Investing and its two outcomes, profit and loss, are never constant and keep on changing. Investors for ages have been trying to work on their risk strategies to secure their invested capital.

Market crashes are among the few circumstances that no investor has control over. Recently investors lost $1 trillion in China’s Wild Week of Market Shocks. But as we all know, profit and loss are not in our hands, and what we can do is study, research and analyze before investing.

Losing and winning is the game of probability, but the question arises: can you lose more money than you invested?

This article will help you get an insight into your investment and if it’s possible to lose more money than you initially invested.

Can you lose more money than you invested?

When you’re investing money in a stock, you are betting that the asset will rise in value. However, if the stock fails to increase in value, you could lose your entire investment if you do not protect your equity by applying risk management rules.

Theoretically, you cannot lose more than what you invested; however, when you use excessive leverage and fail to protect your positions, you stand to lose part or all of your equity.

In which ways can you lose more money than invested?

An investment requires equity or capital, and you can opt to invest all the money or a portion of it. If you decide to support all the capital in a single asset, you should know that the risk of losing it all is real.

Specific investment strategies can cost you more than what you invest. Let’s take a look at these in detail.

Short sale

It is when a broker lends the money or the stocks to the investor. You then take selling positions on the stock, with the intention of the broker to repurchase it at a later stage. You don’t invest all the funds when you take a short sale since the broker provides the rest of the equity.

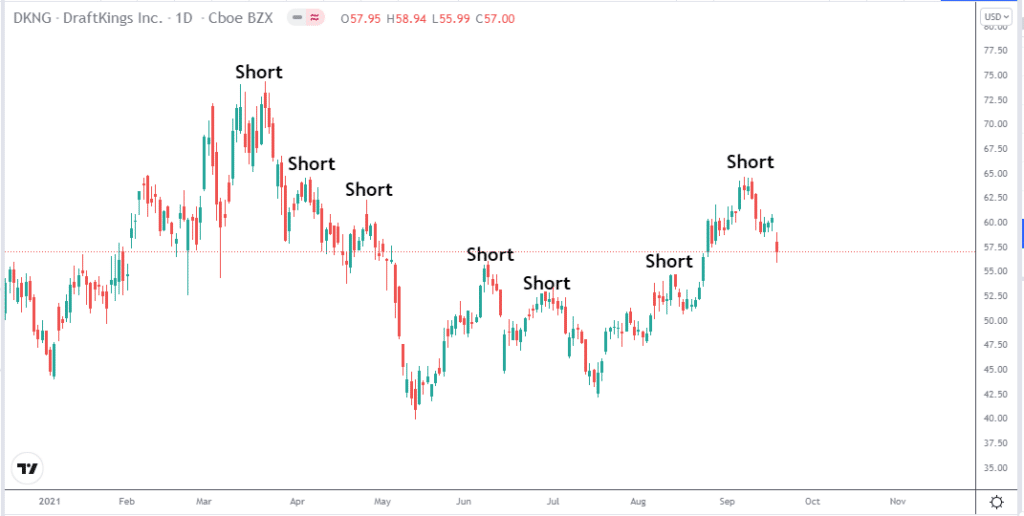

The DraftKings Inc. chart shows where one could easily short sell the stock. Let’s use an example of short selling.

We will assume that a share is worth $10; you opt to purchase 100 shares. Therefore, your investment is $1000, but this is borrowed shares from the broker, so you still owe the broker 100 shares, should the share price rise instead.

If the stock price fell from $10 to $1, you would make a $9 profit per share which is $900 in total. However, should the cost of the shares double to $20, your loss is $2000; in addition, you owe the broker 100 shares, which equates to another $2000. Your total loss on the investment would be $4000. As you can see, a potential bad short sale could cost you more than your investment.

Leveraged investment

Using leverage is always a double-edged sword. Leverage can inflate your profits and, at the same time, exaggerate your losses. However, leverage is not bad, provided you use it moderately, and your equity can sustain the potential losses.

When you invest in stocks, using excessive leverage is a risk, and it can cost you more than your investment.

The stock has shown good uptrend movement since May 2021, and there were numerous occasions where an investor could purchase and hold the stock.

Let’s explain leverage with an example.

We will assume that you purchased 100 shares of Company A for $1 each. You have total equity of $1000, but you invest $100 (100 shares x $1). Now, let’s say the brokerage offers you a $1 leverage per share that you purchase; however, this leverage allows you to make an extra $1 in profit should the price increase. If the share price falls, you stand to lose $100 due to the leverage.

Let’s say hypothetically that the stock price declines rapidly, and your position closes in a loss. As a result, you have now lost the $100 that you invested; the broker will also take the $100 leverage that they lend you.

Therefore, your equity is now $800 ($1000 – $100 – $100). If you chose not to take leverage, you would have only lost $100, and your equity would have been $900.

So, in theory, you invested $100, but you lost $200.

Therefore, it is possible to lose more than your investment if you use excessive leverage.

Can you lose more money than you invest in shares?

If you invest in shares with your own money, you cannot lose more than you invested. The reason is that if a share loses value, the price will drop to a point where it is worthless. Wise investors would usually cut their losses earlier or take the loss completely.

Furthermore, stocks are like any other commodity, and if there is no demand, the price will not change, or if investors fear the company is not performing well, they will start shorting their stocks to protect their capital.

Which ways could protect your money when investing?

Considering all the scenarios we discussed, there are reliable ways you can protect your investment.

Limit leverage

Avoid using excessive leverage since it can inflate your losses. Furthermore, brokers only allow leverage if you have sufficient margin in your account.

Diversify

It is an age-old investment strategy to protect your money. Spreading your money across different assets helps you to dilute any potential losses.

Invest wisely

When you choose to invest in stocks, the best advice is to conduct thorough research. Furthermore, you can consult with fund managers to advise on the best way to structure your portfolio.

Invest in low-risk companies

Always look for stocks with stable growth rates and low risks. The returns might be less, but you will not expose your money to unpredictable market swings.

Upsides and downsides

Stock investing is very lucrative; however, there are upsides and downsides, and we give you the pros and cons to consider.

Upsides | Downsides |

| •Stocks pay dividends Besides making a profit from the rise in value, you can also receive dividends if you invest in a few good stocks. | •Stock market crashes Stock market crashes are a reality, and this adds to the unpredictable nature of this market. |

| •Many to choose You can choose to invest in thousands of publicly traded companies, and you are not limited as long as you have sufficient funds. | •Emotionally daunting Investing in stocks requires you to hold through the market’s swings, and it can be emotionally draining, especially for new investors. |

| •Easy to access These days it’s easy to access the stock markets, and you only require a broker that supports stock trading. | •Requires knowledge Stock investment requires advanced and in-depth knowledge of the markets. |

Final thoughts

No investor wants to lose money, especially in the current economic climate. However, we should emphasize that this is the nature of the financial markets, and losses will always be part of the package.

Greed is the downfall of many investors, and it can be why individuals take excessive leverage and make irrational decisions. When dealing with any financial instrument, the best is to become an expert in that asset class. Thus, you don’t fall into the trap that so many novice investors fall into.