An algorithm monitors the markets and evaluates equities to determine whether they meet the stated criteria to execute a trade. Funding can be allocated, and positions can be opened and closed without human involvement using automated trading technology. Using automated trading tools, traders can keep track of and analyze more stocks than is possible.

At the same time, making transactions in a matter of seconds takes place with a human broker. If you are looking for a similar algorithm trade monitor, here is a list of automated trading tools, i.e., the top three in 2021/2022 for demand.

Automated trading tools: how to choose?

Selecting an automated trading software should take these factors into account:

- Functional interface

It is still necessary to monitor and adapt software that automates most of the workload if you want to make adjustments while trading, you need a user-friendly interface.

- Widely accepted computer programming

To make things easy for you, you should choose a standard programming language if you need to build a unique and comprehensive approach yourself.

Top three automated trading tools in 2021/2022

Most forex brokers can use automated trading via their trading platforms or third-party applications. As a result, trading methods may be implemented automatically, eliminating human interaction requirements. Listed below are the top automatic trading tools presently on the market.

There are two types of automated trading:

A list of the best automated trading tools can be found in the section below. Also, find along with an explanation of the tools’ capabilities. An overview of algorithmic trading systems and social copy trading possibilities is presented in this article.

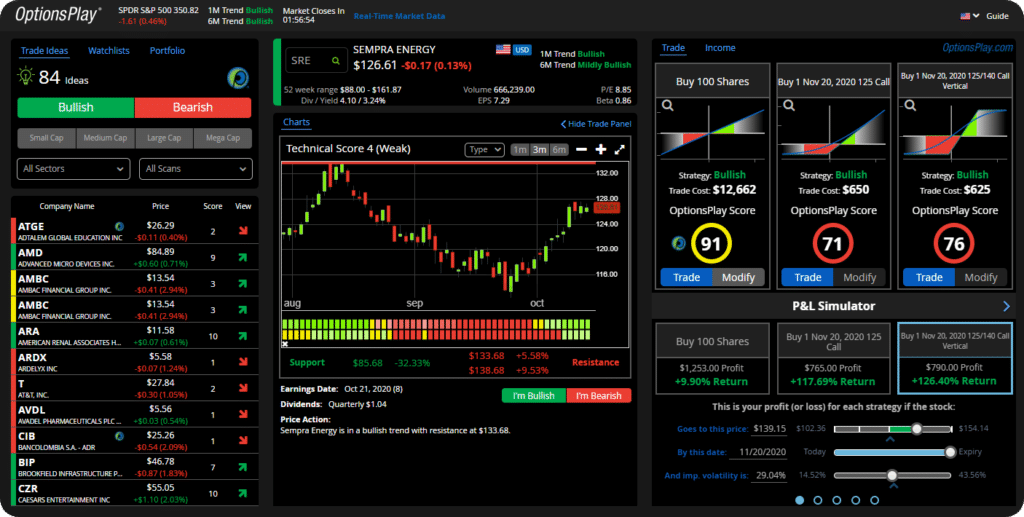

Every short-term trader’s objective is to assess an asset’s momentum and benefit from it. Hundreds of technical indicators and oscillators have been created for this purpose. Use the indicators to develop new tactics or incorporate them into existing ones. Then, try them out in a demo account to decide which to use.

MetaTrader 4

Advanced technical analysis, algorithmic trading, and trading system adaptability are all included in the platform to meet the demands of traders. Professionals in the field may also deploy automated strategies.

With MT4, users may automate their trades by writing custom indicators in its coding language. The site supports more than 30 different languages, and you can mimic the trades of other high-performing users. In addition, MT4 is well recognized as a forex trading tool in other markets, such as options and futures.

Neither in-person financial advisers nor robo-advisors are available via MT4. However, optional features like live adviser help may be made available to you via your choice of MT4 broker.

eOption

Low-cost options trading is what eOption specializes in, and it doesn’t need any programming ability to make trades. In addition, it has a comprehensive smartphone application with easy trading choices and a broad selection of tradable assets.

Another notable aspect of eOption’s tool is its tab arrangement, making it easy to identify. eOption provides a 60-day free trial account for those who want to try out the platform before making payment.

In terms of brokerage services, eOption provides a wide range. However, its focus is on options trading, and this is evident in the broker’s pricing: Although the firm costs $1.99 each exchange, the low 10 cents per contract price makes it competitive for individuals who trade four or more contracts.

eOption also provides $0 fee stock and ETF trading, and in 2022, the service will cut its minimum investment to zero dollars. Other recent additions include a new profit and loss performance analytics function that helps traders better understand their profitability and success, as well as new incentives, such as a free stock for signing up.

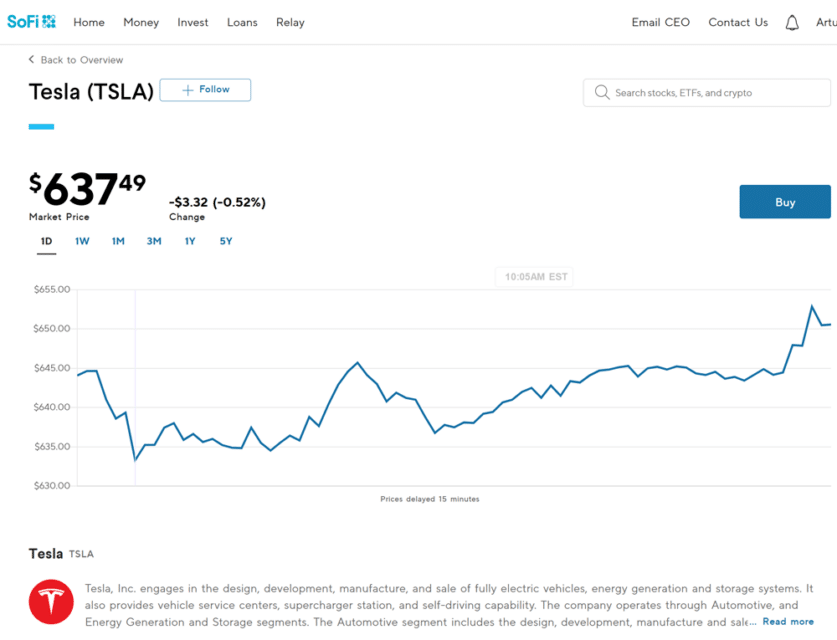

Automated SoFi

As a robo-advisor, Sofi automated investing is free and provides low-cost ETFs and limitless access to financial specialists.

Become a member of SoFi for free, and you’ll get a bonus for every month you stay. In addition, members get access to free career counseling and exclusive events, including dinners and lectures.

On SoFi loans, they are also eligible for lower interest rates. So if you currently have student loans or are expecting to get a loan from SoFi, it may be in your best interest to prolong the terms of your partnership with the company.

However, it’s vital to keep in mind that SoFi Invest does not charge a management fee. Adding SoFi’s own customized ETFs to your portfolio will require you to pay the fees imposed by the ETFs already in your portfolio. If (or when) fee exemptions expire, the expenses of these funds might rise significantly.

Do the arithmetic and be aware that even if you’re expecting to get a great deal by investing for free with SoFi Invest, you may be able to invest for less, or at least the same amount of fees, with more established investment businesses.

Reduce the complexity of your trade

There are several ways that automated trading tools may make your life simpler. While it is essential to keep your investment objectives in mind while making a decision, caution is crucial. Before you conclude, you should know what kind of assets you want to trade and your investment limit. Even if an automated system trades on your behalf, you will be held responsible if things don’t proceed as planned.

The technical indicators that traders use explain market supply and demand and market volatility. These tools are used in technical analysis. This is how to buy and to sell signals are created.

Final thoughts

While assessing an FX market, traders generally use a variety of technical indicators at the same time. Traders must choose the indicators that perform well for them and learn how they function from among the tens of thousands of possibilities available.

Trade ideas may also be generated by combining technical indicators with more subjective technical analysis, such as chart patterns. In automated trading systems, technical indicators are also used because of their quantitative nature.