Nowadays, many companies have prepared 401(k) plans by which they create retirement plans for their employees. Usually, a small amount of your paycheck with a tiny matching fund incentive provided by the company is allocated to your retirement account.

You are charged with managing the placement of these funds into an offering of investment products. Contributing to your 401k account, you can have up to $2million at the age of 65.

Many of us want to learn the basic foundation of 401(k) plans to manage our funds with maximum authority and ease. Using the correct and accurate principles in place, you will make the decisions that can help you enhance your financial position.

Reading on, you will find five essential tips to manage your 401(k) account. If you want a robo advisor to manage your account, skip right to #5 and learn how Blooom helps you diversify your investment mix.

Tip 1: Increase 1-6% now, then continue to an annual 1% increase

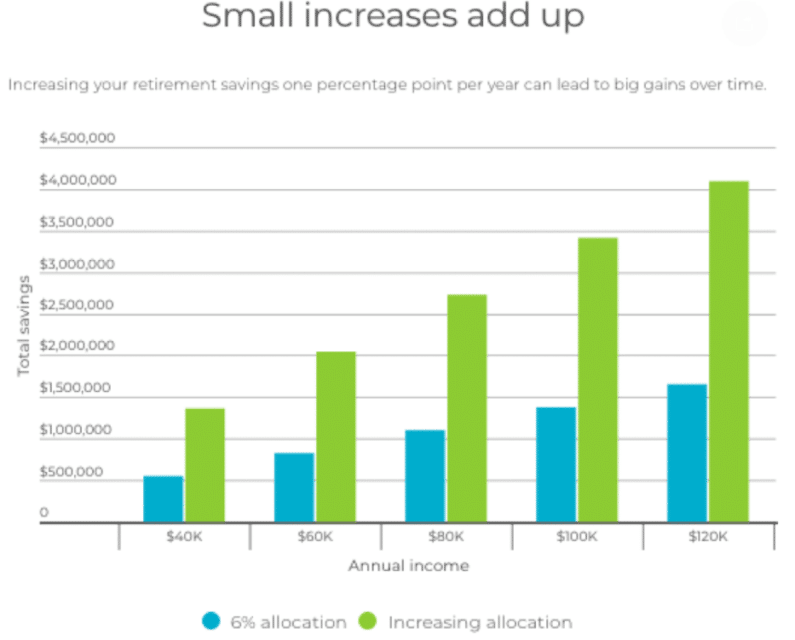

It would help if you took immediate action on increasing the contribution between 1-5%. If you make a 1% contribution, the change will be noticed minimally in your paycheck but significantly impact your account portfolio with time. With a simple example, you will find out how it works.

Suppose you are 25 years old, earn about $60,000 per year, and get bi-weekly. If your company enrolls you in the 401(k) procedure with a 5% contribution rate, they also match dollar-for-dollar up to 3%.

You are paying 5% of your yearly income, i.e., 60,000, which is almost $3000 per year, or you can say $115 per paycheck since your 401(k) contributions are pre-tax. Now, if you increase your contribution to 6%, you have to pay $23 per paycheck, and it will hardly affect your take-home pay, but the long-term results would be excellent.

Sending more time in the company, your salary increases 3% per year on average. So, by increasing the 1% contribution, you will secure 6% of your total income per year. That’s how you will have a balance of $1,302,190 at age 65 with a 6% contribution in your 401(k) account. But if you keep your contribution to 5%, you will get $1,157,502 at the age of 65. It’s a huge difference as you can save $144,688 extra with a $25 investment per paycheck.

Similarly, your 401(k) balance could sharply rise with an increase of 5% in your contribution. So, if you want to have more than $2 million at the time of your retirement, you must contribute 1-5%.

Tip 2: Diversify your investment mix

Investment mix is the idea of how and where your money is distributed in your 401(k) account. It would help if you had a sound mix of stock and bonds in your portfolio. If you can’t invest time and energy in diversifying your investment mix and looking into each fund offered by your 401(k) account, you are wasting opportunities. You can avail one of the following ideas to diversify your investment mix.

Pick a target-date funds

Selecting a target-based fund is the simplest method, but it comes up with a lot of expenses. Target-date funds allow you to choose investments that match the age you expect to retire (i.e., 2060). Also, the funds will select the investments based on your age-related goals.

Choose a diversification mix according to your age

Here you can get estimates of how you can diversify your account portfolio, but these are just estimates. For example, suppose your age is between 21-30. You might put 60% of your portfolio in domestic stocks and, similarly, 40% in foreign stocks. You have not invested anything in bonds. To get a perfect diversification mix in your 401(k) account, you will need to learn about their fund’s offering. But the best option is to hire someone to do this who has significant knowledge about diversifying the investment mix.

Tip 3: Rebalance frequently

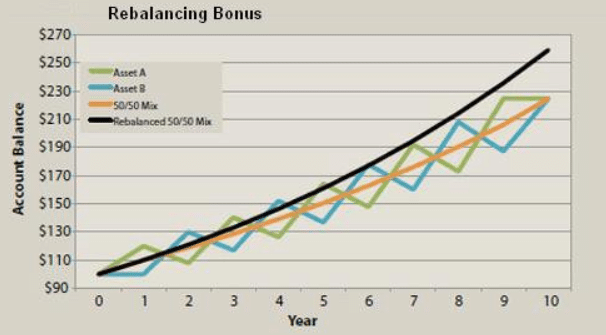

Your 401(k) needs maintenance just like your life needs routine maintenance. In the market of investments, you can say this maintenance is rebalancing. With different assets increasing or decreasing in value, the overall portfolio percentage could rise or fall.

Advisors suggest that stock and bond allocations be based on specific criteria. For example, suppose you are in your 40s; you should have 80% of your investments in stocks and 20% in bonds. If that allocation loses its balance, you need to buy or sell your assets to rebalance frequently.

Tip 4: Use robot advisor to grow your 401K

A robo-advisor like Blooom could be the answer to the problems you face while managing your 401(k) account since they are widespread and more serious. A Robo advisor is an entity that can advise you without the need for human intervention, usually through artificial intelligence.

These Robo advisors are gaining popularity these days because of their low fees, transparency, and automation. Blooom proved to be among the best Robo advisors that actively manage your 401(k) account’s growth.

The monthly fee of Blooom is $10, which is not much expensive. But, it’s up to you to decide what’s right for you. Assess your time value and whether or not you can devote the precious time necessary for making the best investment decision to grow your portfolio. At the very least, Blooom is highly recommended to give a try.

Tip 5: Take the advice of a financial advisor

A financial advisor can also provide targeted investment advice to you. But choosing someone else to deal with your portfolio is not a trustworthy route. Most of the experts consider it as an old-fashioned way of handling money. It is always irritating to think about what they are doing with your money, and it is also expensive.

Upsides and downsides

| Upsides | Downsides |

| •Gain financial freedom The investment in 401(k) retirement accounts allows you to achieve a significant amount of financial balance at the time of your retirement if you manage it properly. | •High fees The fees can be specifically higher in small company plans. |

| •Reduced taxable income The contributions in the account can reduce current taxable income. In addition, it provides possible employer matching. | •Required in-depth knowledge You need to have the appropriate knowledge to rebalance your accounts. Without this, you can lose most of the opportunities that the account plan can provide. |

| •Robo advisors You can get robo advisors like Blooom to manage your account, and also, many financial advisors usually charge a lot to do it for you. |

Final thoughts

Your 401(k) account is critical to your financial future. First, you must understand where your money is going and what your program entails. You can entail the most of your 401(k) by following these five tips and planning for retirement.