The concern about the future of the planet is getting bigger every day. Companies, governments, and institutions do projects to stop global warming, but they need resources.

Green bonds are financing tools that organizations use to fund their projects. According to the Climate Bonds Initiative, the total volume of green bonds from 2007 to 2020 reached $1.1 trillion. Although, in 2012, this amount did not exceed $3.1 billion.

Green bonds allow investors to create a more sustainable way of life while making a profit. Let’s find out what these tools are and how to invest in bonds to make money while helping the planet.

What is a green bond?

It is a debt an organization issues to finance its projects or process. What makes these types of bonds different is the kind of projects they sponsor.

Green bonds are designed for projects that impact the environment, such as constructing solar power stations. Although, a more general concept allows including bonds to finance social projects as green bonds.

There is no central authority that controls or defines which bonds are green and which ones are not. The classification depends on the organizations that issue them. It is regular that organizations use standards such as Green Bond Principles to define their bonds as green ones.

Why invest in green bonds?

Like most people on this planet, you should be concerned about climate change. This phenomenon affects our lives. Like most people on this planet, you are probably not sure how you can help. Thus, everything you do seems to make an actual difference.

Worrying about your financial future seems like a more immediate threat to you than climate change. Green bonds are the perfect opportunity to take care of both. We mean the collective future of the planet and your financial future. You’ll be making money but helping organizations to build a better world for you and your kids.

Green bonds are a perfect combination of self-care and social consciousness.

Can you buy green bonds?

These assets have experienced a remarkable increase in the last few years. Still, they are a small percentage of the bonds issued in the world. Because of these, green bonds are intended to be bought by institutional investors, which can purchase large blocks.

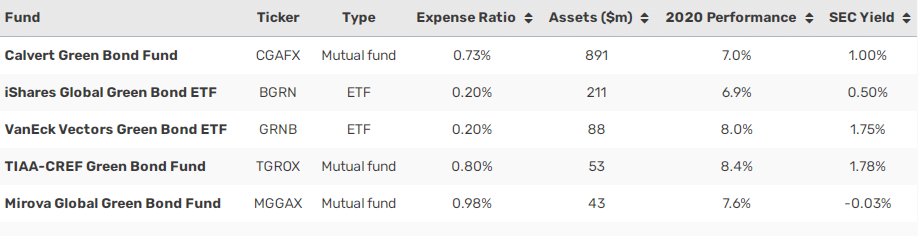

However, there are still ways for small investors to participate in bond funds. For example, through an ETF focused on green bonds, retail traders can buy green funds in smaller amounts than it takes to buy one green bond. Another way to buy green bonds would be to focus on municipal green bonds, which sometimes require less capital but can be complicated.

How to invest in green bonds?

Green bonds are relatively recent on the horizon of investment and financial markets. The first green bond was issued in 2007. So there is not a lot of data on the behavior of the bonds. However, some basic recommendations or rules apply.

Rule 1: don’t get rid of your regular bonds

Green bonds should complement your portfolio. However, it would help if you didn’t get rid of your common bonds to be substituted by green bonds.

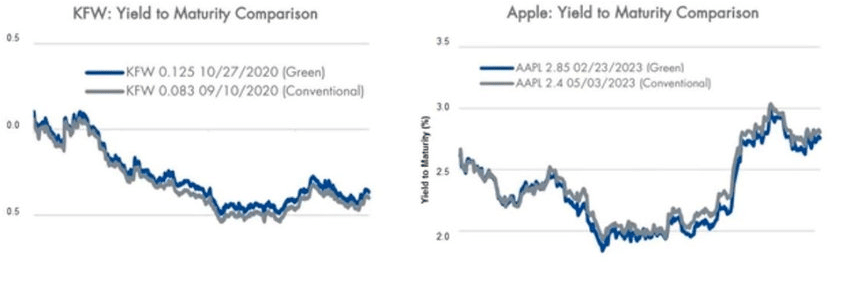

Even though green bonds are gaining traction on the market, the idea is lovely. Green bonds are weighted differently, so comparing common bonds and green bonds is difficult. However, some studies show that green bonds yield 15 to 20 points less than regular bonds. However, most green bonds are very recent, so it’s hard to conclude them, so going from stable bonds to green bonds can be risky. Also, fees and commissions can be higher than other more traditional bonds, so you should keep an eye on that.

Rule 2: choose the right issuer

The idea of buying a green bond can be attractive because of its purpose. Regrettably, good causes sometimes blind us. When investing in green bonds, the filter you chose should be the same as selecting any other asset. Especially when it comes to creditworthiness, only purchase bonds from well-rated organizations so you can minimize your risk.

Rule 3: make sure it’s a green bond

Green bonds are unregulated. The sorting depends on the organization’s criteria. The global standards are not obligatory and are only guidelines. In addition, there is a lack of transparency.

Green bonds don’t yield as much as regular bonds. There are higher fees if you invest in green bonds. It is because you are motivated by the green side of the bond. To make sure money will be used for the right causes, investigate the project and the organizations.

Sometimes green bonds are issued by highly contaminating organizations. So you may feel the bond is hypocrisy. Many climate-align bonds don’t use the “green bonds” label. Maybe you can invest in some of those instead.

Green bonds upsides

- Green bonds are an excellent way of making a profit while helping the planet.

- The increase of the last few years has made green bonds more accessible.

- These bonds attract investors that may be interested in the climate issue to the bonds market.

- Issuing a green bond is good for the organization’s reputation.

Green bonds downsides

- There are fees and commissions associated with green bonds mainly due to the current low liquidity of the market.

- Green bonds yield lower than regular bonds and have longer maturity periods due to the nature of the projects.

- It can be hard to make sure that a bond is green since there is no regulatory institution.

Is it worth investing in green bonds?

Green bonds are excellent choices for people worried about the environment. It allows investors to help to change the planet and still make a profit from it. However, the extended periods, the lower yields, and higher fees can easily scare small investors.

You can help the planet without investing in green bonds. If you start on the bond market, green bonds should only be a part of your portfolio. While you invest a part of your portfolio in green bonds, try the other part to be on other climate-aligned bonds. Or at least invest in bonds from organizations that are not such a contaminant.

Final thoughts

Green bonds are here to stay. Around half of the money invested on green bonds has been invested in the last two years. Climate issues are becoming more critical every day. With the growing consciousness of investors, organizations will need money to change their way of production. Thus green bonds will be an important way of financing that change.