Nowadays, thousands of people live and profit from FX trading from their computers without even getting out of their homes. Opening an FX trading account is a simple process that allows many people worldwide to have a second income by spending just a few hours in front of their computer. Many even become so successful that they are dedicated entirely to this activity.

The FX market is the biggest, and it has room for everyone to profit from it. With discipline and study, you can invest in forex and start making the profits your current job can’t give you. Read on because here we will explain to you the best ways to invest in the FX.

What is investing in foreign currency?

Investing in FX is trading one currency for an equivalent amount of other currency and taking advantage of the fluctuation in price between the two. For example, I own $1,000, and the current price of one euro is $1.10. If I have reasons to think that the price of the EUR compared to the USD will increase, I will exchange my $1,000 to get the equivalent amount of euros 1,000USD @ 1.1 EUR/USD = €909,09.

Then, once the price of one euro increases, let’s say to 1.2 EUR/USD when I change currencies again, I will get 909,09USD @ 1.2 EUR/USD = $1,090,90, which would leave me with a $90,90 profit.

What to know before you invest in FX

It all sounds terrific and straightforward so far, but the reality is that most traders end up losing money. It is estimated that only 5% of traders profit from the FX. It gets even worse because that profit doesn’t mean that you are successful. You are technically gaining profits if you make $1, but that doesn’t mean you’re successful. So, the percentage of what we could consider successful traders is even lower.

Now, this is no matter of luck or anything like that. We know the difference between good and bad traders. So the first step to start in the trading world is preparing yourself. This is a sum zero game, so what you make, another trader will be losing. That means that you are competing with traders worldwide, and some of them are professionals from Wall Street.

So, many factors and players make the forex equation. By understanding these concepts and how the elements interact with each other, you’ll have a better chance of succeeding at trading, or at least you may avoid being a part of the 95% losing money.

Steps to invest in a foreign currency

There is not only one way of investing in trading. The traditional way is explained above, where you exchange currencies directly and profit from them. But, in reality, every transaction that involves different currencies can be classified as a way of FX trading. Let’s see some of the better ways of participating in this market.

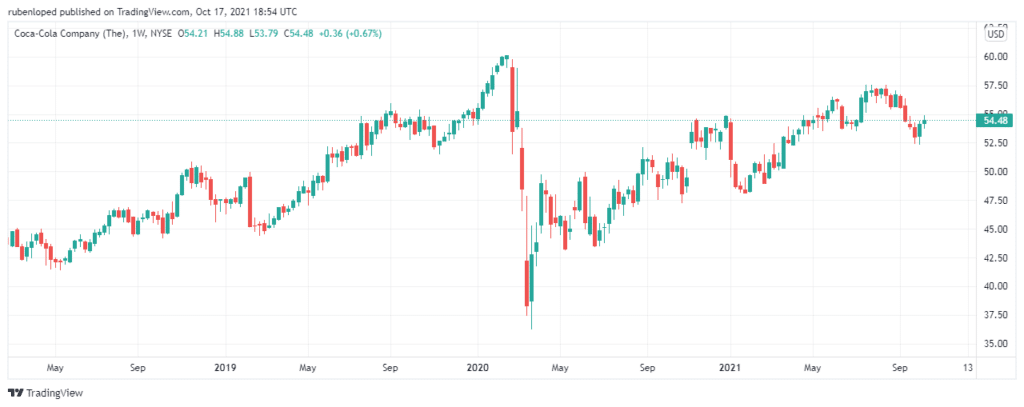

Step 1. The stock of companies with multinational operations

Large companies like PepsiCo, Coca-Cola, McDonald’s, or Apple are present in many countries. When these companies do businesses outside of their own country, they sell their products or services in the local currency. When that money comes back to the company’s headquarters, they need to exchange the currency to USD, for example.

By the time they make the exchange, the relation between the two coins may have changed. That difference in prices can result in a profit or loss for the company. That way, by investing in companies with operations in other countries, you are indirectly investing in FX.

Step 2. Foreign currency ETFs

If you don’t feel ready to trade yourself, ETFs are a good option. Investing in funds allows you to put the money in multiple currencies, and operations are handled by a team of experts on your behalf rather than by you.

Step 3. Foreign bond funds

These funds allow you to invest in different bonds around the world. The principle is the same as traditional trading. The difference here is that investing in a bond is a loan you make to an institution. You will get interested in that loan. Those interests will be the currency of the country in which the institution is established.

So, what you seek when investing in foreign bond funds is profit from the interest. Also, if the country’s coin increases its value, you’ll be making profits again over your principal and your goods when you trade that foreign currency to your local coin.

Step 4. Foreign CDS and savings accounts

Similar to the principle behind foreign bond funds, it is behind investing in foreign CDs and saving accounts. The big difference is that putting your money in CDs is less risky than giving them to organizations. With this type of investment, you are also seeking to get interested in the money you deposit to later profit from the difference in the price of the foreign currency and your base currency.

Step 5. Copy-trading

It is an activity many platforms allow you to do. For example, if you want to invest in FX, but you don’t want to be on your computer, or maybe you are not sure about your call, you can copy the operations of other traders and make the same profits (or losses) as they.

To do this, make sure your broker offers you this service and carefully choose the trader you want to follow.

Upsides and downsides

Before you enter this market, you need to be aware of its pros and cons. First, let’s see the most relevant upside and downsides.

| Upsides | Downsides |

| Minimum investment In contrast to options, stocks, and ETFs, trading FX requires less money than those markets. | Risk We have already established that trading is a risky investment to make. Most traders end up losing money. So before you start trading, you need to test your strategies in demo accounts and keep your plan. |

| Liquidity $6.6 trillion is up to trade in FX. It is very unlikely that you’ll be stuck in a position because no one is willing to sell at least the most popular pairs. | Leverage Often taken as an advantage, leverage could multiply your losses. With the wrong amount of margin as a beginner, you could be out of money in no time. |

| Always running The FX market is running 24 hours a day. Therefore, you can trade whenever you want. However, the beginning of the session in different countries affects the volume and the volatility of some pairs. | Compete against big players As a small trader, you don’t have the possibility of turning the market in your favor. Instead, you want to guess where the institutional traders are going and follow their lead to profit with them. |

Final thoughts

Forex trading is a great place to invest. However, there are some markets where it is easier to start trading. In trading decisions, many factors are involved, including all kinds of fundamental and technical analysis.

If you want to start trading, you need to know that this is a career like any other, and you need some time to prepare yourself. Try demo accounts before you start investing real money and only trade once you have a proven strategy.