Amazon sells virtually anything that consumers may need, making it a leader in the retail industry. As such, the company is likely to see continuous growth into the distant future. If you look to add Amazon to your investment portfolio, that can be a good decision. At the time of this post, Amazon is among the top five most significant stocks in terms of the market cap based on companiesmarketcap.com listing.

Apart from selling everything, Amazon delivers orders at your doorstep as quickly as possible. This way, you do not have to go out of your domicile, allowing you to do the things that matter. With its large customer base, Amazon is likely here to stay.

In this article, let us delve deeper into why Amazon stock is a good investment, how to invest, and how to handle risk. We will also outline the pros and cons of investing in this stock.

Why invest in Amazon stock?

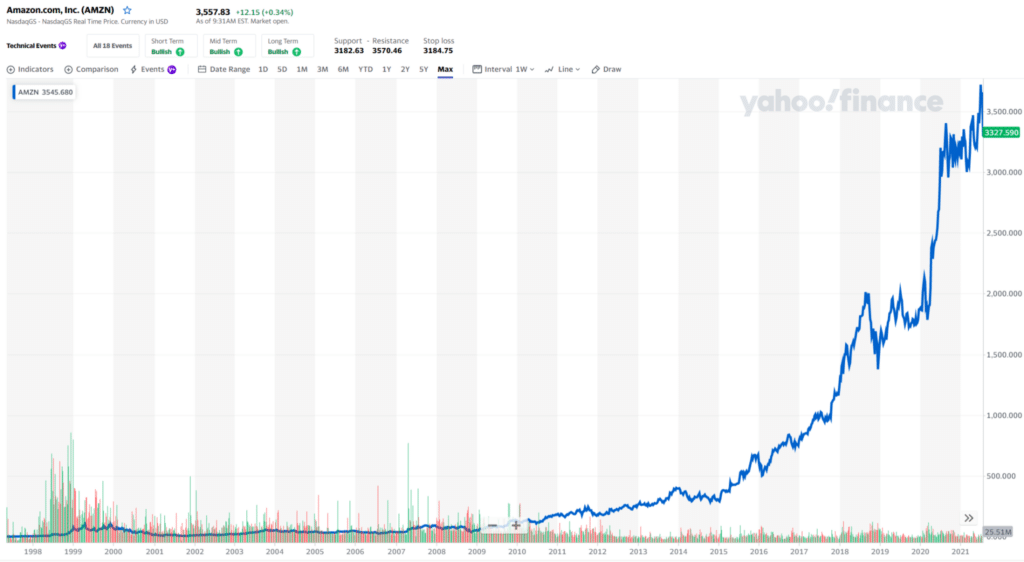

The Amazon stock entered the listing of Nasdaq in 1997. Financial analysts predict the growth of 23 percent in Amazon’s revenue by the end of 2021. They expect it to grow by 18 percent year after year, starting the year 2022.

One reason for the optimistic forecast is Amazon’s past investments. The company spent money to maintain its leading stature in the industry. While the company’s earnings have slowed down a bit in recent years, the balance sheet still looks good. The company invested in infrastructure to continue its forward march in the years to come.

How does it work?

If you are a regular customer of Amazon, you will feel at ease buying stuff from the company. However, buying shares of this stock is a different matter. You must know more than a regular customer would about the business.

It is not a good idea to base your investment decision on the stock’s current price or past performance. Instead, you have to dig deeper to understand the value of Amazon as an investment. Some of the things you have to know are revenue, management, earnings, net income, competition, plans, and more.

These are all stock factors, though. You have to look at your circumstances as well as an investor. Think of your existing investments, current financial status, and investment objectives.

How to start?

There are steps you must take to start investing in Amazon. You would follow the same steps when buying any stock out there. These steps are outlined below:

- Find a broker

You can go for a brick-and-mortar broker, or you can opt for an online broker. If you seek convenience, an online broker is a way to go. Whatever option you choose, consider the pros and cons, services provided, costs involved, and your overall investment objectives.

- Open an account

If you select a traditional broker, you need to step out of your front door and walk into the broker’s office. If you choose an online broker, you can do this step with no sweat. You must provide the required information to verify your account.

- Fund your account

Once your account is verified, the next step is to put money into your account. You have several options when funding an account. Such options include savings, checking, wire transfer, check deposit, retirement plan rollover, paper stock certificates, etc.

- Execute your order

Decide how many Amazon shares or a fraction thereof that you want to buy. To buy shares, you have to know the current stock price. To get fractional shares, you need to define the dollar amount. Then you are ready to execute your order using either a limit or market order.

How to manage risk?

Any type of investing involves risks. To manage risks related to your Amazon purchase, do the following:

- Work with a reputable broker only.

- Use multiple brokers if you have the means.

- Invest in multiple assets to spread the risk across various instruments.

Top five easy ways to invest in Amazon stocks

You can use various platforms when buying stocks, such as Amazon. Here we list down five mobile applications that will allow you to buy Amazon conveniently.

No. 1: Cash App

Cash App allows you to buy stock, crypto, ETF, etc. Plus, this app offers fractional shares. This will allow you to invest in stocks with as little as $1 and with no commissions. You may configure the app to automate your investing activity so that your Bitcoin and stock holdings grow over time.

No. 2: Robinhood

This platform allows ordinary investors to get blue-chip companies for their portfolios at affordable prices. This app also allows fractional share investing. It has more than 7,000 stocks on the platform, including Amazon. The app looks like the image shown below.

No. 3: M1 Finance

Like Cash App and Robinhood, M1 Finance provides fractional shares. The good thing is that it does not charge transaction fees and commissions, and there is no minimum deposit required. It contains more than 6,000 assets for you to choose from.

No. 4: Stash

Stash is accessible both online and mobile. With a capital of at least $5, you will have access to more than 3,000 stocks. Plus, new accounts get a $5 opening bonus. The downside is that each of the three available accounts involves a subscription fee from $1 to $9 a month.

No. 5: Webull

It is among the top stock investing apps of today. It gained an overall rating of 4.7 out of five stars from youngandtheinvested.com. With this platform, you have three choices in terms of trading: desktop, mobile, and online. The mobile platform looks like the image below. What makes Webull a cool investing platform is the zero commission for stocks, options, and ETFs.

Upsides and downsides of Amazon stock investing

| Upsides | Downsides |

| A dynamic leader (i.e., Jeff Bezos) directs the operations of the company. This leader steers the company in a clear direction. | This stock is out of reach for ordinary investors. At present, the share price of Amazon is 3,525.15 USD. |

| The company is always ahead of the competition, and it can disrupt any industry where it does business. | One man runs the company. Without an able successor, the company could face challenges. |

| Amazon runs the AWS division that serves companies, individuals, and governments. This business segment was able to generate huge profits for the company year after year. | The price of Amazon is already too high. Regulators are looking to step in. |

Final thoughts

Carefully consider the pros and cons discussed above before you decide to buy Amazon. The outrageous share price must make you think twice.

Can you still afford this stock? If not, you might be better off buying cheaper stocks. Alternatively, you can buy fractional shares of this stock.

If you get full shares of this stock, it is always good to diversify with various assets and multiple providers.