Buying your first home may be exciting, but it can also be expensive. At the same time, getting started at 25, you can save enough for a house within 7-10 years.

Understanding all of the expenditures of house ownership makes it easier to spot places where you may save money. First-time buyers must be aware of and plan for unexpected expenses. Learn how to save costs before buying a home that doesn’t affect your budget by reading the following steps.

Best money-saving strategies

Most certainly, your house is the most valuable thing you will ever possess. Most people are becoming aware of this, but few first-time buyers know the increasing fees and continuing expenses associated with owning a property.

There are many basic yet smart steps to save money and make house buying less expensive.

Step 1. Purchase in a promising area

Buying close, but not in, a popular area is one of the finest investment options. Sometimes it’s not feasible or cheap to buy in the most desirable places, but looking close may be the best option.

You may frequently save 20-30% off the buying price. Most significantly, appreciation rates will be faster. While the ease of a ready-to-move-in home may appear tempting, these properties are more costly. Before purchasing an under-construction home, look into the developer’s RERA registration and track record. Select properties in projects where the developer has obtained title insurance.

Consider buying a property in a trendy neighborhood that also needs some renovation to save even more money. Then you may upgrade and renovate a little at a time.

Step 2. Never use standard commission

Do not accept the first offer made by a realtor or developer. Always inquire about alternate options, the best price, and the furnishings and amenities that will be available. However, keep in mind that the figure you pick should be reasonable. You risk losing control of the property if you don’t.

Using a reputable and competent real estate agent who is well here in the area will help you save time and money. This is especially important for first-time buyers since a knowledgeable real estate agent can walk you through the process and help you identify ways to save money. In addition, family, friends, and locals may frequently recommend reputable brokers as an online real estate site.

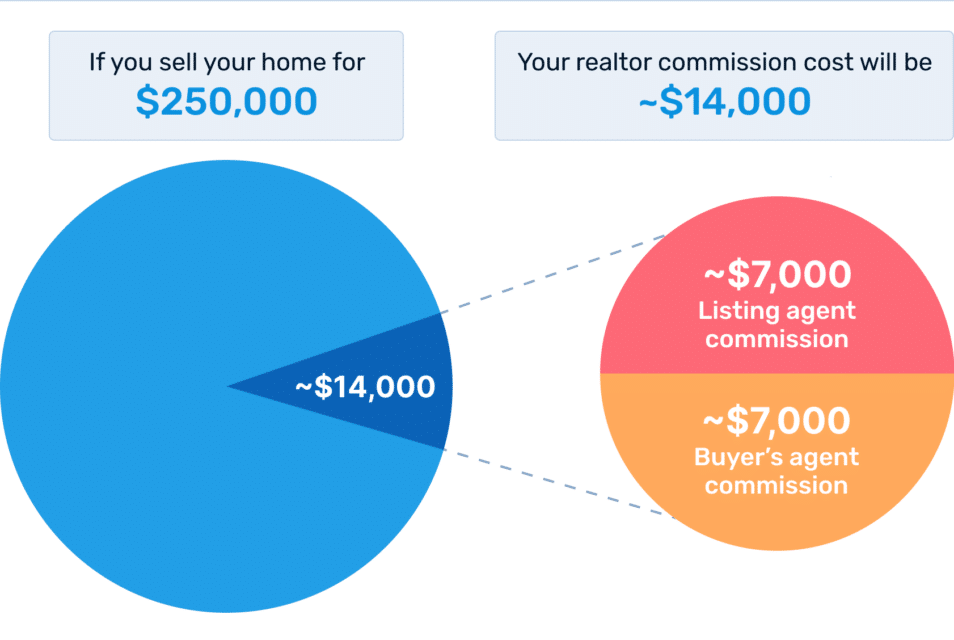

Real estate brokers go above and above to assist their customers in choosing the desired home, negotiating a fair price, and navigating the legal requirements of closing. Unfortunately, they often get a 3% fee ($9,000 on a $300,000 home) in exchange. However, there are strategies to save money in this area.

One interesting alternative is to use a service like SimpleShowing, which returns the buyer 1.5 percent of the purchase price at the time of closing. This might result in considerable savings depending on the size of the property.

Step 3. Agree on the closing costs

Closing expenses might rapidly add up if you pay for everything yourself. Common closing costs include attorney fees, interest, lender fees, title fees, and appraisals. Many closing costs are, thankfully, negotiable. Negotiate with the seller to cover a portion, if not all, of the closing fees.

If you’re not careful, you’ll get stuck with closing costs. According to Zillow, closing expenses will cost the average buyer between 2% and 5% of the home’s purchase price. On a $200,000 home, that’s $4,000 to $10,000.

Closing costs must be paid for the deal to be completed. They may vary substantially due to differences in state and local laws and taxes, but they usually range from 2% to 5% of the home’s value.

Loan fees, evaluations, title fees, attorney fees, escrow fees, interest, termite inspections, radon tests, and other expenditures are included in closing costs. The majority of buyers are unaware that they may negotiate many of these costs. You might be able to save a few thousand dollars pretty quickly if you do this.

Step 4. Get rid of private mortgage insurance (PMI)

Private mortgage insurance is nearly always required if you borrow more than 80% of a house (PMI). This will usually cost you 0.5-1% of the overall loan balance (per year). Therefore, you should avoid having to pay it if possible.

A 20% down payment is the most apparent method to avoid paying for PMI. Then, multiply your down payment by five to calculate the greatest amount you can pay while avoiding PMI.

Step 5. Compare home insurance prices

You may check about and compare costs for house insurance just as you do for any other form of insurance, such as life or car. While each home insurance plan is distinct, you might be surprised at how much pricing variation there is. Logically conclude, you’re obtaining enough already to secure your cash.

In recent years, obtaining a home loan has become increasingly straightforward, with virtually every bank offering cheap rates and attractive incentives.

However, you must conduct your research and choose the bank with the best interest rate. According to experts, many banks provide reduced interest rates to female customers. This might be anything between 0.01 and 0.15 percent.

Final thoughts

Buying a property demands a significant financial outlay. Consequently, if you plan ahead of time and work hard, you may save a lot of money when purchasing a house in 2022. If you have other obligations, such as a car loan, student loans, or credit cards, you may be able to pay less toward your mortgage. Consider paying off some of your debt first since this will not only alleviate some of your financial stress but will also help you get a better mortgage rate.