With the help of a financial advisor, you can devise a plan to reach your economic goals. Such advisors are a superb resource regardless of the amount of money you have to invest or your investment goals.

Choosing a professional consultant can be challenging if you don’t know much about money management. Financial arenas are specialized, so participating in all of them is practically impossible. Planning and investing in REITs are two very different things. Making a monthly budget is not the same thing as portfolio management.

If you need advance advice on real estate planning, consult an advisor with experience in this field. This guide will help you decide which fiduciary is right for you and understand the critical functions of a fiduciary.

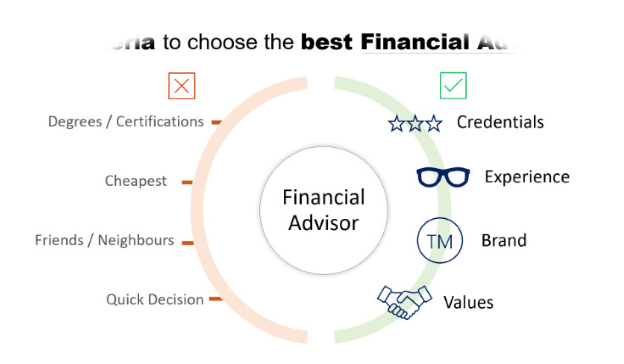

Financial advisors: what to look for?

You can ease a lot of your fiscal burden by hiring the right financial consultant, but you will have to give someone access to one of your most sensitive areas. In finding a financial advisor, you are bringing into your business an expert.

You should pay close attention to all of the expert’s answers in a job interview. It would help if you also were wary of free “advisors” provided by financial companies. Individuals who are more salespeople than consultants, however, usually suffer from conflicts of interest.

It is crucial to take the time to research a variety of potential consultants rather than choosing the first name you come across.

Here are the five tips to help you choose an agent you can trust.

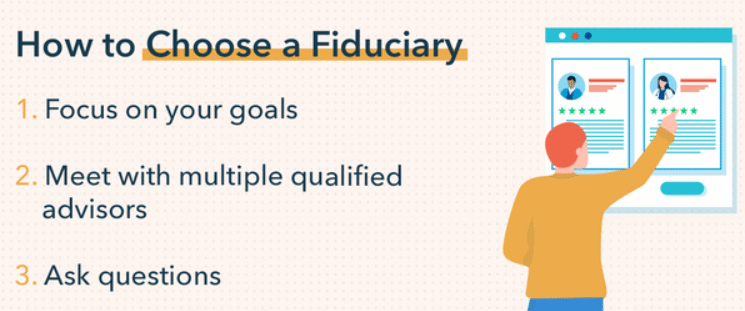

Tip 1: Find a trustworthy fiduciary

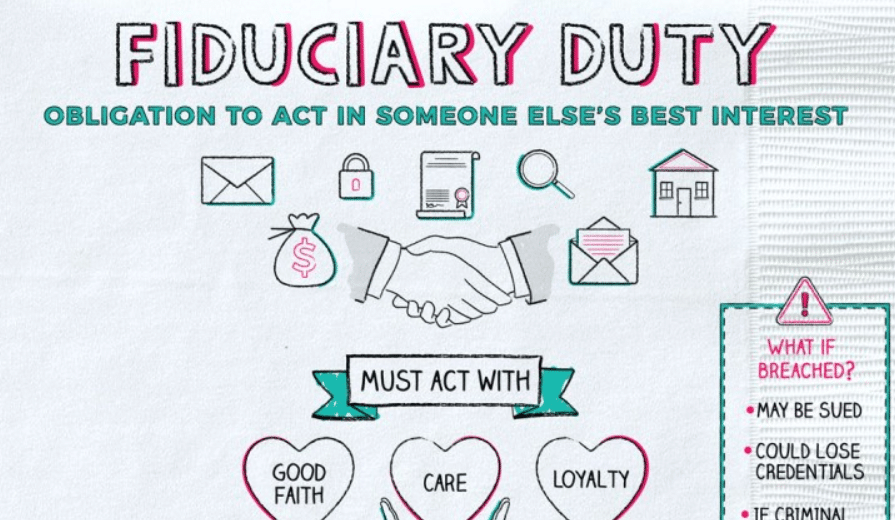

A fiduciary under the law is hard to define. Currently, most consultants are required to act in your “best interest.” However, they often do not have the authority to enforce “best interest,” except in extreme cases. Therefore, it would be best if you had an experienced fiduciary.

Your financial consultant should act as your advocate, not against you. For example, if an analyst does not invest in their education, you shouldn’t work with them.

Tip 2: Check the credentials

The credentials of potential financial consultants are critical to check. Consumers should pay particular attention to those who hold well-recognized designations, such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP).

It is the fiduciary responsibility of those holding these titles. In addition, financial advisors are governed by a code of ethics and possess a wealth of knowledge.

The CFA Institute or the CFP Board are two resources where you can verify a consultant’s credentials. Credentials do not guarantee someone is working in your interest, but they can provide additional evidence of a person’s education and competency.

Tip 3: Find out how the advisor gets paid

It is unlikely the public will truly know what they will receive from a financial consultant or planner. It is common for salespeople to pose as advisers, especially those who work for companies with little or no advising business, such as insurers.

An advisor in such a scenario will often just be trying to sell you the corporation’s products and services. It would be best to be very careful around consultants who are not charging you for their services.

Tip 4: Search for clarity

Ideally, an advisor will explain everything to you clearly and understandably. Walk away if you feel like a consultant is incompetent or inscrutable. Relationships with such people are not sustainable.

When an advisor offers only proprietary products, charges fees without explaining why, or actively trades your account without authorization, especially if they get paid per transaction, the investor may suspect that the consultant is not working in their best interests.

In any of these situations, you should not stay with a consultant who cannot explain why. It is not sufficient to get your consultant to stop when you haven’t authorized the transaction, and the explanation is unclear. Find a new advisor.

It is common for financial consultants to conceal their actions to make money. Therefore, your investment adviser needs to know who pays him.

Tip 5: Hire an advisor who can keep you focused

An individual who is competent, humble, and empathic is regarded as a successful one. A crucial characteristic is empathy. Knowing your client’s feelings and communicating that you can address those feelings is essential to your role as a client.

Advisors need to listen to clients’ needs, but it’s not their only option for addressing their specific financial situation and goals. It’s not just a consultant who tells you what to do, but one who keeps you motivated as well.

You might need to be calmed down by the professional after a particularly trying or exciting time in the stock market or even in your life. But ultimately, the advisor’s job is to help you reach your goals, which sometimes means becoming a psychologist.

Financial advisors: how much do they charge?

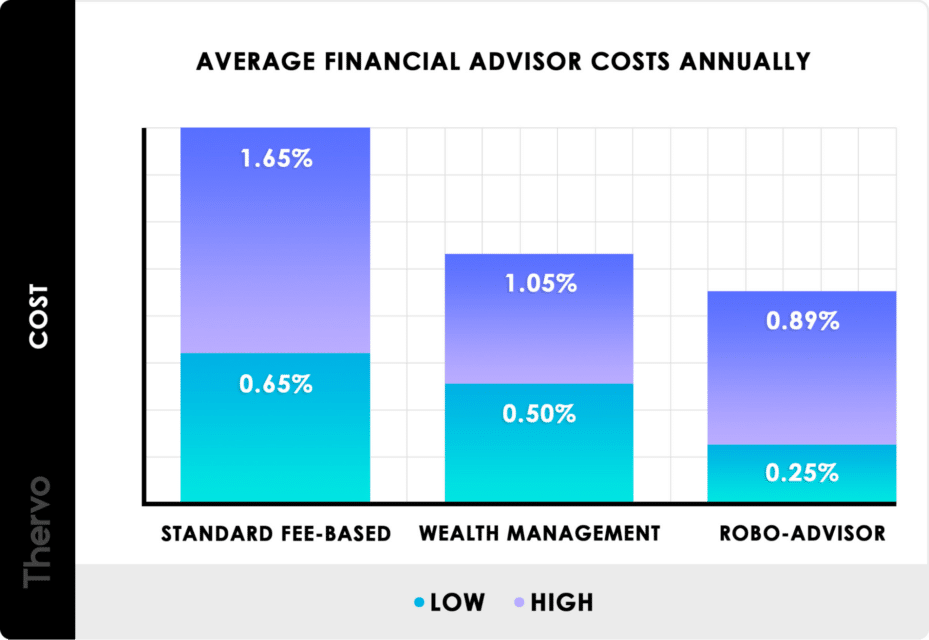

Due to the wide range of prices for financial advisors, estimating the final cost can be difficult. If you do not have a lot of money to spend, it may be challenging to find a financial consultant who is both knowledgeable and affordable. It will help if you compare local and online rates.

A robo-advisor is one of the cheapest options available for investors, as mentioned previously. Your annual account balance will typically be charged 0.25% as a fee.

The cost of the advisor’s services can range from a flat fee per year to a charge per hour if you have virtual meetings. Online banking fees are typically higher when it comes to investment transactions. 0.30% – 0.89% are imposed on the fee.

Some traditional consultants charge hourly or flat fees. In addition, many advisors require a minimum balance on your account to accept you. Investors who pay an hourly rate, however, will typically be accepted regardless of their tax bracket.

Upsides and downsides

| Upsides | Downsides |

| Enables you to plan long-term. | Creates additional expenses. |

| Conducts research, compares products, and makes recommendations about investments. | There is no guarantee that recommendations will be unbiased. |

| Assists your financial team by acting as the quarterback. | A recommendation for a more expensive product/ portfolio that is more likely to churn. |

Final thoughts

Consultant selection is more complex than choosing the person assigned to you by a fund or insurance firm. To find someone who will work in your best interest, you need to search for them actively. You will undoubtedly get better advice, save money, and earn more if you follow his advice. Having someone you can work with both now and for decades is worth the extra legwork it takes to find them.