In 2020, the worldwide debt rose by $24 trillion to strike an all-time high of $281 trillion. It is almost more than 3.5 times the worldwide GDP. In addition to that debt imbalance, computer parts, raw materials, and shipping have all gone into difficulties and have become very costly. The products made out of these materials are more expensive.

A lot of the largest banks around the world were desperately hunting for cryptos right after the recent crypto blast. The banks found cryptos as the best way out in terms of securing their money along with hedging as opposed to inflation. According to what history has exposed, the banks must not be the ones worrying over their savings. Moreover, the destructive inflationary rates and the debt to GDP ratios are staggering in expanded financial adversity.

Why is it worth investing in cryptocurrency?

As per the historical caliber, crypto has been an extraordinary investment. However, there is an inherent risk associated with crypto investment which is relatively riskier than other assets. But Bitcoin is targeting alternate gold as value storing, and on the other hand, Ethereum may potentially play havoc with the entire industry of the financial services. However, crypto has enormous ambition and excellent growth potential compared to other investable assets.

How does it work?

Crypto is trafficking from one person to another on the web regardless of any intermediary such as a government or bank. However, cryptocurrencies operate on the blockchain, a shared public ledger. It keeps track of all transactions and updates made by currency holders. Moreover, crypto units are built by the mining process that involves computational power to resolve complex mathematical issues while generating the coins.

How to start?

People are sometimes dumbfounded as they get confused about how to start investing in cryptocurrency. However, it just takes three steps to start investing in crypto. As the first step, you have to decide on which platform you want to use, which usually can be any conventional broker or any cryptocurrency exchange.

Afterward, you have to fund the account to start trading. You may use fiat currencies to buy crypto since most of the platform accepts it. Then you may place an order through the platform offered by your broker or exchange. Finally, if you are keen to buy the crypto, select “buy,” then select the order type and enter the number that shows how much you want to buy and confirm the order. In terms of ‘‘sell’’ order, it will apply the same procedure.

Ethereum (ETH)

52-week range: $2,000-$4,800

1-year price change: 28.67%

Forecast 2022: $5,000

Ethereum is the second most famous cryptocurrency, while Bitcoin is the first. However, Ethereum is the hosting network of smart contracts and dApps. Despite using the same mechanism, Ethereum is a bit distinct and more complicated. The complexity since Ethereum’s users is allowed to mine their coins. Mining means people utilize their computers to resolve complex mathematical issues along with ensuring new crypto transactions are accurate that is added up to the blockchain. These people are called miners, and they get paid by the Ether coins. It is currently in the PoW network but is planning to switch to PoS.

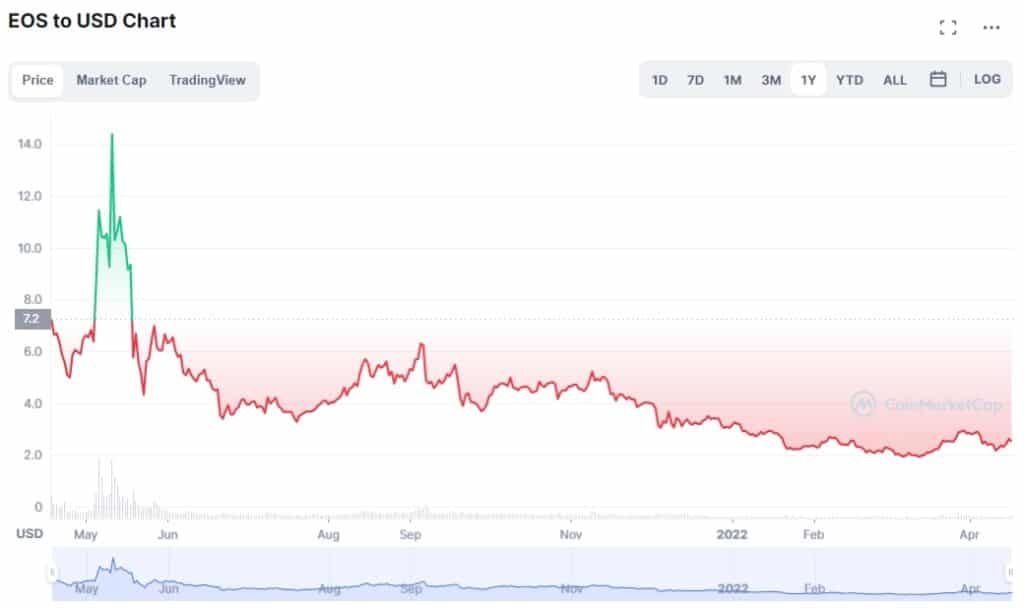

EOS (EOS)

52-week range: $1.80-$14.00

1-year price change: -64.17%

Forecast 2022: $10.00

Creating blockchain is complicated; therefore, it is difficult for crypto projects to get benefits. Blockchain technology is very time-consuming and requires a vast amount of scientific knowledge to set it up. EOS linchpins create the procedure of utilizing blockchain technology as efficiently and uncomplicated as possible. EOS network utilizes a delegated proof-of-stake or dPoS consensus framework. The dPoS mechanism uses delegates for it to be in control of the protocol.

However, 1.02 billion tokens are supplied, with 954 million in circulation. Also, if any proposal gets passed by the EOS community, EOS coins get burned. Before approximately $132 million, EOS tokens were burned back in 2020, and by the end of the year, 0.8% of their supply was deflated to curbing inflation.

Binance Coin (BNB)

52-week range: $260-$680

1-year price change: -13.33%

Forecast 2022: $700

Binance is the most significant global exchange for crypto that also provides a great variety of trading components. Its BNB started at first on the network of Ethereum as an ERC-20 token. It was transferred to the Binance Smart Chain, its network of proof of stake authority (PoSA).

Moreover, around 170,532,785 BNB coins are supplied; more than 90% of the coins are circulated. BNB uses the burning process to ensure its power and sustainability. It permanently burns 20% of its total profits every three months until it’s circulated coins lower to 50%. However, BNB does this because it is a vital system that may offer a higher range of prices to investors.

Upsides and downsides

| Upsides | Downsides |

| Investing in crypto may allow traders to generate a higher profit potential. | The crypto market is considered a terrifically volatile investment. |

| Since crypto is based on blockchain technology, providing a relatively secured network. | The concept of crypto is quite complex to comprehend and takes a lot of time. |

| Being a 24/7 active market, crypto investment leads the traders to continuous profit gain. | It may be the best-suited investment for the short term, not in the long term. |

Final thoughts

Finally, if you are interested in crypto, you must be careful about its specific risks before investing. Earning a generous profit relies upon the acceptability of your trading objectives and risk tolerance. However, crypto does have the potential for remarkable profit gain, yet there is the risk of a significant downturn or irrecoverable loss in the fundamental invested amount.