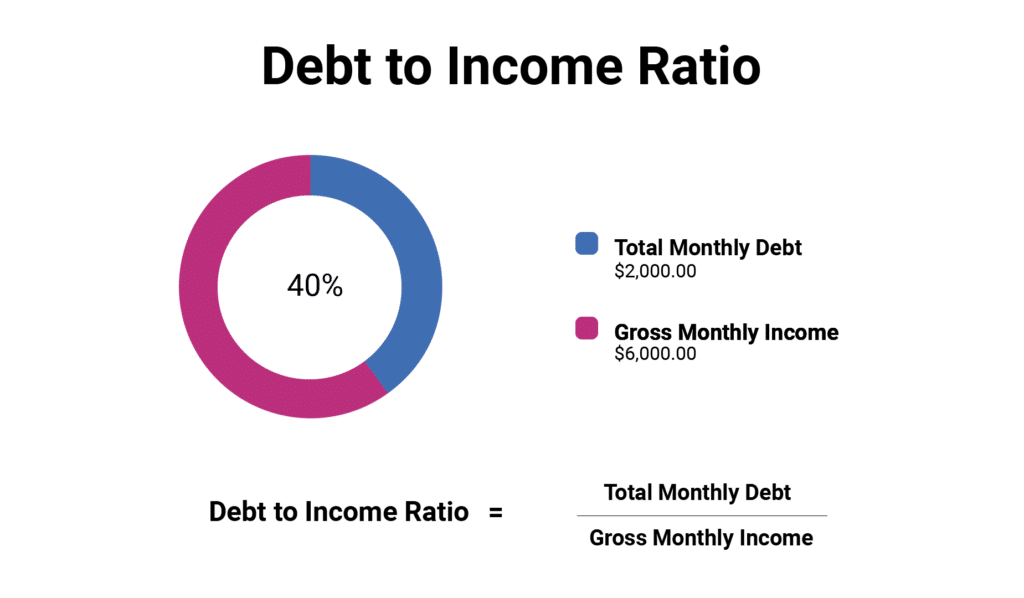

Unfortunately, it is next to impossible to save enough for you to invest optimally and take care of all your bills without debt financing. The debt-to-income ratio (DTI) measures how much of your income goes into settling off debts as a percentage.

Why bother with all of the calculations and figures?

The DTI forms the basis of all your borrowing. Lenders use this ratio to determine the risk associated with advancing money to individuals, set the interest rates, and determine how much to lend.

Here we take a look at:

- How to calculate, and what is the ideal DTI?

- The relationship between DTI and credit score

- Debt to income ratio guided purchasing

DTI calculation

Calculating DTI starts with an understanding of all the recurring monthly debt expenditures. They include:

- Student loans

- Mortgages

- Alimony and child support

- Credit card repayments

- Motor vehicle loans

- All other debts are financed every month

Once you identify all of your monthly obligations, factor in all your incomes, pretax:

- Commissions

- Salary

- Alimony and child support

- Bonuses

- Tips

- Wages

- Social security

- All other monthly incomes

To get the DTI ratio, add all the monthly obligations and divide by the total monthly income. The resulting figure is expressed as a percentage.

Example №1

Tom has the following monthly obligations:

- $1,400 mortgage repayment

- $600 motor vehicle repayment

- $180 student loan

- $380 credit card payments

- $750 alimony

- $420 other debts

Tom’s total recurrent monthly obligations are $3730.

Tom’s monthly incomes include:

- $9500 salary

- $300 from rental property

- $150 from monthly dividend payouts

Tom’s total monthly gross income, therefore, amounts to $9950.

To calculate Tom’s DTI

So divide his total monthly obligations, $3750, by his total monthly pretax income, 9950:

DTI = 3750 / 9950 = 0.37688

This expressed as a percentage is approximately 38%:

0.37688 X 100 = 37.688% ≈ 38%.

Paying off debts or a raise in the income levels results in better DTI. For example, if Tom could eliminate the other miscellaneous monthly obligations, $420, the new DTI would be approximately 33.5%.

On the other hand, if the rental income increased to $500, the new monthly gross income would be $10150, reducing the DTI to approximately 37%, with all obligations remaining the same. However, the best strategy is to utilize debt reduction and income enhancing tactics to reduce the debt-to-income ratio.

What is the ideal DTI?

Lenders look at DTI to ascertain how much debt to advance individuals. They analyze individual credit history, monthly pretax income, and how much down payment one can afford.

The majority of the lenders have 36% as the maximum capping for a DTI acceptable to advance a facility to individuals. In addition, if seeking financing other than the mortgage, they prefer the 36% DTI. A mortgage should not exceed 28%.

Example №2

If Maria has a monthly income of $5500, the maximum mortgage monthly installments should not exceed $1540, 28% X $5500. The total debts should not exceed $1980; 36% x 5500.

The extreme DTI allowable by high-risk lenders is 43%; anything above this value is considered too high a risk.

Is there a relationship between DTI and credit score?

The excellent news is agencies that calculate and provide credit score reports have no access to your earning information. However, these agencies rely on the DTI to develop the final credit score rather than use the debt-to-income ratio.

It means that despite having an outstanding debt to income ratio low, individuals might still have a poor debt to credit ratio resulting in poor credit scores and, as a result, denial of credit services or access to inferior credit terms.

Rather than pit debt against your total income, since they don’t have access to the data, credit utilization ratio, debt to credit ratio, is a measure of your credit card totals vis a vis your total obligations.

Example №3

Assuming Elaine has an outstanding credit balance of $5500 and their maximum limit is $11500, their credit utilization level is approximately 48%; ($5500 / $11500) X 100. The less amount you have utilized relative to the upper cap limit, the lower your credit score. The goal is to have a lower credit score and a lower DTI as well.

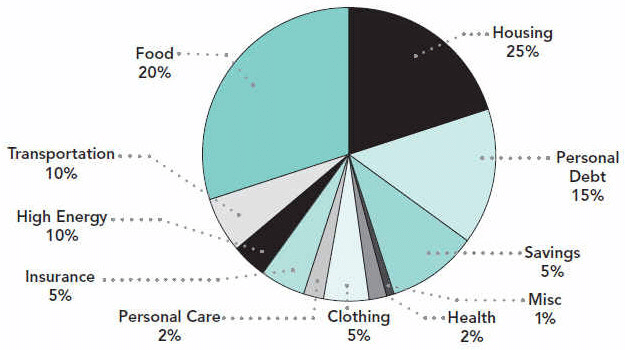

DTI guided purchasing

Debt financing of any kind that has a monthly repayment period affects the debt-to-income ratio. As such, always calculate the new DTI before making the final decision on buying on credit.

Why bother?

Lenders consider the ramifications of the new debt financing on the overall DTI score before making approvals. Legally, consumers are protected from overextending their credit by the Consumer Financial Protection Bureau. The Bureau is responsible for legislation not advancing mortgage loans to individuals with a DTI score of more than 42%.

Calculating the DTI score before making purchases ensures one knows the toll on their debt burden and whether that expenditure is a need or just a want.

What are the advantages of an optimal DTI score?

Ideal DTI scores may seem like a trivial matter, but they ensure:

- Low DTI scores are attractive to lenders facilitating fast loan approvals at low-interest rates and favorable loan terms.

- Credit score affects: DTI score does not affect the credit score directly, but keeping it low through minimal debt impacts the credit utilization score, ensuring a low credit score.

- Access to financing deals: lenders advance financing deals to individuals that boast both an optimal DTI score and a low credit score.