Bonds are an essential value reserve in the financial world. Bonds offer better interest rates than banks and, in some sense, depending on which bond you choose, are more reliable.

Great investors have a big part of their portfolio invested in bonds to protect their capital while making money because of the interest. Even when they are less profitable than stocks and other markets, they are also less risky.

When investing in well-rated issuers, the possibility of losing money is almost zero. Stocks and forex are always going up and down, but with bonds, you can be 99% that you’ll make a profit.

To know more about this important financial instrument, keep reading.

What is a bond?

A bond is a financial instrument through which companies and institutions borrow money from investors in exchange for the promise of returning the totality of the money plus interest at the end of the period. Bonds allow organizations to get money for their projects, avoiding the bank system to pay higher interests. Also, allow investors to get better interest rates than they would get by letting their money in a bank account. The duration of the bond is called maturity and can be as long as 30 years. The organization can pay the investors in different periods. The most common are: monthly, quarterly, semiannually, and annual.

When to invest?

The time to invest in bonds depends on multiple factors. The coupon, the creditworthiness, the yield, and the maturity influence the price of the bond. All these factors must be considered when investing in bonds. The same techniques applied in forex can be applied in the bonds market to get the most out of each trade. So bonds, like stocks or futures, are constantly being bought and sold in the bond trading market, where traders try to get the best deal for their bonds.

What is bond trading?

When you buy a bond, that doesn’t mean that you are stuck with it until maturity. Like any other asset, you can trade it, and the reasons to do it can be diverse, from changes in interest rates to upgrades and downgrades in the issuer’s rate. This reality opens a trading market for bonds in which, like any other trading market, some strategies seek the most profit from buying and selling bonds. Let’s see some of those strategies.

Strategies for bond investments

Let’s explore some strategies for investing in bonds.

Price action movement

This strategy is the most intuitive of all. When investing in bonds, you want to get the bond with a better yield, but you also want to enter a position at the best moment.

Traders used technical analysis techniques to identify the best time to enter or exit a trade through price action movements. This includes the patterns identification, price bands, resistance and support levels, trends, and others.

Of course, traders never make the same interpretation about the price behavior. The market participants trained to anticipate bond movement according to the price action will benefit most from the trades.

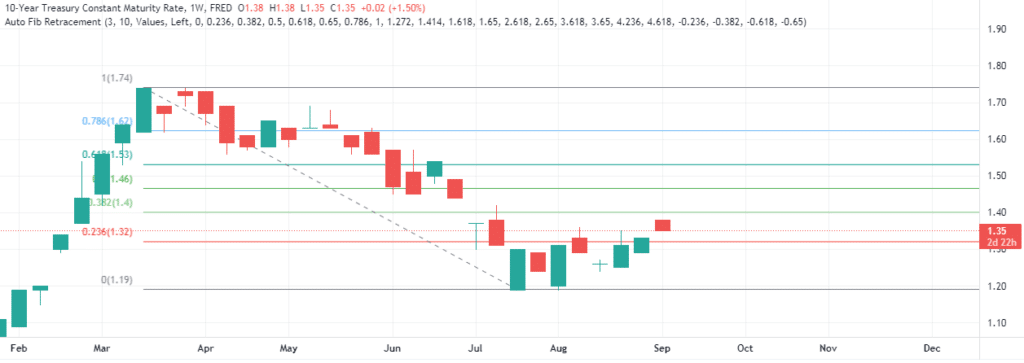

Above, we see the 10-year treasury bonds. If we look at the Fibonacci retracement, we’ll notice that the price is about to hit the 50% retracement level. So, it is not a good idea to buy right now since the price is likely to go up a little more to consolidate or downtrend.

Japanese candlestick strategies

The Japanese candlesticks are a particular kind of price action strategy based on the graphic representation of the price. This chart is the favorite chart in modern trading. The amount of information in a single candlestick and its wicks is easy to access, even for beginners.

In this chart, the price action is represented against time. The price variation is there for traders to figure out where the price is heading with the help of patterns and other technical analysis tools. By using Japanese candlesticks patterns, traders can identify when is the best time to buy a bond or if, instead, it is better to sell.

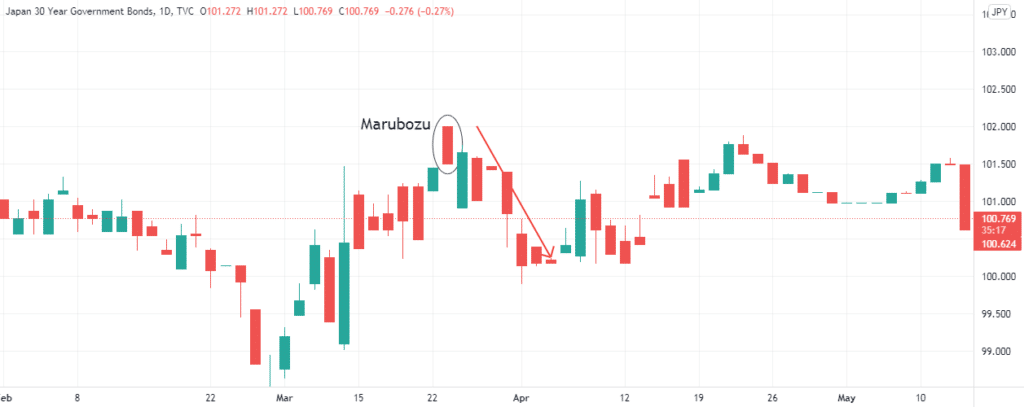

Above, we can see an example of how Japanese trading patterns can help us decide when is a good time to sell. At the top of the uptrend, we see candle patterns called Marubozu. In this case, it’s a red Marubozu. This pattern is made of a candle with no wick. As it is bearish, this signifies that the bears are stronger than the bulls, and there was almost no rejection of the low price from which we can conclude that a downtrend is coming next.

Scalping strategies

The principle of scalping is to make several transactions during the day and exit positions as soon as they become profitable. The scalping strategy requires a lot of discipline. Due to the gains being so small, one bad trade can take many small successful trades to recover.

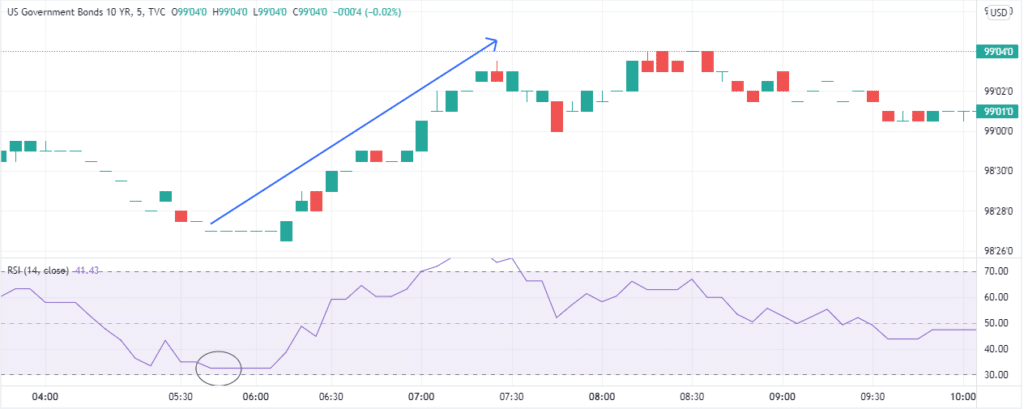

Traders often use RSI to help them decide when to enter a position and when to exit. The way of doing it is to pay attention to when the index reaches the 30% level and then start rising to enter a long position. To know when to enter a short position, you want to wait until the index reaches 70% and starts a downtrend.

We look at the United States 10-year Government Bond on the five-minutes chart in the example below. On the bottom, we see that the RSI reached the 30% level, and the price started an uptrend.

Momentum/swing trading

Momentum/swing trading is focused on profiting from the minor reversal in the primary trend. For example, when there is a strong downtrend, along the way, we probably will see a slight uptrend before the price continues to fall.

Therefore, the momentum/swing trading strategies will enter a long position even if the primary trend is downwards. That trader expects to exit before the price continues to its downtrend. This is a risky strategy with small gains, so why do traders apply it? Besides having more chances to find trading opportunities, they can catch earlier more substantial reversal of the primary trend, generating an enormous profit.

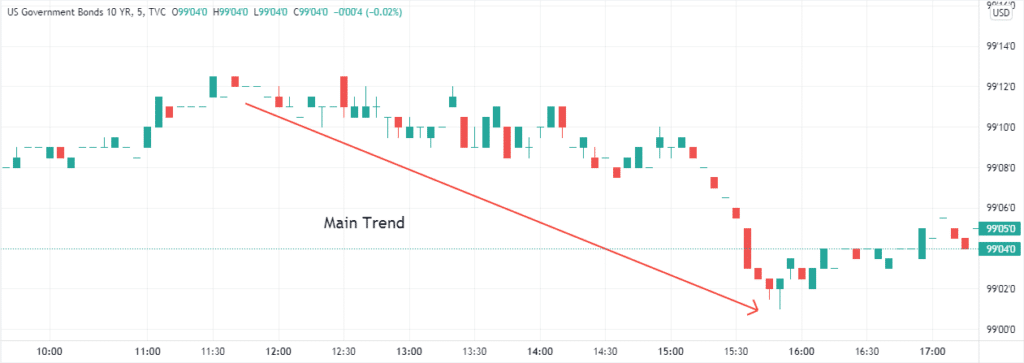

In the example above, in the US government’s ten-year bond, we see how a momentum/swing trading opportunity is generated.

Trend following strategies

Trading with is the most obvious advice any trader can give you. Every trader wishes to predict where the trend is heading so they can get on board. When buying and selling bonds, you want to buy the bond right before the price starts an uptrend and sell it when it starts to fall. Trend strategies are designed with that purpose.

We can see the difference between the two strategies using the same case in the momentum/swing strategy. With the trend-following strategy, the investor doesn’t care about the minor correction in the price and maintains his position until the primary trend is over.

Final thoughts

Bonds are reliable financial instruments that allow an investor to keep their money safe while making a profit. They are essential loans you make to the issuers and where both sides get better deals than the ones you would get from banks.

It would help if you always bought bonds from respected organizations to make sure you get your money back. The returns from bonds are small when compared to other markets. However, you can always trade bonds to get better profits from these trading practices.