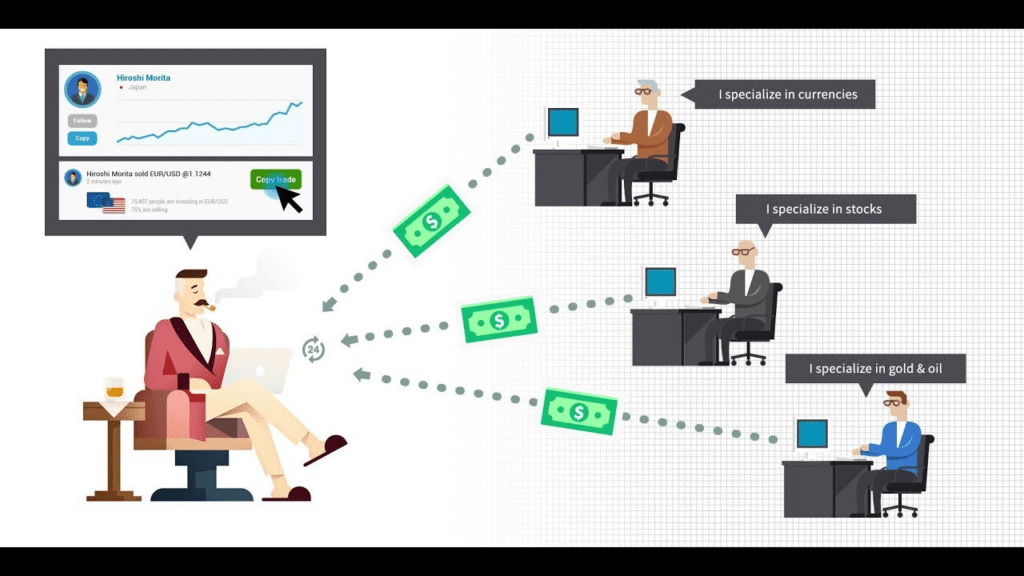

In recent years, one of the most popular strategies to generate passive income in the stock market has been copy-trading. Beginners may make as much money as the experts if they use specific platforms and features to emulate seasoned traders. With copy trading, you can earn between 1% and 15% per month. In addition, most copy trading signals have a monthly target return of between 2% and 8%.

The idea behind copy trading is to copy the trades a particular investor makes. When you follow a trader’s trades automatically, you do not get an analysis of their system.

Traders copied the first automated trading algorithms. Earlier, the developer’s trading history had been made public, allowing others to copy their strategies. This led to the creation of social trading networks. Eventually, if you want to get started by copying the deals of other traders rather than following a strategy. This article will explain copy trading mechanics and the top five steps to make money.

Top five steps to make money

Let’s start copying the trades of other traders by using the following simple steps below.

Step 1. Open a brokerage account

Creating an account on a reliable copy trading platform is a must before you can begin copy trading. However, which platform is best? As a newbie, you should choose a platform with an easy-to-understand UI for your benefit. So, it’s a good idea to create a sample account before making a real purchase. In addition, the platform should include money and risk management capabilities available to users.

You have a lot to learn when starting. Check to see whether the platform provides enough resources for learning before signing up.

When looking for a social trading broker, be sure to choose a well-established and subject to regulatory oversight. Inquire about their terms of service, deposit/withdrawal options, and customer service standards.

Find out whether they’ve signed up for TrustPilot, and then look through the negative feedback. Negative reviews for a broker are common when the user is to blame since they didn’t understand the terms and conditions and made assumptions.

Finally, have a look at the platform’s number of copy traders and their success rates.

How to avoid mistakes?

Even experienced traders make mistakes. If you lose money, it doesn’t mean you’re doing anything wrong. It is possible to suspend trading signals for a while to observe whether the trader improves. Don’t close shop after a few losses.

Step 2. Observe professional investors

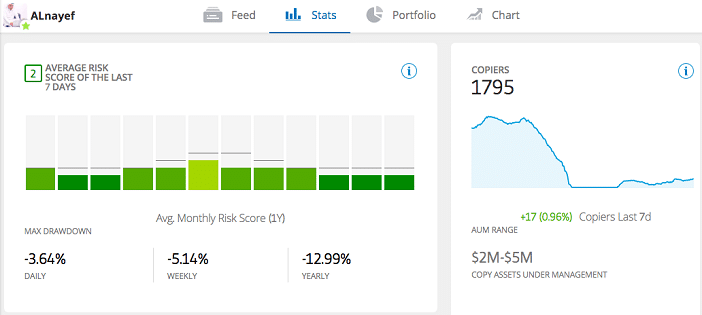

You must imitate other traders to succeed in copy trading. If they’ve been authenticated, be wary. There is a prevalent concept in the copy trading market that traders should emulate those who have had successful years in the past. However, it may not always work. Some of the best traders may have a sudden downturn, even if their overall performance is excellent.

First, let’s go over a few simple tips for following someone on social media. Next, look at a trader’s Closed Trade Profits to see how much money they have made. Because of his significant realized profit, the trader is considered to be a good trader.

How to avoid mistakes?

For the second time, don’t copy traders who are doing the same thing you are doing. If this is the case, your options will be limited. However, you must diversify your approach. You may learn a lot about a trader’s strategy by reading their bio. Try to find out what they invested in and how long the deal lasted if you have access to it. Having an understanding of the trader will also benefit you in this regard.

In addition, following a trader with a 10% to 20% annual return is a decent approach on average.

Step 3. Make funds in your copy trading account

As a novice, you must learn and explore a wide range of topics. As a result, it may not be a good idea to invest a large sum of money. Instead, inexperienced investors may learn the ins and outs of the stock market by investing a small sum, such as $100. Even though such a sum will not guarantee immediate success, it is enough to get you started in copy trading.

A lack of strategy may be the cause of copy trading’s failure. On the other hand, copy-trading may be profitable if done correctly.

How to avoid mistakes?

Only risk money you can afford to lose in the stock market. Don’t risk your mortgage or your children’s college savings by taking a risk.

4. Choose a copy trader

Choosing a copy trader may be difficult since some social networks offer more than 500 copy traders. First, decide whether you want to follow a copy trader who scalps, day trades, or swing trades. Next, choose a copy trader who trades the financial instrument you want and follows their trades. Whether you want to trade in Forex, stocks, options, or something else, it’s up to you.

Find a few traders you like, and then go through their copy trader profiles to learn more about them. Finally, take a look at what they do.

How to avoid mistakes?

Most brokers are familiar with the possibility that systems can automatically copy an account of a trader. Hence, choose online brokers that offer a wide range of options for trading wisely.

5. Set up your copy trading signals

Gain more from the FX market by following signals from expert traders. Then, check your settings twice to ensure they’re correct. Making a mistake could cost you a lot.

How to avoid mistakes?

If you set a stop loss of 20 pips, the signals won’t work for trades with stop losses greater than 20 pips. By keeping an eye on the exact signal and the time of that specific signal, one can avoid making mistakes.

Upsides and downsides

| Upsides | Downsides |

| •Commissions are charged by some platforms and not by others. These platforms profit only from spreads. Overall, it’s a simple and inexpensive method to invest. | •When copy trading, the most prominent risk that a trader will encounter is market risk. |

| •You don’t need thousands to start copy trading. Start with as little as $50. | •Traders can lose money if the strategy they are copying does not work out. |

| •If you’re not an experienced investor and use a platform like Plus500 to trade CFDs on margin, you’re likely to lose money. Copy-trading may help novice investors to decrease risk. | •Traders may also be subject to liquidity risk if the instruments they are trading are subjected to illiquid conditions during periods of high volatility. |

Final thoughts

You invest in the same way when you copy another trader’s strategy. When an investor initiates an investment transaction, the activity is reflected instantly in your portfolio.

Copy-trading allows people to follow and manage market positions in the stock market automatically. The key difference between mirror and copy trading is that a portion of the copying trader’s money is linked to the copied investor’s account.