As an investor with a high net worth, you can consider using a managed account as another type of investment. With this investment vehicle, you have better control of your investment, and you can set goals that your account manager will work to achieve.

Let’s learn about these accounts, the positive and negative aspects of such investment, and how they compare with mutual funds.

What is a managed account?

Owned by the investor, such an account contains a combination of stocks and bonds that is being managed by a single account. As an investor, you hire an account manager to handle the operation of your account, execute investment decisions based on your needs and objectives, and make it grow. If you are an institution or individual, this option is suitable for you.

Your account manager will make the investment decisions for you to reach defined goals, taking your risk tolerance and asset size into consideration. Due to the ever-changing nature of the markets being invested, the manager actively supervises your account to address potential risks and take advantage of potential opportunities.

How does a managed account work?

The administration of your managed account involves typically three persons:

- You as investor

- Account manager

- Advisor

While each person may have different goals, they join the partnership and work together to help the investor achieve his financial goals. The advisor and account manager often differ in perspectives.

Advisor

While an advisor takes a holistic view of the account and considers your financial situation, an account manager handles the monitoring and adjustment of the account and performs the actual investment operations.

You might have taken a managed account to realize specific goals, and your portfolio may contain a combination of liquid assets, cash, or titles.

Account manager

As long as your manager carries out transactions based on your objectives, he may not need your prior approval before purchasing or selling assets. Your account manager is aware that he has an obligation to you as the investor to act in your best interests and conduct business honestly.

Otherwise, he may face civil or criminal liabilities due to breach of contract and risk losing compensation. Your account manager must exercise transparency about performance and assets being held in the account.

Minimum investment requirement

Opening a managed account is not easy as the minimum amount required is typically high and the involved transaction costs. Typically, you would need $250,000 at minimum to get started. However, some account managers consider an account with a minimum capital of $100,000 or even $500,000.

Annually, you will have to pay your account manager his professional fee. This amount depends on the portion of the account being managed by your account manager. What percentage of the allocation you pay varies from one manager to another. However, standard practice is one or two percent of the allocation. If your manager manages the whole account, then the percentage applies to the managed account.

An account manager might offer you a discount for his professional fee if your allocation is sizable. The smaller the allocation size being managed, the more significant the percentage of the professional fee. On the other hand, the lower the percentage fee will be if the asset size is substantial. This is where you realize a discount. Also, be aware that tax deductions apply to professional fees as they are investment expenses.

Mutual fund versus managed account

We cover this topic here because these two types of investments are somewhat similar. They are identical in the sense that both require a manager to manage the portfolio actively. You can say a mutual fund is a subset of a managed account. The difference is that a fund hires an investment company to manage the assets in a portfolio owned by a pool of investors.

As a result, retail investors can participate in mutual funds even with relatively more minor capital. As already mentioned, only one investor or client owns a managed account, and the minimum investment is significant.

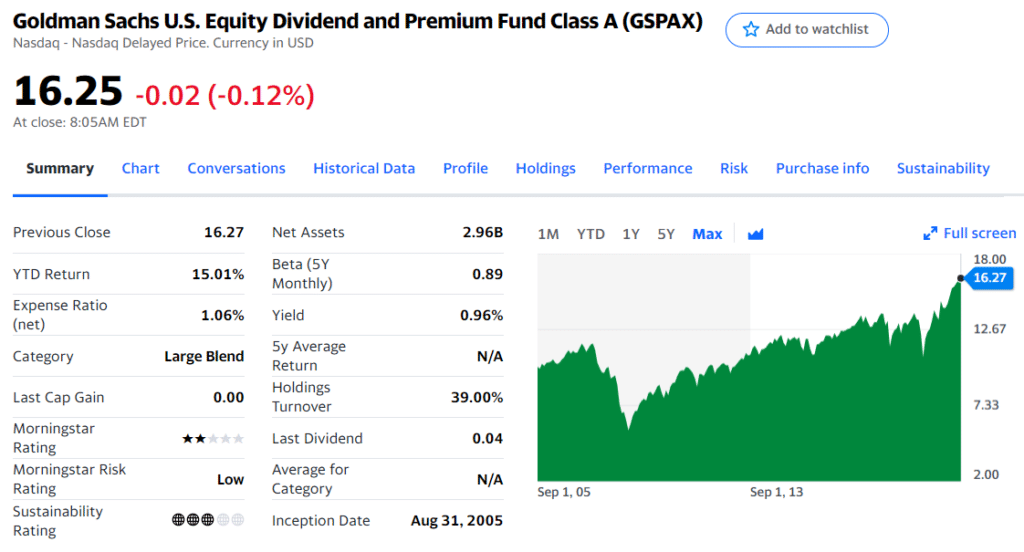

Here is an example of the mutual fund — GSPAX, which seeks to maximize income and total return. The fund invests, under normal circumstances, at least 80% of its net assets in dividend-paying equities of large-cap US issuers with public stock market capitalizations within the range of the market capitalization of the S&P 500 index at the time of investment.

Another similarity between the two investment types is the discretion given to the money manager. A fund manager has the authority to do transactions without obtaining prior approval from investors so long as those investment decisions reflect the fund’s aims and purposes.

Mutual fund investment started and became prominent in the 1950s as it opened the door for shallow pockets to have their share in the bounty offered by the financial markets.

Upsides and downsides of managed accounts

Letting a professional individual or firm manage your account often comes with advantages, but there are also disadvantages you have to be aware of. This section will outline the upsides and downsides of managed accounts.

| Upsides of managed accounts | Downsides of managed accounts |

| Your account manager has more experience than you in investing because of his lengthy exposure in the markets. | Your account manager may not give the attention your account requires. He might brush aside minor losses or overlook opportunities. |

| With your account manager at the helm, you do not need to learn trading. | Since you have no idea how the market works, your account manager may fool you by showing a mediocre track record. While it is true that positive performance in the past does not guarantee future profitability, it is a critical factor you should consider when hiring an account manager. You should not entrust your money to a rookie manager. |

| Since you do not spend time making trading decisions, you get to use your time on something that matters to you. | Since you do not understand the workings of financial markets, you cannot outline your goals based on objective grounds. Because of this, your judgment will lack conviction. As a result, you end up giving all power to your account manager to wield, and he might make investing decisions detrimental to your account. |

| You will not feel the stress or burden of managing your account, especially during turbulent market conditions. | If you have selected an account manager who does not hold himself to high ethical standards, the person might not honor his fiduciary obligation. Worse, he might run away with your money, which is not at all an unprecedented occurrence. |

Final thoughts

A managed account is your alternative if you do not want to trade and invest in financial markets actively. If you’re going to spread your money across different types of investments, a managed account is an option. This article has outlined the pros and cons of managed accounts.

Of course, there is always risk involved in any investment. Just do your due diligence before you hire someone to manage your money. Take note that managed accounts require higher initial investments than mutual funds do.