Investment is not a simple approach of buying an instrument and holding for a future price appreciation. A perfect investor should consider other factors besides buying and selling tools where tax and inflation are necessary.

Tax and inflation work together to reduce the purchasing power of your trading portfolio. Therefore, you always have to focus on how much profit/ loss you are making after considering these. Investment in any financial market involves several risks, but the ultimate goal of an investor is to achieve asset growth to stay ahead of tax and inflation.

The tax has a significant impact on your investment that we will see in the following section.

How taxes affect you

There is no way to ignore that paying tax will hurt your trading portfolio. You cannot eliminate tax at all, but you can reduce the rate by following some techniques.

The government changes tax rates to collect money from people. Moreover, this fluctuation helps investors find tax-free sectors where the government encourages them to invest and benefit. For example, despite the traditional business, investing in stock, forex or cryptocurrency involves taxation for what you have got as a profit from trading.

Tax on stock trading

Making a profit from stock trading is a great way to make money online, but tax implications may affect your profitability. Every time you sell a share, you have to pay tax on profits with a rate between 0% to 20%. Moreover, any gain from dividends is also taxable.

If you are a retail trader and making money from stock trading through a forex broker, you have to pay tax every time you sell a share. This type of tax is known as capital gain tax.

- The short-term capital gain tax involves the profit you make from selling shares within the tax year.

- The long-term capital gain tax affects profit from long-term investment.

Tax on forex trading

FX trading tax applies to every profit you make during the tax year. Here whether you make a profit from buying or selling, every gain is subject to tax. In tax calculation, you have to count the aggregate profit or loss during the tax year, and if you are in profit, you have to pay tax, and if you make a loss, you don’t have to pay tax until you make a profit on the next tax year. The tax rate fluctuates from 0% to 20%, depending on the country’s legislation.

Moreover, there is no tax implication for unrealized profit; you have to pay tax once you close your position and make a realized gain.

Tax on cryptocurrency trading

There are three types of profit-making events happening in the cryptocurrency market:

- Crypto to fiat

- Fiat to crypto

- Crypto to crypto

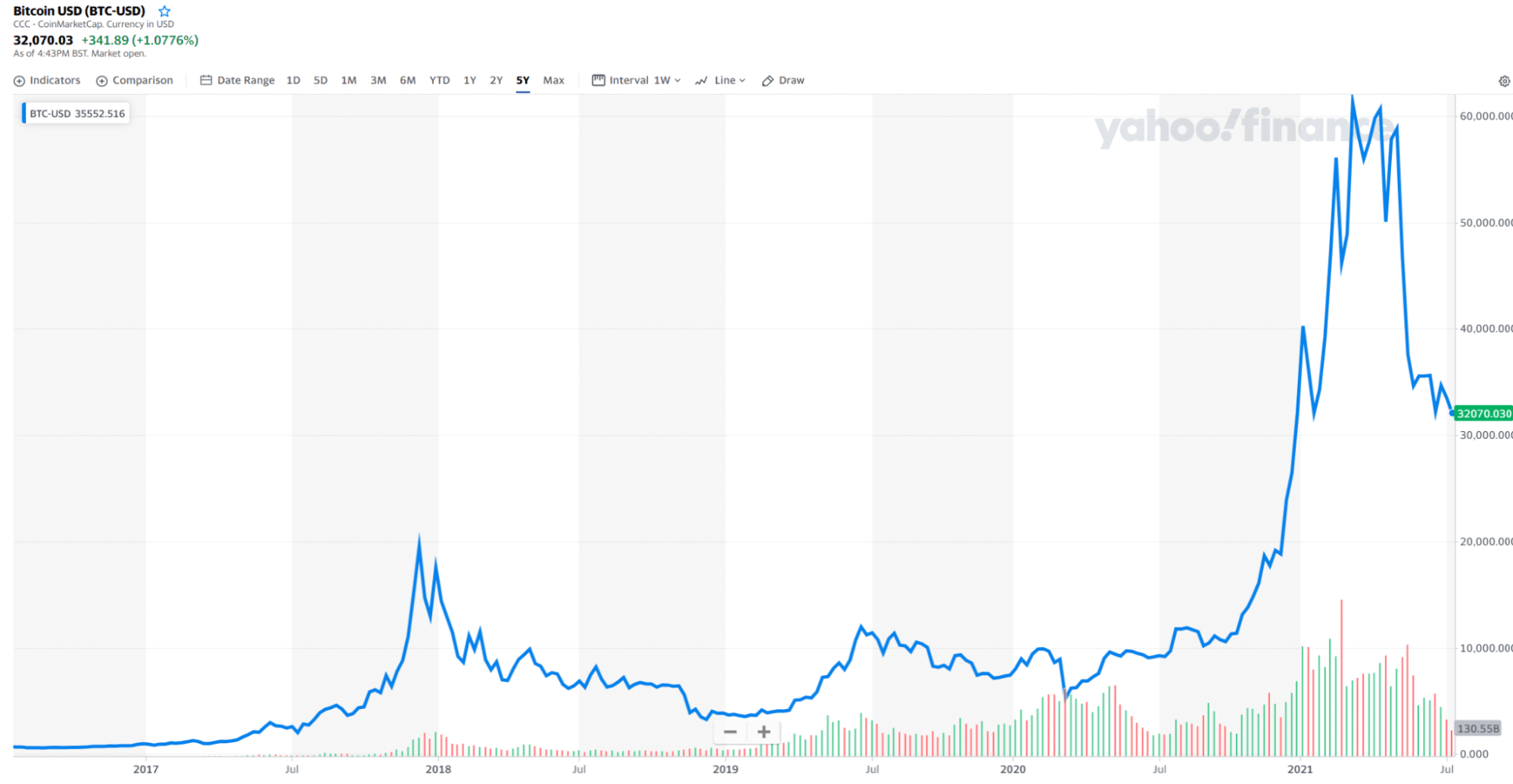

If you buy Bitcoin using fiat currency, you don’t have to pay any tax until you transfer the cryptocurrency to any fiat currency. For example, let’s say you bought 1 Bitcoin in 2016 with a value of $6000. In this transaction, there is no tax implication.

Later on, in 2021, your investment value reached $60,000 with an unrealized gain of $54,000, and there is no tax on this unrealized gain. After that, if you decide to cash out your investment by making crypto to fiat transactions at $60,000. Here the realized profit of $54,000 is taxable.

Moreover, you have to pay tax in crypto to crypto transactions, but it is not applicable until you transfer your profit to any fiat currency. However, the tax rates and calculation system depend on your country’s legislation.

Calculating capital gain or loss

Capital gain tax is applicable once you sell any stock where an extraordinary capital gain tax rate may apply.

The capital gain or loss happens when you realize a sale of assets in the amount of cash and other value less the basis of the asset. If your selling value is more than the basis amount, you have to pay a capital gain tax. On the other hand, if your selling amount is less than the basic calculation, it will be subject to capital loss.

Let’s say you have adjusted the basis of a stock at $20,000.

- If you sell your stock with a value of $25,000, you have to pay tax for $5000 profit.

- If you sell your stock with a value of $15,000, it will incur a capital loss of $5,000.

You have to calculate the short-term and long-term capital giant ax on schedule D of the income tax. Here you have to consider the holding period and marginal income tax bracket, besides the gain/ loss.

- The holding period is a time frame indicating how long you have owned the asset.

- The short-term capital gain tax is applicable for any assets with a holding period below one year.

Tax rates for short-term capital gain are lower than the long-term capital gain tax. On the other hand, the marginal income tax bracket shows the marginal tax rates that changed from 0% to 30%, depending on the country’s legislation. It depends on the level of your taxable income and filing status.

However, any capital loss from the current year or previous year is applicable for reducing the current year’s capital gain tax.

Tax-efficient investment

All investments are not taxable. Therefore some investment income like internet from municipalities are taxed at the federal level. Moreover, income from government bonds or gilts has no tax or lower tax rates.

Anyways, there is no way to say that the tax rate is fixed. It can change anytime and make the tax-efficient investment useless. Moreover, it is not wise to invest in any instruments to achieve tax benefits.

Final thoughts

In the above section, we have seen how tax changes the profitability of your investment. There are both taxable and tax-exempt investment opportunities in the world. However, it would help if you did not focus on tax exempted investment because the decision might change at any time.

Investors should focus on building a stable gain by setting a target by considering the tax implication and inflation in investment or financial trading.