Gold-backed cryptocurrencies track the price performance of precious metal gold. Each token is worth specific grams or troy ounces of gold. These crypto-assets become attractive investments as they remove transport transferability, inconveniences, volatility, and illiquidity in physical gold dealings. These assets let investors trade, purchase, and hold physical gold from anywhere globally, anytime.

However, several gold-backed tokens are available in the crypto industry, and gold backs them in different ratios based on the project features. This article will introduce you to the top three gold-backed cryptos alongside highlighting all the essential info.

Why is it worth investing in gold-backed cryptos?

These assets are becoming popular among crypto investors as they are portable, digital, can be split into small pieces, transferable to other parties, and affordable for any level of investors. Crypto investors often use these assets to hedge against the volatility of crypto assets. Investors hedge their monetary value against regulation-bound stable coins and weak fiat currencies using gold-backed crypto. However, it requires a matching supply amount of the coin and gold-backed amount to verify the project. The projects are, in most cases, transparent about backing and verifiable through custodians and third-party audits.

How does it work?

The backing by gold occurs depending on different ratios, a unit of token price equals any unit of golf price. More specifically, may a single token is worth one gram of gold, and the price of the token fluctuates equivalent to the price of gold.

How to start?

When investing in any gold-backed crypto, it is mandatory to check vital factors. The procedure is the same as other crypto assets, open a crypto wallet and purchase your preferable coins from crypto exchange platforms. Most potential gold-backed coins are available on many major crypto exchange platforms.

The top three gold-backed cryptos to buy in 2022

We checked many gold-backed crypto coins from several angles while making this list, such as matching the token amount and gold reservation data through audit reports, circulating supply, future projections, etc.

The top three are:

- Tether Gold (XAUT)

- Perth Mint Gold Token (PMGT)

- Digix Gold Token (DGX)

Tether Gold (XAUT)

52-week range: $1,681.10-$2,069.20

1-year price change: +23.10%

Forecast 2022: $3,061.52 by Dec 2022

Tether Gold enables investors to direct exposure to physical gold without investing vast amounts of money, avoiding drawbacks such as limited accessibility and high storage costs. TG Commodities Limited offers this digital asset to investors around the globe. Each XAUT coin reflects the value of one fine ounce of gold, and it is an ERC-20 token.

The team behind this crypto project wants to apply the same idea of fiat-backed stable coin Tether USD or USDT. Any holder of this token will have ownership rights to specific gold bars that gold allocations are identifiable through a unique serial number, weight, and purity.

The price of XAUT is currently floating near $1921,50 today with a 24-H trading volume of $2,391,083 and is available on many major crypto exchange platforms, including Bitfinex, FTX, Uniswap (V3), Gate.io, and BTSE.

Let’s check the most relevant information about XAUT:

- Fully diluted market cap: $202,863,234

- Live market cap: $202,874,811

- Circulating supply: 105,549.09 XAUT

- Max supply: not available

- Total supply: 105,549 XAUT

- Volume / market cap: 0.01224

- Minimum purchase: 50 XAUT

Perth Mint Gold Token (PMGT)

52-week range: $0-$187,082.15

1-year price change: +98.97%

Forecast 2022: $2561.86 by Dec 2022

Perth Mint Gold Token (PMGT) is an ERC-20 token, a tokenized version of the GoldPass certificate. Trovio is the developer and issuer of this token, and each token represents one fine troy ounce of gold that is stored in the central bank grade vaults of the Perth Mint.

PMGT enables a smart contract proving investors’ title in gold in their vault, transferable peer to peer, and tradeable on Independent Reserve. You can consider it a government-backed crypto project, as the Government of Western Australia guarantees the gold reserve. The launching period of this token is Oct 2018. The price of PMGT is currently floating near $1934.43 today with a 24-H trading volume of $9,537 and available in the “Independent Reserve” to purchase.

Let’s check most relevant information of PMGT:

- Fully diluted market cap: $2,239,587

- Live market cap: $2,239,655

- Circulating supply: 1,157.75 PMGT

- Max supply: not available

- Total supply: 1,158 PMGT

- Volume / market cap: $13,358

- Minimum purchase: not available

Digix Gold Token (DGX)

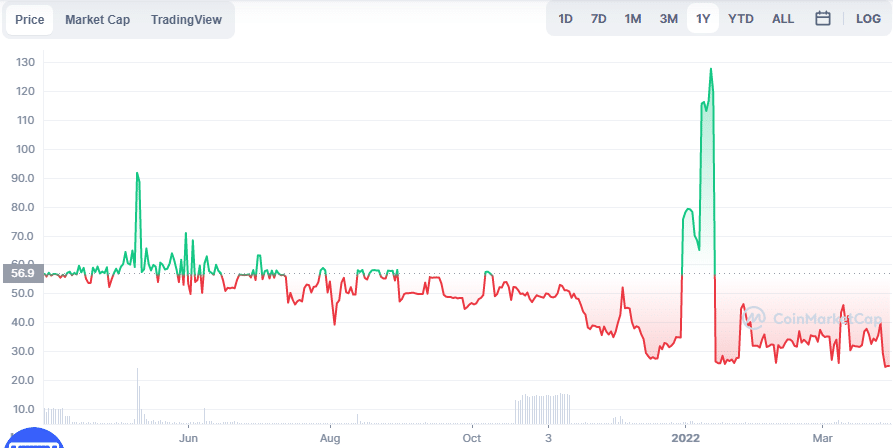

52-week range: $20.87- $142.79

1-year price change: +$121.92

Forecast 2022: $53.17 by Dec 2022

Digix Gold Token is the tokenization of physical asset gold. DGD and DGX are two cryptos of Digix. Each DGX token represents one gram of gold. The foundation period of Digix is Dec 2014 in Singapore and involves third-party auditing from Bureau Veritas for security purposes.

It is a suitable asset for investors who want to invest in physical gold with limited cash and seek to invest in fractional tokens, send/receive, and redeem them. The price of DGX is currently floating near $24.78 today with a 24-H trading volume of $726 and is available on many major crypto exchange platforms, including KULAP, ProBit Global, Indodax, and Hotbit.

Let’s check most relevant information of DGX:

- Fully diluted market cap: $1,434,941

- Live market cap: $1,352,770

- Circulating supply: 54,623.27 DGX

- Max supply: not available

- Total supply: 58,000 DGX

- Volume / market cap: 0.0007968

- Minimum purchase: $150 for gold ETF, $50 to $600,000 for gold bar and $0.50 for the tokens

Upsides and downsides

| Upsides | Downsides |

| You can sell legitimate gold-backed cryptos for more than the gold spot price. | Negative carry can come when playing with a large amount of gold. |

| Gold-backed cryptos offer access to various blockchain apps. | Maintenance of physical gold can be tricky. |

| It doesn’t require a vast investment to start. | These assets involve risks like other cryptocurrencies. |

Final thought

Finally, it becomes easier to invest in financial assets in this digital age, avoiding relative factors of owning the actual asset. These assets are suitable investments for crypto investors who like to play with less volatility, but remember, as the textbook says, “all that glitters is not gold.” So follow trade and money management rules while investing in these assets.