Most of us are investing money to be able to afford some of the things we desire later in life or to earn enough money to retire at a convenient age and live a relatively carefree life, as far as our finances go.

But investing in our future has little purpose if we put our assets into companies that damage our planet and make our future lives less comfortable than they could be, right? That is the entire idea around which sustainable investing is revolving. It looks to answer the question: how can I make money and still be a responsible human?

What are sustainable investments?

In simpler terms, sustainable investments are a practice of financially backing the companies that aim to, at least in part, fight against climate change, environmental destruction while, at the same time, promoting corporate responsibility.

As the primary goal of businesses is always to profit, companies have historically competed to see who will come out on top. The more competitive the market got, the more tempting it was for some to break specific rules to get the upper hand over their rivals.

That’s why we’ve heard of so many corporate scandals regarding pollution, fraud, false reporting, and other malpractices. With the investors becoming more aware of the harmful practices, they started to turn to other companies unburdened with criminal investigations and public stigma.

In today’s article, we aim to answer why that is, exactly?

Are sustainable investments viable?

There isn’t one way to determine what sustainable investing means, but the most common approach nowadays is ESG investing. ESG is an acronym, and it stands for environmental, social, and governance. At the same time, these three words are the criteria for deciding if an investment is sustainable.

For a company to be generally considered an ESG investment opportunity, it needs to act responsibly concerning pollution, animal welfare, community engagement, human rights, diversity, and similar aspects.

Tips for investing in sustainable assets

If you want to invest in sustainable assets, we have listed some tips to help you do it right.

- Set up a meeting with your bank’s investing advisor

If you are new to investing, it might not be the best idea to rely solely on reading articles or watching videos before deciding to part with your money. Some banks offer the services of an investment advisor so that you can take advantage of that by scheduling a meeting during which you can lay down the specifics of your case.

- Determine the values you want to be supported

Not all companies are rated equal, and even if the two firms are considered ESG investments, it doesn’t mean that they score the same on the value that comes up first when you think of sustainability.

So if you want to invest in solar power, find a company or a fund specializing in that sort of thing. If human rights are at the top of your list of priorities, invest in a company that gives the same attention.

- Look for the ESG tag

Experts nowadays usually use the ESG factor in their stock analysis. This can save you some time when it comes to reading about the companies and the sustainability of their practices.

- Assess the risk, and determine the maximum loss plan

Like with any other investment, you need to say how much money you can lose and still be on track to achieve your financial goal.

In connection to this, you need to find out how much risk you can bear, both assets-wise and in emotional terms. Make plans ahead, and it will bode you well.

Pros and cons of sustainable investing

It might all sound good, but before investing in any financial asset, you must consider knowing its pros and cons.

Pros

Let’s dive a bit deeper and see some possible pros of sustainable investing.

- It’s a growing sector

The entire sustainable investing field amounted to less than $500 billion just seven years ago. By some estimates, in the next seven years, its market capitalization will reach $1.8 trillion.

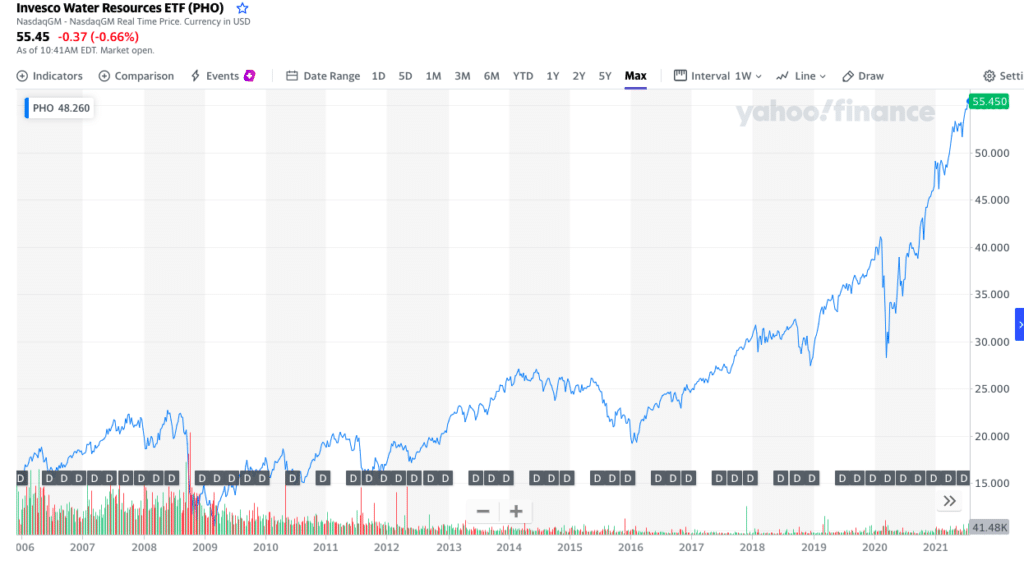

Above is an example of ESG investment. The Invesco Water Resources ETF Fund is on the NASDAQ OMX US Water Index. The NASDAQ OMX US Water Index tracks the performance of US exchange-listed companies that create products to conserve and purify water for homes, businesses, and industries. Here we can see the good returns of the Invesco Water Resources ETF within the last year.

- It’s safer

The fact that the companies you will invest in have to abide by rules and standards makes it less likely for the firm to be involved in a scandal that might bring about a crash for its stocks.

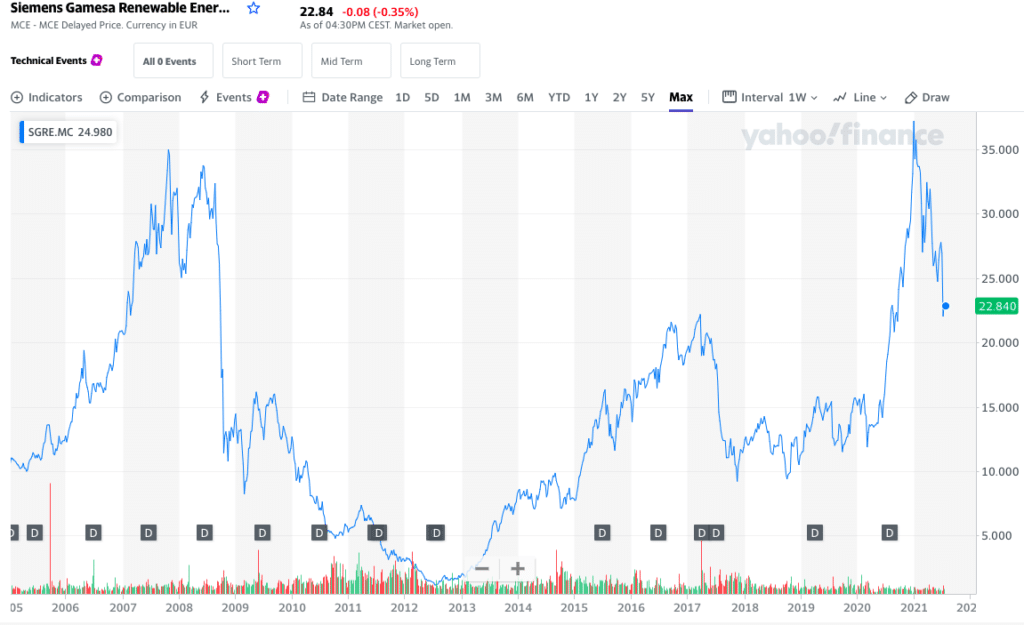

Example of Siemens Gamesa Renewable Energy S.A. — a leader in the renewable energy industry, working to provide the world’s best offshore and onshore wind turbines and services. In the above chart, you can see the ETF showing the general trend.

- It’s a win-win scenario

Investing in companies that care about the environment and the workforce will give more power to the sector itself. In turn, it will mean more investment opportunities for you down the road. As you can see, everybody stands to gain.

Cons:

That being said, there are some potential drawbacks you should consider before pouring all your money into sustainable stocks.

- Fewer options

Unfortunately, if you decide only to buy sustainable stocks or funds, some companies will fall below the cutoff line. And while those firms may not be the most responsible businesses, limiting the number of horses you can bet on poses a challenge.

The diversification of your portfolio will take a hit, even though it is for a great cause, making it easier for investors who are not as righteous to outrun your gains.

- Higher costs

Due to the high demand for sustainable stocks and funds, their price tends to be higher than their regular counterparts. It sounds counterintuitive that you have to pay more for a better option for everyone, but alas, that is our sad reality.

Final thoughts

Sustainable investing is a noble cause, and the field itself will likely grow and widen to other aspects in the future. Jumping on the bandwagon now is a good decision and needs to be made carefully.

We can give you the best advice to treat this read as a starting point and start your research before deciding the best option. That is the best way to make your investing sustainable regarding your industries and prosperity.