According to cryptocurrency enthusiasts, the US dollar will soon become obsolete. Nevertheless, this year’s crypto trading craze has resulted in significant profits for companies facilitating digital currency transactions. Companies are making money, either directly by charging trading fees or selling data, as people try to catch the highest-priced coins on the moon, hoping it doesn’t crash. The velocity of money on planet crypto is much higher. You must have to pay fees if you are an active trader.

Here’s how to keep crypto-coins trading fees from becoming unmanageable.

According to research data, the market value of coins has tripled in less than six months and briefly topped $2.5 trillion in 2021. As a result, a wave of new investors and traders leaped on board the fast-moving bandwagon, leaving behind a revenue trail worth billions for the companies trading the digital coins.

Fees can have a wide range of effects on an investor’s wallet. For example, a typical Bitcoin transaction fee ranged between $4.38 and $62.77 in 2022. The pricing scale for Ethereum and different coins were similar.

Fees for trades and other transactions vary so greatly that your timing and strategy are crucial. Below are a few suggestions to minimize transaction fees.

Top five tips to avoid high fees

Here are a few tips to avoid high crypto trading fees.

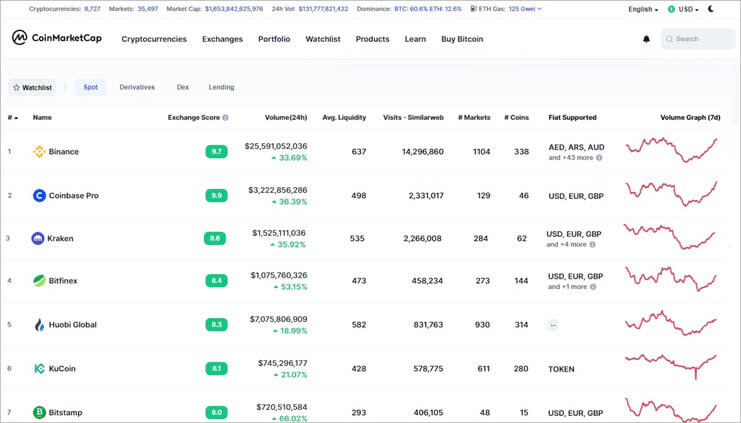

Tip 1. Use an exchange with commission-free trading

Choose a decentralized exchange. The exchanges eliminate the middleman, enabling peer-to-peer crypto swaps with low fees, beyond transaction fees. For example, Uniswap charges 0.3% a flat fee while PancakeSwap charges 0.25%.

Investing app Robinhood recently made cryptocurrency trading commission-free, helping make zero-commission trading familiar in brokerage houses. Cryptocurrency exchanges such as Blockfolio, Digitex, and Lykke, which FTX acquired, offer this.

Users of Phemex’s Premium and Premium Trial accounts get to trade spots for free. In addition, you can make investments in Bitcoin and altcoins without paying commissions at Amplify.

The more prominent cryptocurrency exchanges, such as Coinbase and Binance, assess trading fees for investors, but there are ways to minimize them.

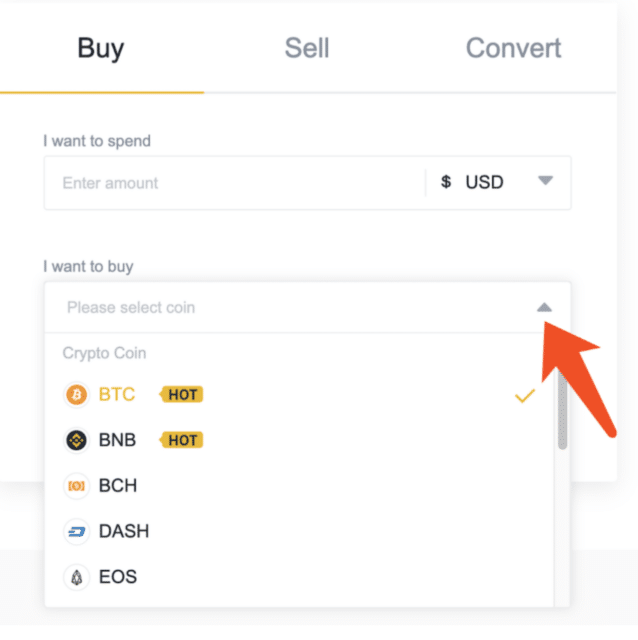

Tip 2. Buying it using coins

For withdrawing cryptocurrency and depositing it into your digital wallet, you may face fees if you liquidate it into fiat currency. By contrast, you’ll be able to trade coins most of the time without paying for them. So use this strategy to cut or eliminate fees for trading coins.

The good Bitcoin point-of-sale system can save you money on transaction fees on credit cards.

There is a flat fee of either 20 or 30 cents for every card transaction. It depends on the type of card used. In other words, customers should be encouraged to use Bitcoin instead of their credit cards. The benefit here is not so much lowering bitcoin transaction fees but lowering credit card fees so you can save money in the end.

Other ways to save money with Bitcoin payments are also available. For example, they remove the risk of common charge-backs when using credit cards. When a cardholder’s bank initiates this forced transaction reversal, money will deplete from their accounts, and, depending on their bank, they may even incur additional fees.

According to IRS law, taxpayers can deduct the costs of acquiring assets on their annual taxes. If, for example, you pay $1 to the network and $15 to the exchange, you can deduct the whole $16 from any capital gains that may result from the trade. Unfortunately, there is no way to remove transfer fees since these do not apply in acquiring cryptocurrencies.

Tip 3. Watch transaction amounts

Many FX exchanges charge a percentage of the traded amount, usually around 0.1%, so if you are executing a $10,000 transaction, you could incur a $1,000 fee. Of course, there are times when flat prices are available, but the larger the transaction, the more you will pay.

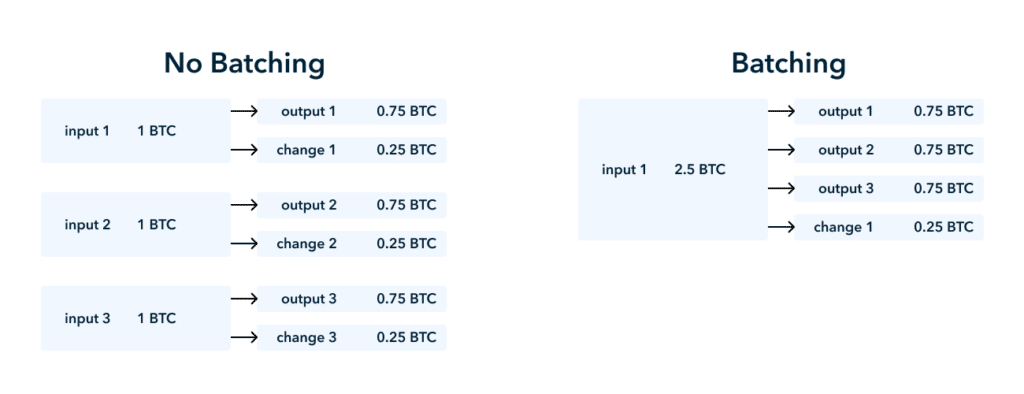

The batching process refers to sending multiple transactions into Bitcoin’s limited blockchain space. As a result, multi-payments can combine into one operation cost- and space-efficient.

Tip 4. Be strategic about your transaction types

Maybe you want to liquidate your investment, but do you need fiat currency? In that case, you may be able to trade your crypto holding for another cryptocurrency investment and exit the holding with minimal fees. Of course, there may also be fees for deposits into your digital wallet and conversions between cryptocurrency and fiat currency.

Batching is a method of reducing your per-transaction fees by aggregating several transactions into one. Many merchants who deal with Bitcoin transactions daily or weekly take this route so they can trade immediate transactions for efficiency. In addition to benefiting you, following this protocol helps keep transaction fees low for all parties.

Tip 5. Offset fees by taking advantage of promotions

Some exchanges provide free coins with their signup offers, so your portfolio balance will be less stingy due to fees.

Check out these exchanges:

- Coinbase is offering $5 in Bitcoin when you sign up.

- If you sign up with Gemini or refer a friend, you’ll get $10.

- If you refer a friend successfully to Voyager, you’ll get $25.

- If you successfully refer a friend to eToro or Celsius, you will receive $50.

- By having at least $100 in your BlockFi account, you can earn Bitcoin payouts.

Maximize your investments by controlling crypto fees

Often, investors focus solely on their return when designing a financial strategy. However, paying attention to the price you pay for investments is equally as important, if not more so. Significantly over time, fees can drain your portfolio very quickly.

There is no exception to this rule when it comes to cryptocurrency. The price of trading crypto is still there, even if no third party such as a brokerage house is involved. Crypto exchanges need to earn money to support their role as crypto networks, document trades, and manage online networks.

Final thoughts

Digital currency investors should be aware of the pitfalls of a 24/7 volatile market. Because crypto traders are well aware that their next investment decision could happen at any time, they must keep their knowledge of fees up to date. First, develop a plan to buy, sell, and store the cryptocurrency you intend to use. Then, revisit that plan as new developments will likely emerge in the space.