We now know that cryptos are as common as fiat currencies as a medium of exchange and transactions. All exchanges take place over the internet as digital assets or tokens, which hold a lot of value. Moreover, all of these transactions occur in the blockchain, where they are tracked.

The cryptocurrency world is decentralized, and there is no one supreme power heading it. Another fact about cryptos is that they are highly volatile. You can either gain a hefty amount or lose it because of the drastic upward and downward price movements.

You can never be sure when crypto will gain value; you can merely predict it. Some aspects impact crypto and its importance, which can benefit all traders. We will discuss this to shed light on how cryptos gain value.

What determines the value for crypto?

Many factors determine what the value of crypto will be. We will discuss this one by one.

Supply and demand

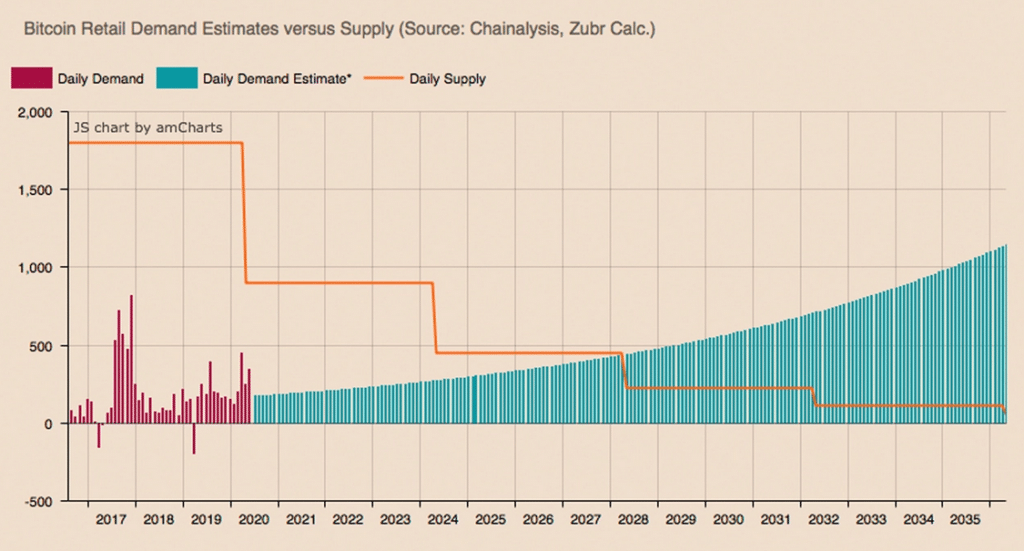

Like a regular physical monetary economy, crypto markets are also based on supply and demand. Therefore, the price will likely go down if the supply increases beyond the demand. Crypto is no different and follows the same rule.

The converse is also true:

- When demand increases beyond the supply

- The value of crypto rises with it

There are several ways that supply and demand can increase. For example, demand can increase as the awareness and the use of crypto increase.

Generally, the supply of Bitcoins remains the same as a fixed number is produced through token minting. However, if a token is “burned,” it is sent back to the blockchain. Here, the Bitcoin increases by a known amount.

Cost of production

We just understood that mining is how new tokens are produced. A computer is utilized to verify the upcoming block on the blockchain. To verify a block, you need extensive work to be done. A computer and other costly paraphernalia are also required to ensure the blockchain works seamlessly.

The investments in this entire process increase as the competition for different cryptos increases. So, as the mining costs increase, the value of crypto increases. Otherwise, miners will not be able to recover the costs. So, an increase in the cost of production of crypto increases the value of cryptocurrency.

Competition

There is not a particular type of crypto in the world. In the early days of crypto, there were not many types available. This has changed remarkably now. In fact, there may be countless ones in existence, many yet to come into the limelight.

The passageway to entry into the crypto market is not that easy. Still, several crypto users can determine what enters the market, what stays, or what leaves.

Competition can both be beneficial and also significantly burdensome. For example, if a new token is made on the blockchain and gains momentum, it is only a matter of time to steal the value of existing tokens – increasing its value and pushing the incumbent’s price down.

The good thing is that crypto, particularly Bitcoin, has not depreciated but has only increased with growing competition.

Rules and regulations

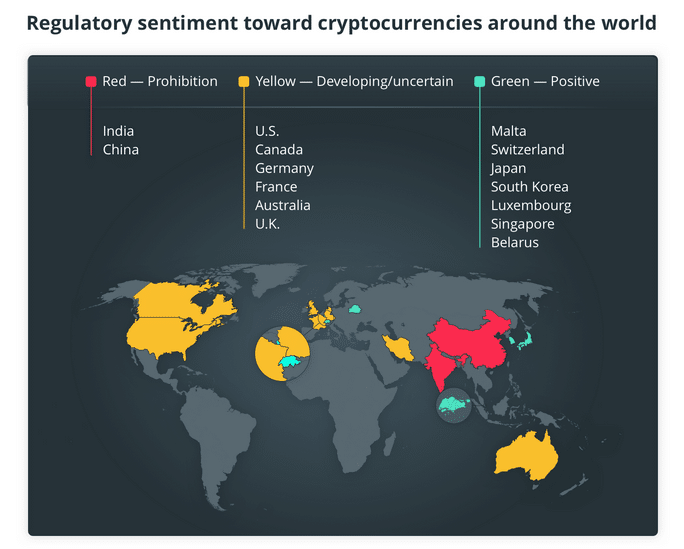

One of the most under-looked factors of what drives crypto is the rules and legalities of the market. Unfortunately, there has always been a misunderstanding about who should regulate the crypto world.

The Securities and Exchange Commission (SEC) believes that crypto assets are like bonds and stocks. In contrast, Commodity Futures Trading Commission (CFTC) does not give them a value beyond coffee and gold.

There needs to be a fixed regulatory body that looks over crypto transactions and makes the process easier for both buyers and sellers. A proper authority can allow investors to utilize the short-term position, resulting in better pricing of crypto and a reduction in volatility. But, of course, regulations are not always advantageous.

Legalities can efficiently work in the disfavor of crypto investments, ultimately causing their value to decrease.

Internal governance

Although crypto is decentralized and there are no static rules to be followed, some tokens can control how they are mined or used. These are called governance tokens. They are used to provide holders with a say in the future of a project. There has to be some agreement between stakeholders before deciding that a governance token can make changes. This is yet another reason why crypto may increase in value.

For crypto value to increase, stable governance is advised where it is comparatively more difficult to change the way tokens are mined, used, or, consequently, priced.

What are the best crypto gainers of 2022 so far?

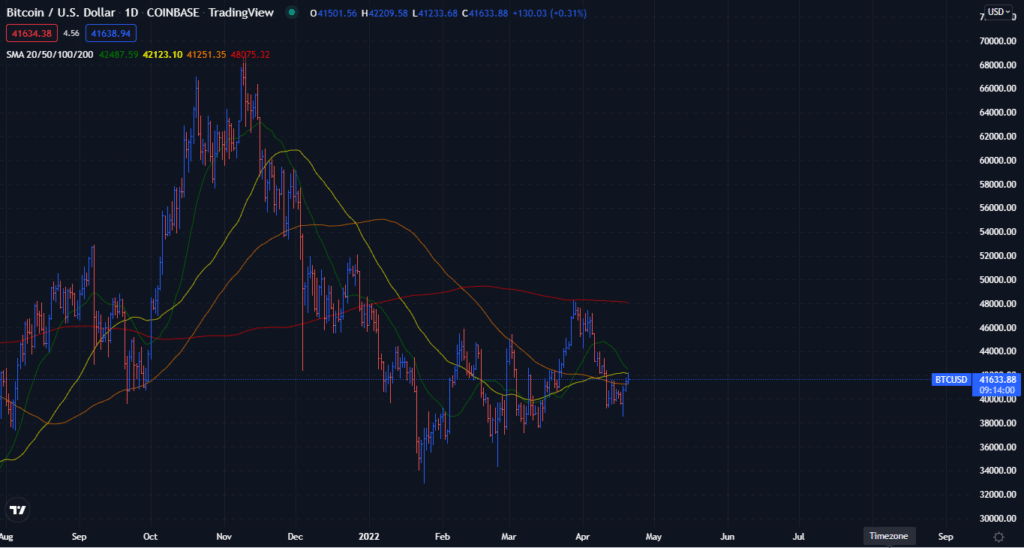

With the pandemic seemingly becoming a thing of the past, 2022 initiated uncontrolled volatility in the crypto markets. A majority of this volatility has been bearish. Some currencies have taken a dip, while others promise good returns this year. For example, Bitcoin is down by more than 12%, but it still holds a market cap of $867 billion with its popularity.

One reason behind this is the ongoing war between Russia and Ukraine. Some of the currencies harbingering healthy returns include:

- Toncoin

- Dogecoin

- Swarm City

- Chain

- XRP

DOGE and XRP lie within the top ten non-stable coins, which have remained on top consistently. XRP has a market cap of $82 billion, and DOGE has one of $18.4 billion. EOS and Moonbeam are the worst-performing cryptos. While the top-performing includes Decred. Terra is among the top stable currencies with a market cap of $78.9 billion.

Final thoughts

Crypto values are ever-changing. You never know when it will increase, when it decreases. We went over five factors that affect this fluctuation in crypto value. Several other aspects affect crypto, but these are the most relevant. Remember to have an eagle’s eye on the production, supply, demand, regulations, etc., to ascertain when the value of crypto increases.