A typical cryptocurrency exchange cost is between 0.1 percent and 1 percent or more for every transaction, although this may vary widely. On average, this means that if you invest $1,000 or more in a crypto, the transaction costs you may range from $100 to $1,000 on average.

Investing in crypto might have a wide variety of consequences due to fees. For example, between April and June 2021, the average cost of a Bitcoin exchange transaction ranged from $4.38 to $62.77. Of course, there have been comparable price fluctuations for other cryptocurrencies, too, like Ethereum.

The time and strategy you employ for trades and other operations are crucial when dealing with such a wide variety of expenses. Here are five ways traders and investors may save money while sending cryptocurrencies.

Tip 1. Wait it out

Take advantage of a less crowded moment on the blockchain if you have free time. For example, fewer transactions occur since many establishments are closed on weekends. In addition, it means transactions may occur more rapidly.

Wait for your transaction to clear for a lower cost before you proceed. For most customers, a BTC transaction will not cost them more than $25.

According to bitcoinfees.earn, the quickest transaction fee is about 102 satoshis/byte. So, it would cost about $11 to make a 224-byte BTC transaction. Using this service costs about $93 (about $9) per byte, taking about 30 minutes for most people. If you’re willing to wait, the price will continue to drop.

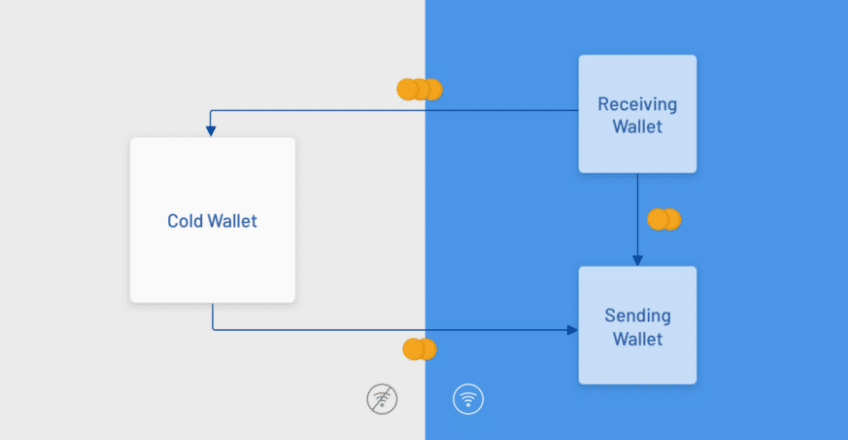

You need a crypto wallet to set your transaction fees for this approach to work. Before you use your wallet, make sure you understand whether or not you can customize the fees.

However, keep in mind that this strategy comes with a degree of risk. A charge that is too low may cause a failed transaction. If you’re concerned about the price of a BTC transaction, you can view how much it’s presently costing at mempool.space. High-priority transactions incur a higher cost. Transactions will proceed more swiftly as a consequence of the increased priority pricing. Choose a more negligible cost and add it later if necessary if you’re not in a hurry.

If the fee is high enough, it is also possible to determine how much the BTC network would disregard a transaction with the “purging” header. Make your cost “replaceable” by selecting “Replace-By-Charge (RBF)” in your wallet.

RBF is an option if you’re not sure whether the cost is high enough but don’t want to spend too much. Once a BTC transaction has been submitted, you may use this function to increase the transaction fee if the transaction has not yet finished. Only a few wallets, such as Blockstream Green and Electrum, allow you to do so.

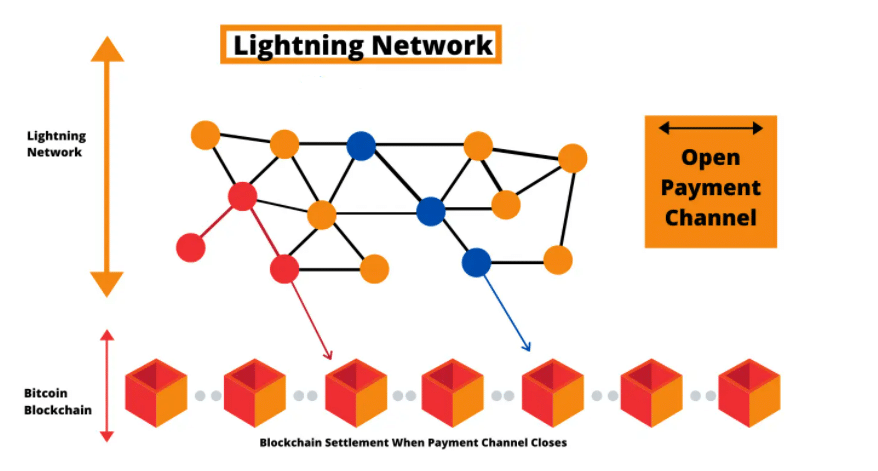

Tip 2. Lightning to the rescue

On-chain BTC transaction costs and Lightning transaction fees are just a cent apart. Transaction costs may rise as more people use BTC, as developers have predicted. Hence, the Lightning Network is a network built on BTC that can handle more transactions while lowering congestion. Customers who plan to make several purchases in the future may wish to investigate this long-term option.

You’ll have to spend money if you use Lightning to start a channel. Clients will no longer be able to send as many transactions at the same fee once their first few are free (provided they have enough money in their account).

To top it all off, Lightning is still a work in progress. As technology has improved, customers still have to worry about being bankrupt. So you shouldn’t invest all of your savings into it.

Tip 3. Use wallets with scaling technology

When it comes to blockchain transaction costs, we’re back. There may be a 30 percent reduction in costs for SegWit transactions compared to earlier transactions established by the BTC community in 2017. Simply, a SegWit transaction may cost as low as $10.50 in the best-case scenario.

Even though SegWit has been available for quite some time, not all wallets and exchanges have adopted it. With SegWit’s benefits and cost reductions, Bech32 addresses may be a substantial addition. However, only bech32, a file format mainly designed for SegWit transactions, has been implemented, several services currently support SegWit transactions.

It’s becoming more challenging to keep up with all the latest developments, like SegWit and bech32. Several wallets and exchanges to select from to save money on fees. You are more likely to save money if a company has more checkmarks or green squares on the app. You should remember that some of the posts may not be up to date. BitPay, one of the most recent SegWit adopters, has yet to be included in these rankings. However, users must expressly choose SegWit while creating their wallets to save transaction fees.

Tip 4. Be strategic about your transaction types

Is it possible to sell your Bitcoins without needing fiat currency? By exchanging it for another cryptocurrency, you may be able to exit your BTC investment with minor charges. However, there may be fees associated with deposits into your digital wallet, and there may also be fees when converting from BTC to fiat money.

Tip 5. Use promotions to reduce the cost of your crypto transactions

Sign-up bonuses and other promotional offers from crypto exchanges reduce the effect of fees on your account balance. Here are some instances:

- For signing up with Coinbase or referring a friend, you’ll earn $5 in BTC.

- For signing up with Gemini, you’ll get $10 in BTC.

- A $25 bonus is yours when you successfully recommend a friend to Voyager.

- A $50 bonus is yours when you successfully recommend a friend to Celsius.

- A $50 bonus is yours at eToro.

- Maintain a $100 or more balance in your BlockFi account to get BTC incentives.

Final thoughts

And there you have it — a few tips for you to consider the next time you deal with cryptocurrency. Plan your transactions and use these ways to reduce your crypto transaction costs.