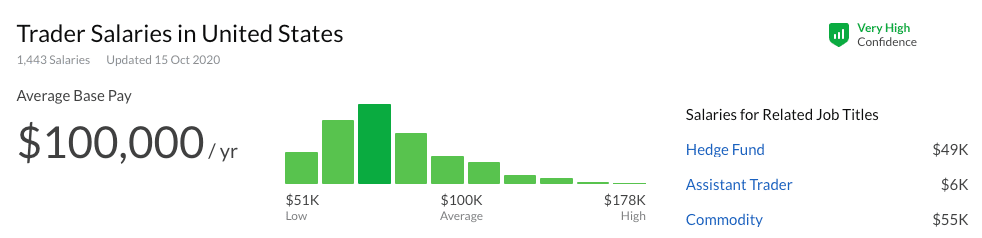

Salary consists of basic pay plus a bonus depending on the number of years you have traded with your business and the trading earnings you have achieved during the bonus period. The pay scale fluctuates according to your expertise and the business.

As per the US Bureau of Labor Statistics’ 2019 study, the median annual compensation for commodity and currency traders is $62,270, with the top 10% earning a yearly salary of $204,130. The median wage, according to the salary comparison website Payscale, is $77 593.

Company revenue and trade volume might have a significant impact on your salary. For example, a forex trader’s pay at a big trading firm may consist of a basic wage of $100,000 to $120,000, with incentives pushing their total compensation to $150,000 to $250,000 or more. Scroll down to find out more about the salaries and incomes of traders and how to become rich with the FX platform.

Salary statistics

Salary consists of basic pay plus a bonus depending on the number of years you have traded with your business and the trading earnings during the bonus period. The pay scale varies according to your expertise and the business.

Trader salaries can range from broker to broker depending on their skill level, record size, the many techniques they have in their weapons arsenal, and risk to the corporation’s plans.

According to the US Bureau of Labor Statistics’ 2019 study, the overall annual pay for commodity and currency traders is $62,270, with the top 10% earning a yearly salary of $204,130. The average earnings, according to the salary comparison website Payscale, is $77 593. So corporate revenue and trade volume might have a significant impact on your reward.

Trader’s pay at a big trading firm may consist of a basic wage of $100,000 to $120,000, with extras increasing their total compensation to $150,000 to $250,000 or more. Furthermore, the fluctuation of commodities on any given day and the number of trades; stated, the traders will make more if they invest extra.

Is it possible to become wealthy through FX trading?

Making a profit is the overwhelming majority’s fantasy, and it’s obvious that this is maybe the most well-known research among new forex brokers who need to know their possibilities of getting rich quickly with trading.

The short answer is yes, and you can get wealthy by trading FX or CFDs. First, however, you must understand that trading is not a pyramid business. Instead, trading is a skill that, like most others, takes substantial commitment, patience, tenacity, and knowledge to acquire and develop.

What is the risk of profiting from FX trading?

In reality, virtual investing with a trading account is simple but risky. As an FX trader, the cost of managing funds is specified as one of four major risks that may result from the above.

Forestry traders use the capital of one province to back a country’s currency. Therefore, changes in the cost-effective system of both currencies are likely to impact your profits if you go on a foreign visit.

When you aren’t entirely safe, the market values of both currencies might shift. It may result in a loss of money due to currency fluctuations. When you purchase a currency, its value concerning cash rises.

Retail trader vs. prop trader salaries

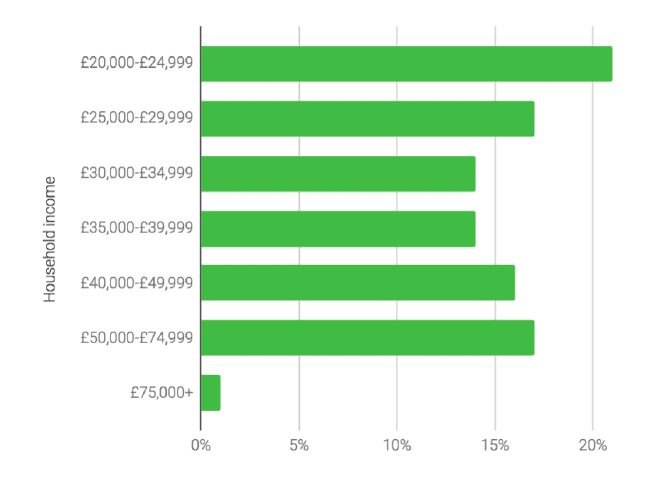

Before discussing the various pay scales for traders, it is important to note several paths to a successful career trader. They are generally classified into two types: working for an organization and working for oneself.

Working for an organization

Suppose you work for a firm (such as a hedge fund or investment bank) as a day trader, hedge fund manager, or quant trader. In that case, you are an employee who gets paid a base trader salary and a commission depending on achievement.

Self-employed trader

Instead of being paid a salary as an independent FX trader, stock trader, or commodities trader, you would trade and invest your money and pay yourself with the profits from your trading.

You are investing your capital at risk, which may result in increased stress. In addition, there is less safety since you cannot automatically rely on the same basic pay provided each month, specifically if you have a difficult month.

There is less built-in structure and assistance than with a corporation — while there are several educational materials available for traders, you will need to seek them out yourself rather than having them delivered to you. To increase your trading success, you will need to locate or create your tools.

Upsides and downsides

| Upsides | Downsides |

| •You are not putting your money in danger when trading, which helps reduce some of the stress. | •If you don’t reach the company’s profit goals, you’ll almost certainly face extra regulations, limitations, and scrutiny. |

| •There is scope for improvement, which means you may work up the ranks to handle higher-value customers’ or more clients’ assets. | •There is less availability — while television and movies portray a trader’s position as attractive, it is still normal employment with duties that frequently exceed 9 to 5 hours. |

| •You have a steady paycheck while working, and depending on the firm and local standards and procedures, you may also be eligible for health or pension payments. | •You may have to deal with office politics or unpleasant clients. |

Final thoughts

The typical yearly pay for traders hired by firms, such as hedge funds and investment banks, is approximately $90,000 per year, plus bonuses. However, this may grow substantially as a trader gains experience and their performance develops. Some traders who deal with the market with their own money will be paid based on their average monthly gains and their beginning investment. The more their beginning capital and monthly profits, the greater their earnings.

If you still want to use trading as a career, you must start it with proper safeguards. You must limit your leverage, keep your stop-losses tight and use a highly reputable broker.