick all the boxes. So, here are the factors on which a passive income robot depends.

It should pass a demo test

A demo test is required for a robot to generate passive revenue. It would help if you pushed a robot through its paces during demo testing. If it fails a demo test, it will not earn you any money on your current account.

It’s important to remember that just because a robot earned steady income on a demo account doesn’t indicate it’ll do so on a live account. Actual trading is not the same as demo trading, but this isn’t to say you should pack your belongings and ignore the forex robot.

If a forex robot performs well on a demo account, it is likely to act effectively on the main account.

Is it back-tested?

Back-tested forex robots outperform the competition. Back-testing is a forex approach, looking at past data to see how it performs. A robot can evaluate data scores in a matter of seconds.

But how will it generate money for you if it cannot back-test? A lucrative bot is the one that has been back-tested.

Need to have minimum drawdown

A decrease in your trading capital is referred to as a minimal drawdown in trading. The goal of your trade is to keep your accounts from losing money. At the very least, your wins outnumber your losses. Because you have more winners when a robot has a low drawdown, it will naturally provide an excellent revenue for you.

Some robots, on the other hand, increase productive trading but have a maximal drawdown. They get more losers over winners, even if they are generating six figures a year. So, as a result, they’re not going to be of any use to you.

Can perform multitasking

A forex bot, as previously said, can conduct hundreds of computations in a matter of seconds. If a robot’s coding permits it to multitask, it will provide you with additional options. It opens the door to a variety of trading techniques.

For instance, if a robot can pick signals from every oscillator, it’ll open multiple trading positions for you, thus creating more profitable opportunities. They give a false impression that they are making little gains, but they might add up to a substantial number when added together.

Great user-experience

Many programmers boast regarding their robots, promising their clients immense benefits. This may not always be the case, though. Before choosing a robot, look at its ratings and statistical data on Myfxbook to see how it has performed.

A robot that constantly makes money will have favorable ratings on websites such as Trustpilot, and its Myfxbook chart clearly shows you how much it makes.

Recovering unfavorable positions

There are forex robots that can recoup deficits by taking a position on the other side of the market. Hedging is the term used to describe this type of strategy. Even robots can’t control market volatility. Yet, it can help to keep the balance of trade. A forex robot might open both a shorter and longer position via hedging. In addition, it will act as a brief loss hedge. The goal is for there to be more winners than losers in this game.

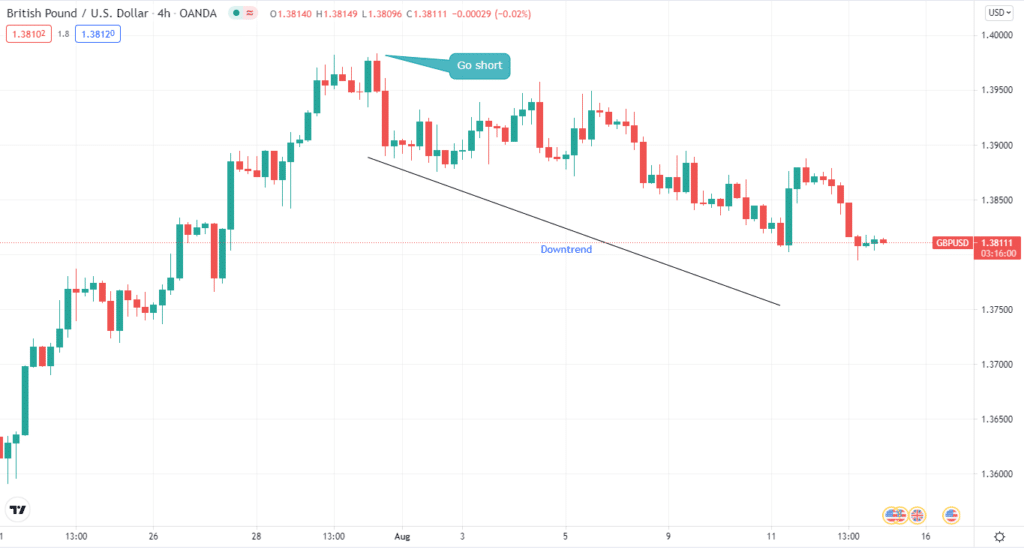

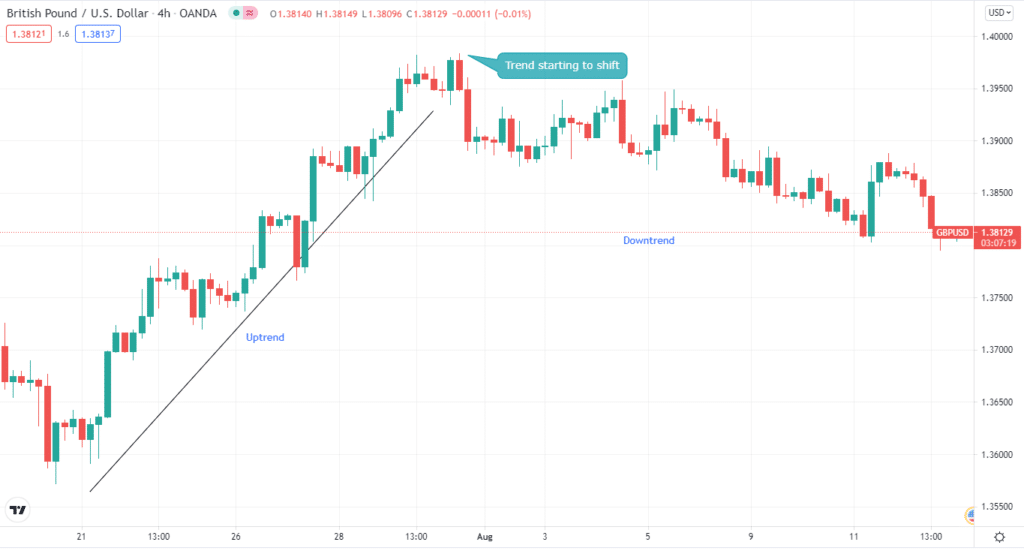

Take a look at the chart. As you can see, there is a fantastic buying opportunity. However, after a while, the price began to drift.

A forex robot will also open a sell position at this point. As a result, it will operate as a barrier, shielding you from unfavorable price movements. Sure, a forex robot can generate a passive income when all factors are considered. It’ll use all of its skills to buy and sell on designated occasions, earning money in the end.

With all the hype, you must conduct an extensive investigation before purchasing a forex robot. It’s ideal if you can develop a forex robot personally. If you can’t, read reviews about the robot and think about what we’ve said thus far.

The main task is to choose a bot that fulfills your requirements and dependable transaction execution.

Final thoughts

Many people profit passively from forex robots, and you might too if you follow the instructions indicated above. A profitable robot should have long-term efficiency and a modest drawdown.